- The Soft Landing

- Posts

- ✈ Tesla Begins Cyber Truck Delivery Next Month!

✈ Tesla Begins Cyber Truck Delivery Next Month!

PLUS: Other Interesting News You Need To Watch Out For 👀

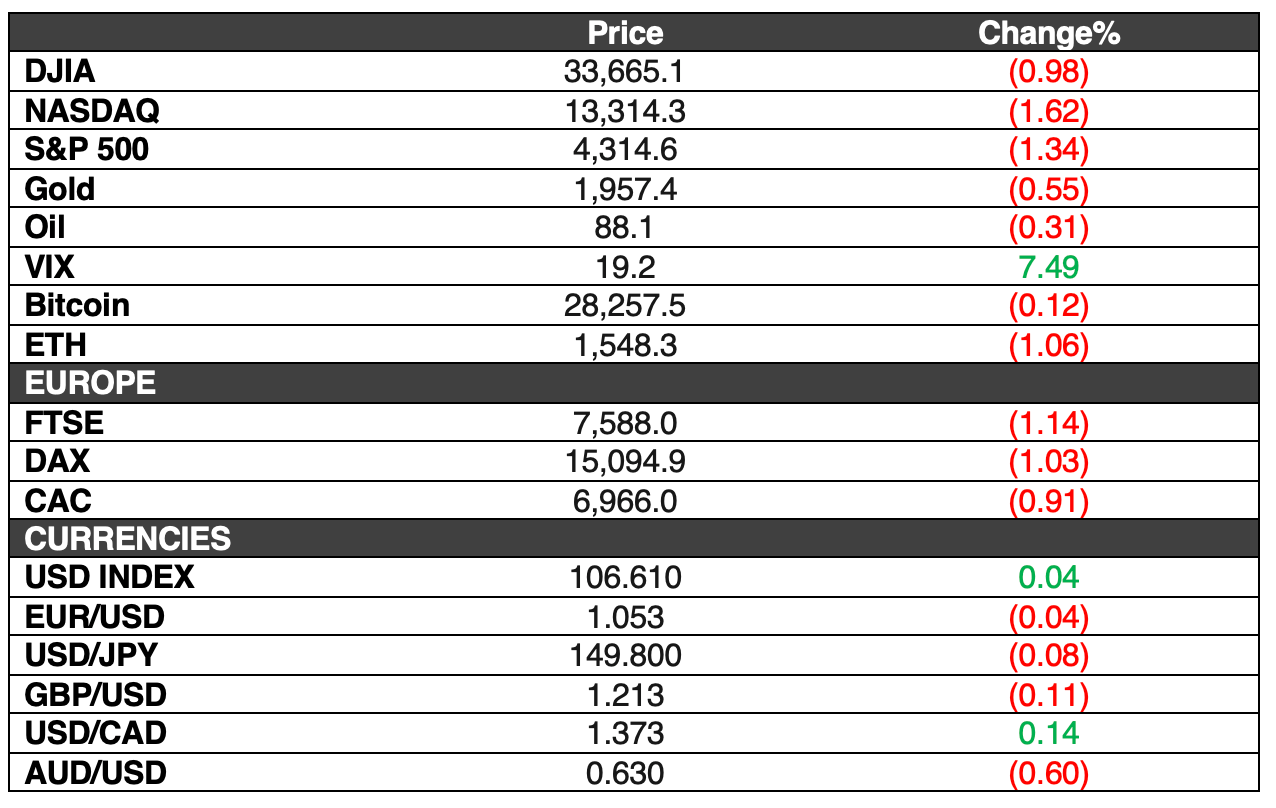

Stocks took a tumble on Wednesday as earnings season ramped up, and Treasury yields soared to levels not seen in years. The Dow Jones Industrial Average saw a decline of 332.57 points, or nearly 1%, closing at 33,665.08. The S&P 500 followed suit with a 1.34% drop, settling at 4,314.60, while the Nasdaq Composite posted a 1.62% decline, finishing at 13,314.30. Throughout the trading session, none of the major indexes managed to break into positive territory.

Adding to the market's unease, the 10-year Treasury yield made a notable climb, surpassing 4.9% for the first time since 2007. U.S. The 2-year Treasury yield remained near 5.22%, levels last seen in 2006. The 5-year Treasury yield hit 4.937%, the highest level since 2007. Concurrently, the average rate for the widely watched 30-year fixed mortgage hit 8%, marking its highest point since the turn of the millennium.

