- The Soft Landing

- Posts

- The Soft Landing ✈

The Soft Landing ✈

The Bond King's Warning

The Dow Jones Industrial Average ended a three-day losing streak on Wednesday, thanks to a pullback in Treasury yields following disappointing jobs data. The 30-stock index rose 127.17 points, or 0.39%, closing at 33,129.55. The S&P 500 saw a gain of 0.81%, finishing at 4,263.75. In the meantime, the Nasdaq Composite performed even better, rising by 1.35% to reach 13,236.01.

In the S&P 500, the consumer discretionary sector outperformed, with a roughly 2% increase. Tesla and Norwegian Cruise Line were the standout performers in this sector, posting gains of 5.9% and 3.8%, respectively.

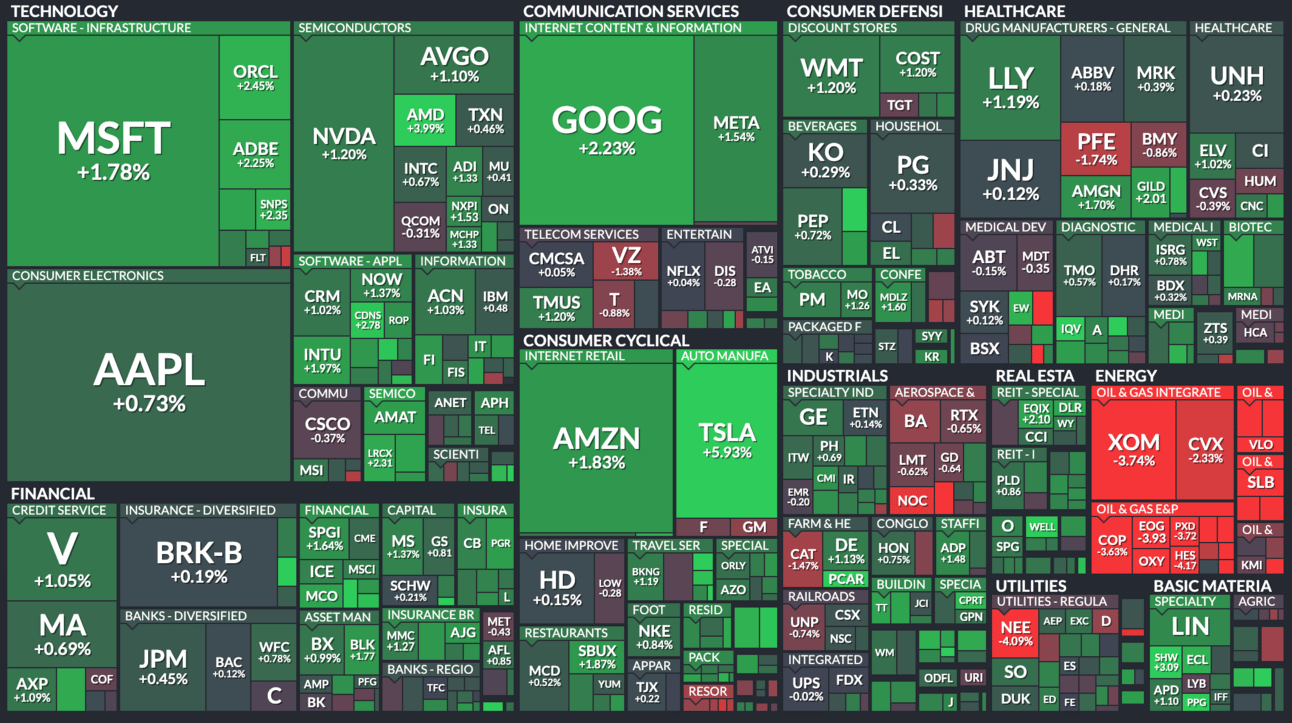

Here’s a look at the S&P 500 heatmap:

Other interesting news in the world of business:

The Bond King’s Warning: DoubleLine Capital CEO Jeffrey Gundlach, often referred to as "The Bond King," expressed concerns about a weakening economy in 2024 and warned of a potential "death spiral" for American consumers' personal finances. Gundlach pointed out that the government's response to the pandemic, including stimulus measures, has led to inflation and excessive consumer credit card spending. He cautioned that relying on credit cards to pay off other credit card debt is an unsustainable practice, akin to a "death spiral."

Mortgage Rates Surge: Mortgage rates are rapidly rising, with the average rate for a 30-year loan reaching 7.53%, the highest level since 2000. This spike in rates has resulted in a sharp decline in home-purchase applications, reaching a nearly three-decade low. The Mortgage Bankers Association reported a 6% drop in mortgage applications, citing the recent increase in Treasury yields as the cause.

Lower-Than-Expected Payroll Growth: Private payrolls grew by only 89,000 jobs in September, significantly below economists' estimates of 160,000 and a decrease from the revised figure of 180,000 in August. Additionally, annual wage growth has slowed for the 12th consecutive month, now standing at 5.9%. These numbers suggest potential softening in the labor market.

General Motors Prepares for Strikes: General Motors (GM) secured a $6 billion line of credit to prepare for the possibility of monthslong strikes by the United Auto Workers union. The strikes have already cost GM $200 million in the third quarter. Ford also obtained a $4 billion line of credit in August due to the strikes.

Attractive Bank Stocks Despite Rising Bond Yields: Bank of America suggests that rising bond yields could negatively impact bank balance sheets, especially for banks holding long-term Treasurys. This concern is affecting bank stocks. However, the bank believes that this could present a buying opportunity for long-term investors, particularly for bank stocks trading at attractive levels.

Metro Bank Shares Suspended: Shares of UK's Metro Bank were briefly suspended from trading multiple times due to significant volatility, with the stock losing over 29% from the previous day's close. The London Stock Exchange attributed the suspensions to its circuit breaker mechanisms triggered by the extent of the stock's rapid drop.

X (Formerly Twitter) Removes Article Headlines: X, formerly known as Twitter, has removed article headlines from links shared on the platform. Instead, links will display a thumbnail image along with a website link, marking one of several changes to the app. This update comes as Elon Musk promotes X as an alternative to traditional news outlets.

Elon Musk Tests Game Streaming on X: Elon Musk has tested game streaming capabilities on X, by broadcasting himself playing Diablo IV. This aligns with Musk's vision of expanding X into an "everything app" to diversify its revenue sources.

Housing Unaffordability in the US: A report by real estate data provider ATTOM reveals that median home prices in 99% of U.S. counties are now unaffordable for the average income earner, who typically makes around $71,214 annually. The report highlights that housing prices have become increasingly unaffordable, driven by rising home prices and mortgage rates, with homeownership becoming more difficult for the average American.