- The Soft Landing

- Posts

- ✈ US Banks Are Cutting Staff

✈ US Banks Are Cutting Staff

PLUS: Other Interesting News You Need To Watch Out For 👀

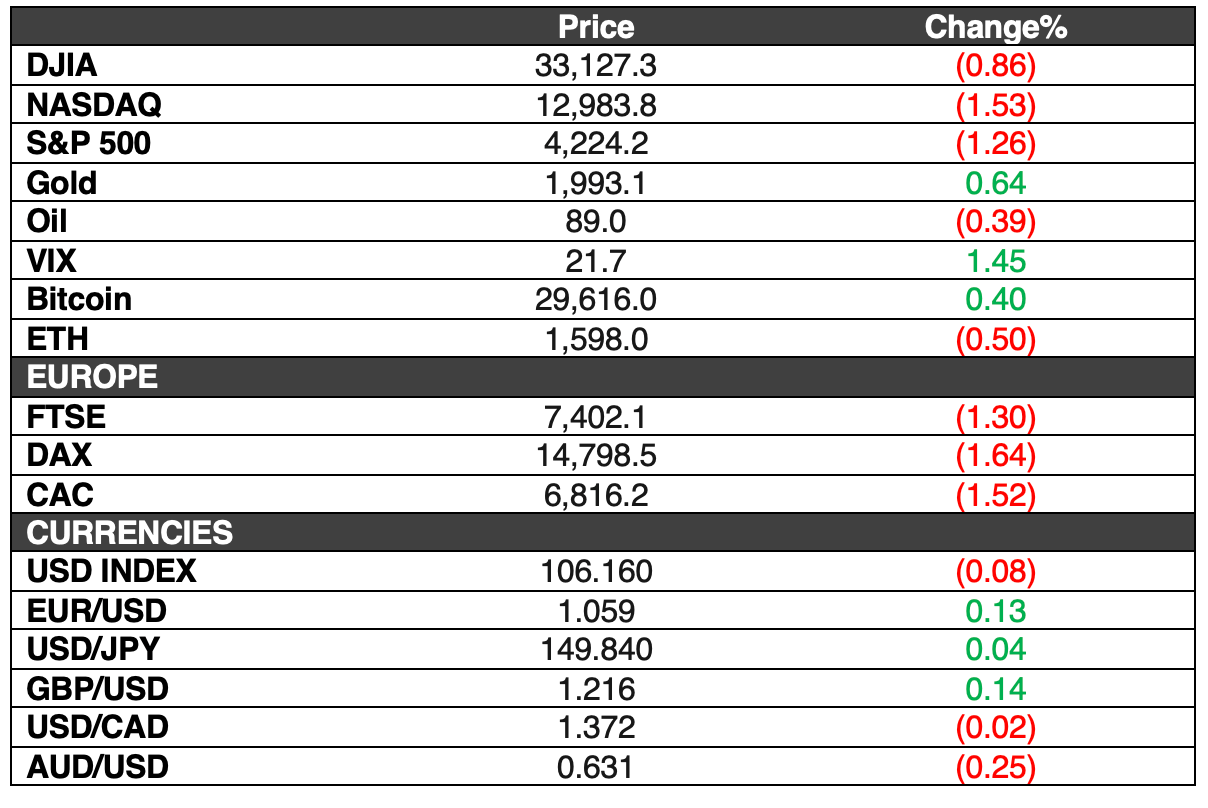

Stocks experienced a decline as the 10-year Treasury yield surged, raising concerns about the state of the economy. The S&P 500 fell by 1.26% to 4,224.16, marking its first weekly loss in three weeks. The Nasdaq Composite also dropped 1.53% to 12,983.81, and the Dow Jones Industrial Average lost 286.89 points or 0.86% to end at 33,127.28.

The rise in the 10-year Treasury yield to over 5% for the first time in 16 years is of particular concern, as it could impact various sectors of the economy, including mortgages, credit cards, and auto loans. Additionally, the higher yield is becoming an attractive alternative to stocks for investors.

