- The Soft Landing

- Posts

- The Soft Landing ✈

The Soft Landing ✈

Yield Inversion Steepens

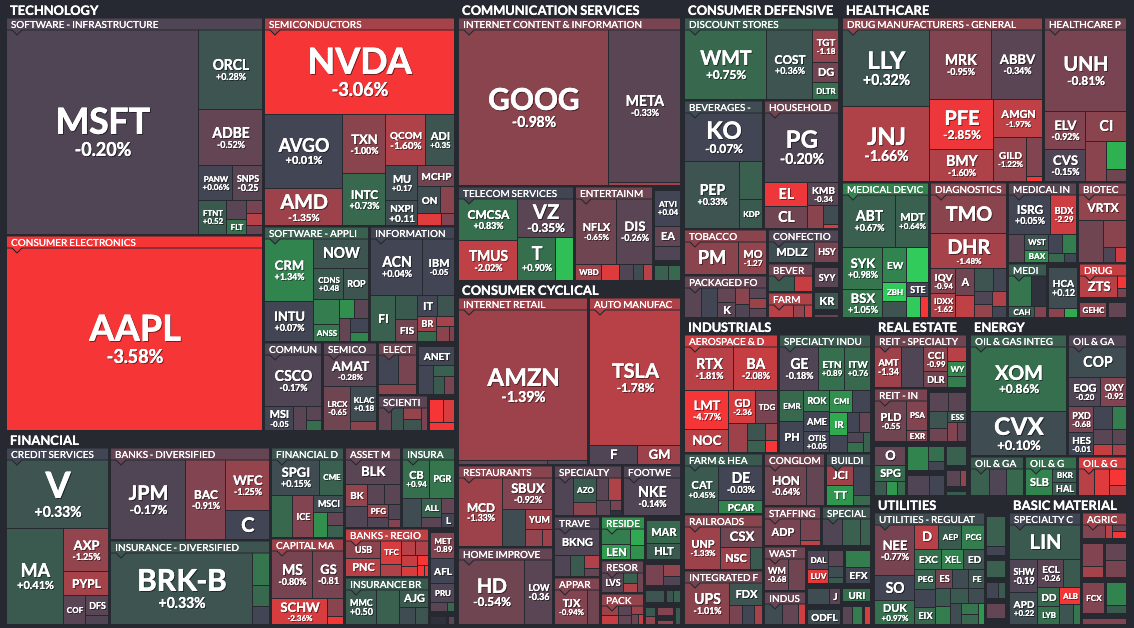

Stocks experienced a lackluster start to September as concerns over potential Federal Reserve interest rate hikes loomed large. The Dow Jones Industrial Average dipped by 198.78 points (0.57%) to 34,443.19, while the S&P 500 declined by 0.7%, closing at 4,465.48, and the Nasdaq Composite fell by 1.06%, settling at 13,872.47. Technology stocks, led by companies like Nvidia and Apple, bore the brunt of the rate worries, with the Nasdaq marking its third consecutive day of losses. Meanwhile, a steeper inversion in the Treasury yield curve further fueled these concerns, as the 10-year yield dropped significantly below the 2-year rate.