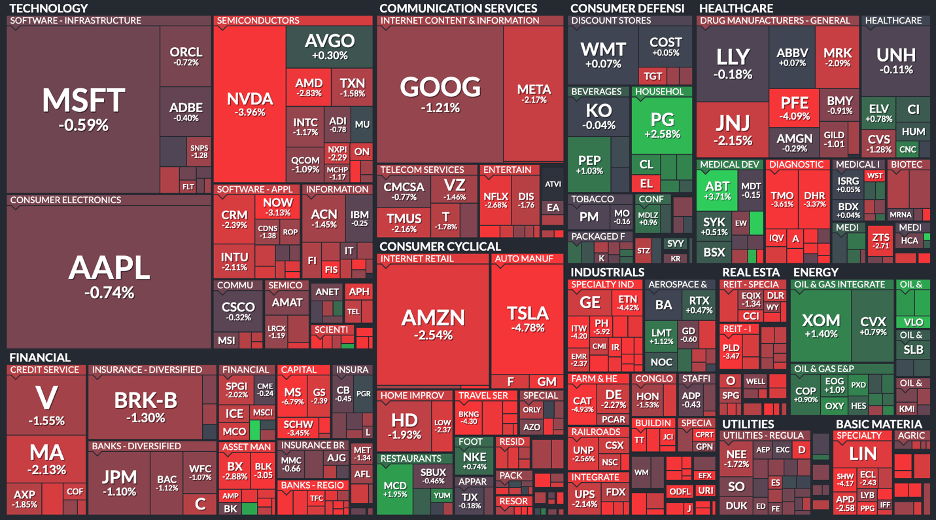

Here’s A Look At The S&P 500 Heat Map

Performance Of The Largest Stocks:

Apple $AAPL -0.7%

Microsoft $MSFT -0.6%

Google $GOOGL -1.2%

Amazon $AMZN -2.5%

Nvidia $NVDA -4.0%

Facebook $META -2.2%

Tesla $TSLA -4.8%

Berkshire $BRK.B -1.3%

Eli Lilly $LLY -0.2%

$UNH -0.1%

Visa $V -1.6%

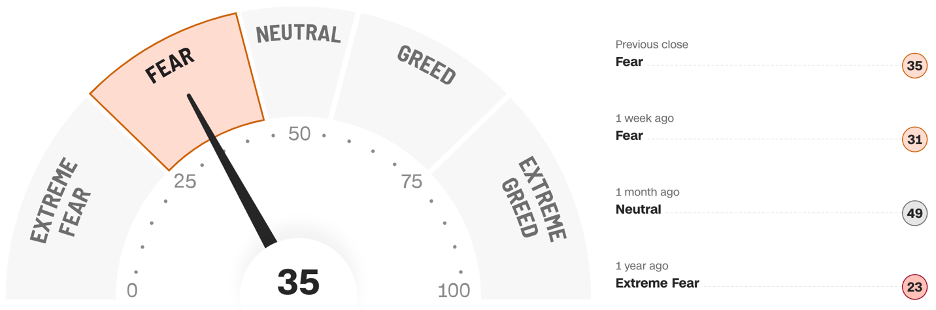

Fear & Greed Index: FEAR

Chart Of The Day:

Statista

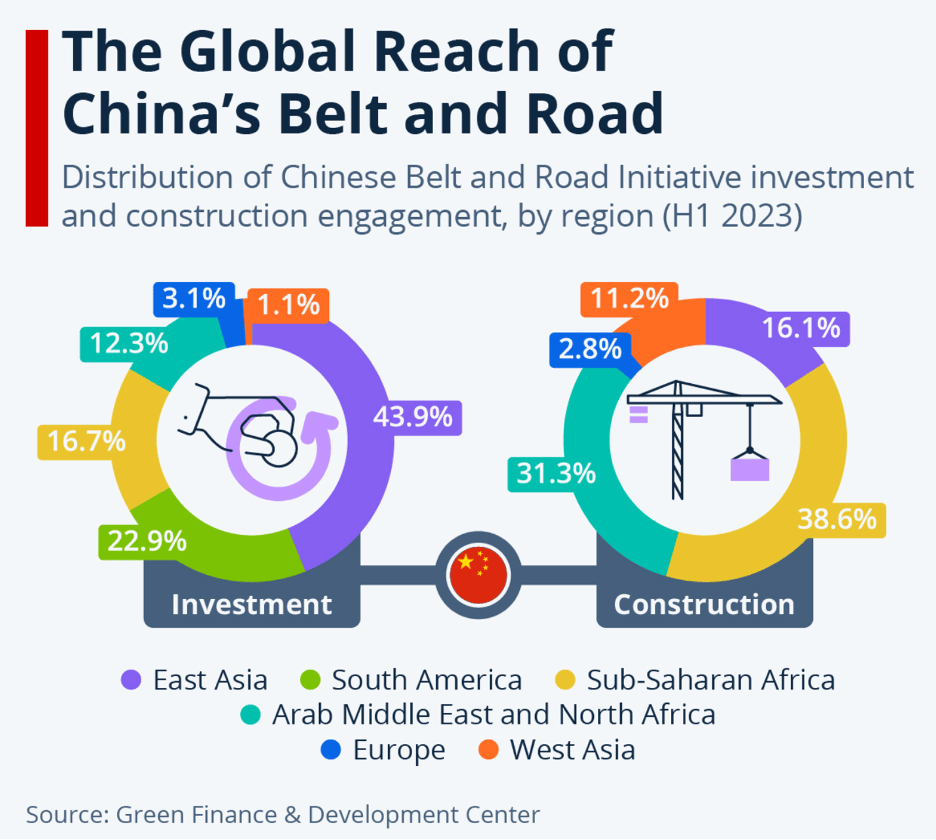

China has commenced its third Belt and Road Initiative Forum. The Belt and Road Initiative (BRI) has seen China's investments and construction activities spread across 148 nations globally, amassing an impressive $1.01 trillion in commitment. Nonetheless, a recent report from Boston University underscores a growing concern about "accentuated debt distress" in several nations benefiting from Chinese financing, as they grapple with significant portions of their external debt owed to China.

This year's forum, attracting delegates from 130 countries, has notable attendees such as Russian President Vladimir Putin, marking his first visit to China since the outset of the Ukraine conflict. Data from the Green Finance & Development Center reveals that BRI investments in the first half of 2023 have predominantly centered on East Asian and South American countries, constituting 43.9% of the total investment. In terms of construction projects, which often rely on Chinese loans, the focus has primarily been on Sub-Saharan Africa and the Arab Middle East and North Africa, jointly accounting for 69.9% of these endeavors.

In Other Interesting News:

Tesla CEO Elon Musk Sounds Pessimistic about Economy on Earnings Call: Tesla reported its Q3 results, with earnings at 66 cents per share (adjusted) compared to the expected 73 cents, and revenue of $23.35 billion versus the expected $24.1 billion. This marks the first time Tesla missed on both earnings and revenue since Q2 2019. CEO Elon Musk cautioned that the Cybertruck would not deliver significant positive cashflow for 12 to 18 months after production begins and emphasized the company's focus on making its cars more affordable due to the high-interest rate environment.

Tesla Cybertruck Deliveries Set for Nov. 30: Tesla announced the first deliveries of the Cybertruck will take place on November 30 at the company's Austin gigafactory. This date comes as Tesla reported a 44% drop in profits from the same period last year in its Q3 earnings report. Pilot production of the Cybertruck has started in Giga Texas.

Fed Chair Powell to Deliver Key Speech Thursday: Federal Reserve Chair Jerome Powell is set to deliver a crucial policy address where he will need to balance the fight against inflation with maintaining economic growth. Markets expect the Fed to hold rates steady, but they are looking for confirmation and clarification on current economic conditions and future trends. Powell is expected to discuss the strength of the economy, consumer strength in Q3 as a risk for inflation, and the need to maintain vigilance regarding inflation.

JPMorgan Says 60/40 Portfolio Far From Dead, Set to Trounce Cash: JPMorgan Asset Management reports that the traditional 60/40 portfolio, allocating 60% to equities and 40% to Treasuries, is poised to outperform cash by an annualized 4.1 percentage points and inflation by 4.5 percentage points over the next decade, despite current high money-market fund rates.

Netflix Stock Surges as Profit Beats Expectations, Ad-Tier Subscriptions Rise: Netflix reported strong Q3 results, with earnings of $3.73 per share, beating the expected $3.49 per share, and revenue of $8.54 billion, in line with expectations. The company added 8.76 million global subscribers during the quarter, outperforming the expected 5.49 million. Netflix credits this growth to its efforts to curb password sharing and the popularity of its new ad-supported tier.

Costco’s CEO Steps Down: Costco CEO Craig Jelinek will step down at the end of the year, with Ron Vachris set to replace him. Jelinek has been Costco's CEO since 2012. Costco has 861 warehouses worldwide, 591 in the United States, and around 66 million paid members and 119 million cardholders.

OpenAI Is in Talks to Sell Shares at $86 Billion Valuation: OpenAI is negotiating a tender offer to sell existing employees' shares at an $86 billion valuation with potential investors. The artificial intelligence startup is known for creating ChatGPT.

U.S. Crypto Regulatory Fog Keeps Standard Chartered Rooted in UAE, Asia: Standard Chartered has chosen Dubai as its base for launching crypto services, reflecting a trend among large banks and institutions that prefer jurisdictions with more mature digital asset regulations. The bank plans to safeguard bitcoin (BTC) and ether (ETH) for institutional clients starting in Q1 2024.

Disclaimer: This is not financial advice, the newsletter is strictly educational and is not investment advice.