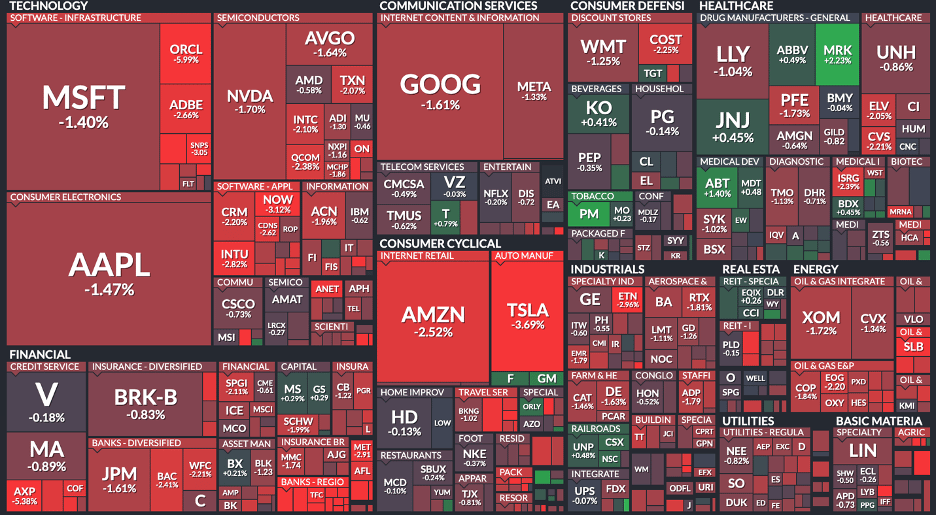

Here’s A Look At The S&P 500 Heat Map:

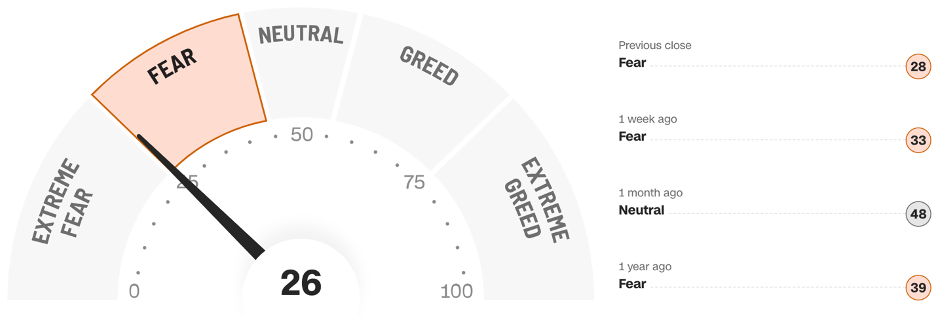

Fear & Greed Index: FEAR (…NEARING EXTREME FEAR 😱)

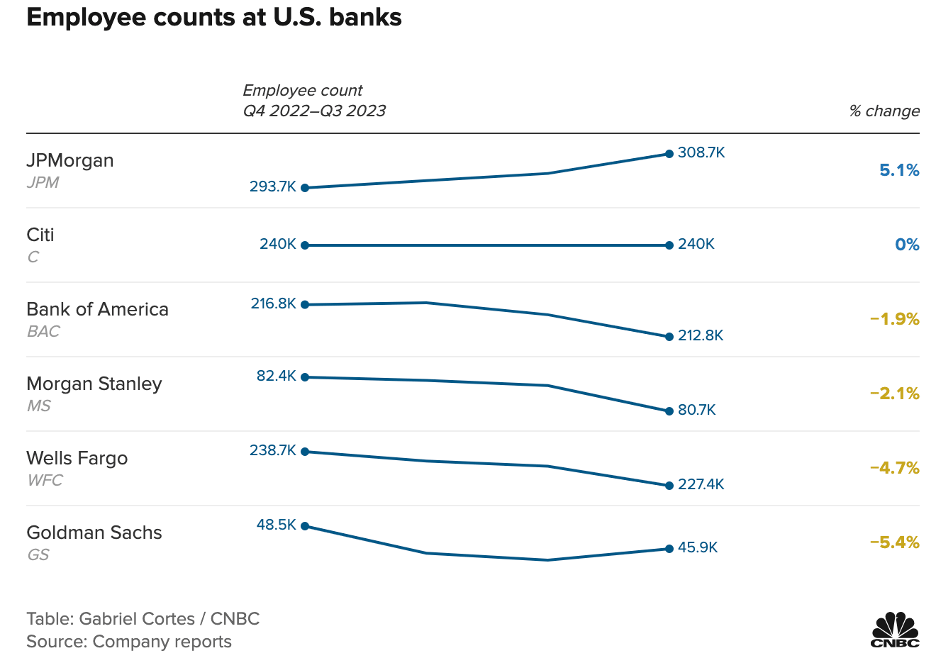

Chart of The Day: Big Banks Are Quietly Cutting Thousands of Employees, and More Layoffs Are Coming!!