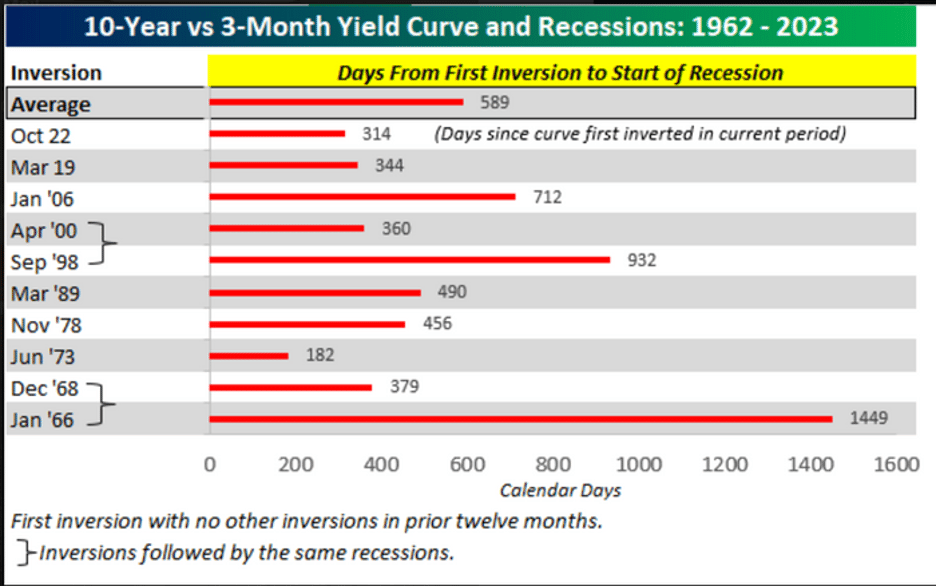

Does the steeper inversion signify an impending recession?

According to Bespoke analysts, they estimate that the next economic downturn could be roughly 275 days away, potentially starting in early June 2024, based on historical data indicating that past recessions occurred an average of 589 days after the 10-year and 3-month yield curve initially inverted.

Here’s how the markets closed:

Airbnb and Blackstone Shares Set For Price Bump On S&P 500 Inclusion: Airbnb (ABNB) and Blackstone (BX) are poised to join the S&P 500 Index on September 18 as part of the latest quarterly rebalancing. This inclusion in the large-cap benchmark follows the removal of Lincoln National Corp. (LNC) and Newell Brands Inc. (NWL), which will be transferred to the S&P 600 Index, focused on small-cap stocks. The move is expected to boost the share prices of Airbnb and Blackstone.

GameStop's Positive Results: GameStop Corp. reported second-quarter results that exceeded expectations. These results come amid significant changes within the company, including the firing of its chief executive, the resignation of its CFO, and the election of activist investor Ryan Cohen as executive chairman. Despite a net loss of $2.8 million, compared to $108.7 million, in the same quarter the previous year, the company experienced an increase in revenue, reaching $1.16 billion.

Elon Musk's SpaceX Loan: Elon Musk secured a $1 billion loan from SpaceX to facilitate his acquisition of the social media company formerly known as Twitter. The loan was reportedly backed by Musk's stocks in SpaceX, and he promptly repaid it in full, including interest, in November 2022, just one month after finalizing the acquisition.

Arm’s IPO and Tech Giants' Interest: Arm, a British chip designer that provides designs for the majority of the world's smartphones, is preparing for a highly anticipated IPO in the US. The company aims to price its shares between $47 and $51 each when it debuts on the Nasdaq later this month. SoftBank, Arm's Japanese owner, seeks to raise as much as $4.9 billion through the IPO, which could potentially increase to $5.2 billion if the underwriting banks exercise their option to purchase additional shares.

Sam Bankman-Fried's Laptop Access: Sam Bankman-Fried, the founder of the now-defunct FTX exchange, continues to face legal battles over access to his laptop while detained. Despite his incarceration, he has access to a laptop seven days a week and three hard drives containing defense materials. This situation highlights the complexities of managing his defense from within detention as he prepares for his upcoming criminal trial scheduled for next month.

Bitcoin's Volatile Session: Bitcoin's price experienced notable volatility during a single session, initially approaching six-month lows and later surging by about 2%. This surge followed the Financial Accounting Standards Board's approval of favorable accounting treatment for companies holding cryptocurrencies on their balance sheets and ARK Invest's submission of paperwork for a spot ether ETF. However, the rally quickly faded, with bitcoin returning to just below $25,700, while ether mirrored similar price action, remaining flat at $1,630.

Manchester United Shares Plunge on Sale Report: Manchester United shares have endured a steep decline, with a drop of over 19% this week, resulting in a nearly $740 million reduction in the soccer club's market value. This decline follows a UK newspaper report suggesting that the Glazer family, the club's US owners, would halt their attempt to sell the company, at least temporarily. United's shares extended their losses by falling an additional 1% following the Labor Day holiday, leaving the club valued at $3.15 billion at the close of trade on Tuesday.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.