Several major American banks have been quietly reducing their workforce throughout the year, with JPMorgan Chase being the primary exception. The workforce reductions, totaling around 20,000 positions, have occurred primarily at the next five largest U.S. banks. This downsizing comes as a response to various factors such as the impact of higher interest rates on the mortgage industry and funding costs. These banks had previously experienced a hiring boom during the COVID-19 pandemic, driven by increased Wall Street activity. However, as the Federal Reserve raised interest rates to address an overheated economy, they found themselves overstaffed for a market with reduced demand for mortgages and corporate debt. This trend is expected to continue into 2024, potentially affecting the broader U.S. labor market.

Wells Fargo and Goldman Sachs have witnessed some of the most significant workforce reductions, with both banks cutting approximately 5% of their employees this year due to revenue declines in crucial business areas.

In Other Interesting News:

Tesla Stock Ends the Week Down 15% - Worst Performance in 2023: Tesla's stock saw a significant decline, plunging over 15% in a week to close at $211.99. This drop followed a Q3 earnings call where CEO Elon Musk struck a pessimistic tone regarding macroeconomic concerns. Musk emphasized the need for cost-cutting and price reductions in upcoming quarters. In its Q3 2023 report, Tesla reported $23.35 billion in revenue and $1.85 billion in profits. Notably, profits were lower than the same quarter in the previous year.

Cryptocurrencies Cap Winning Week - Bitcoin Tops $30,000: Bitcoin recorded a 10.4% weekly gain, briefly breaching the $30,000 mark on the back of increasing confidence in the approval of a spot bitcoin ETF. Ether also enjoyed a 4% weekly increase, reaching $1,630.03 at its peak. This week marks Bitcoin's best performance since June 23, reflecting the crypto market's resilience amid ongoing regulatory uncertainty in the U.S. and globally.

Coinbase 'Confident' in U.S. Bitcoin ETF Approval: Coinbase's chief legal officer, Paul Grewal, expressed strong optimism regarding the approval of a U.S. bitcoin ETF by the SEC. This confidence is bolstered by a recent legal development where a judge ruled against the SEC's denial of Grayscale's request to transform its GBTC bitcoin fund into an ETF. With the SEC declining to appeal this ruling, it signals a potentially smoother path for bitcoin-related ETF approvals in the near future.

X to Launch New Subscription Tiers: X, previously known as Twitter, is set to introduce two new subscription tiers, as announced by owner Elon Musk. One tier will offer all features with no reduction in ads, while the other, at a higher cost, will be ad-free. This development follows the introduction of a $1 annual subscription in New Zealand and the Philippines, designed to combat spam and bot activity.

Impact of Soaring Bond Yields on American Consumers: Blackstone president Jonathan Gray warned that soaring bond yields, including 8% 30-year mortgages and car loans, will influence consumer behavior and potentially slow down the economy. As bond yields surge and borrowing costs rise, the housing market is experiencing stagnation, with transaction volume reaching a 13-year low.

Pakistan's Stock Market Rises to Six-Year High: Pakistan's KSE-100 Index achieved a six-year high, driven by optimism regarding the strengthening currency's potential to alleviate inflationary pressures. The index gained nearly 10% in the current month, ranking as the second-best performing global equity index among those tracked by Bloomberg. Despite this impressive performance, the index maintains a favorable one-year forward price-to-earnings ratio of 3.2, compared to 8.8 for the MSCI Frontier Markets.

Alibaba, Tencent Among Investors in China's AI Start-Up Zhipu: China's tech behemoths, including Alibaba and Tencent, have backed Zhipu, an AI start-up aiming to compete with OpenAI. Zhipu secured over 2.5 billion Chinese yuan ($341 million) in funding, with support from prominent venture capital firms like Sequoia and Hillhouse, as well as corporate investors such as Xiaomi, Alibaba, and Tencent. Zhipu specializes in AI models trained on extensive data to support various applications, including the development of a generative AI chatbot.

Disclaimer: This is not financial advice, the newsletter is strictly educational and is not investment advice.