- The Soft Landing

- Posts

- The Soft Landing ✈

The Soft Landing ✈

Amazon's Secret Pricing Algorithm

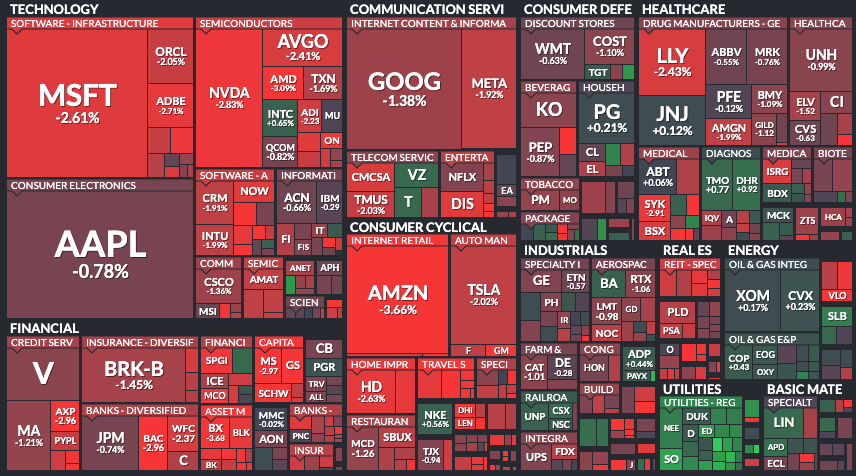

U.S. stocks took a hit on Tuesday, with all major indexes experiencing losses of at least 1%. This decline pushed the Dow Jones Industrial Average into negative territory for the year. Adding to the financial turbulence, the 10-year Treasury yield reached 4.8%, marking a 16-year high.

In Europe, the Stoxx 600 index fell by 1.1%, with all sectors and major stock exchanges showing negative performance. Meanwhile, in the United Kingdom, the FTSE declined by 0.54%, accompanied by a six-month low for the British pound against the U.S. dollar.

Here’s a look at the S&P 500 heatmap:

Other interesting news in the world of business:

Amazon's Secret Pricing Algorithm: The Federal Trade Commission (FTC) has filed a lawsuit against Amazon, alleging that the company used a secret algorithm named "Project Nessie" to determine price increases designed to be followed by competitors. The FTC characterizes Project Nessie as an "unfair method of competition" and a violation of the FTC Act. Many details about Project Nessie are redacted in the lawsuit.

US Treasury Yields at 16-Year High:US 10-year and 30-year Treasury yields reached their highest levels since 2007, driven by strong US jobs data and the Federal Reserve's hawkish stance on rate hikes. The 10-year Treasury yield rose to 4.80%, while the 30-year Treasury yield reached 4.927%. The surge in yields was fueled by robust job openings data for August and expectations of further rate hikes by the Federal Reserve. The avoidance of a federal government shutdown also contributed to this increase.

Sharp JOLTS: In August, there were a surprising 9.61 million job openings, exceeding expectations of 8.8 million and surpassing July's figures by 700,000. However, the number of actual hires only increased by 35,000 compared to July, reaching 5.857 million. Additionally, the number of people quitting their jobs, a sign of confidence in finding new employment opportunities, remained relatively unchanged at 3.6 million.

Japan's Property Sector Thriving: Foreign investments in Japan's real estate sector have surged by 45% over the past year, boosted by a weak Japanese yen and the country's central bank's continued loose monetary policy. Industry experts describe this as a "golden period" for Japanese real estate. Multifamily properties, in particular, have seen increased interest due to their transparency and strong fundamentals, making them an attractive investment.

TikTok Ends E-commerce Service in Indonesia: TikTok Indonesia has announced the discontinuation of transactions on its e-commerce platform to comply with new local regulations. This move follows a directive from the Indonesian Ministry of Trade, which set a one-week deadline for TikTok to become a standalone app without e-commerce features. TikTok stated its commitment to compliance with local laws and will cooperate with relevant authorities. The decision aligns with President Joko Widodo's call for social media regulation to protect domestic businesses from foreign competition.

Online Delivery Billionaires Lose Fortunes: Founders of online delivery companies that thrived during the pandemic are now witnessing their fortunes decline. Six known billionaires emerged from this boom, but four have already lost that status, collectively losing over $15 billion. The founders of companies like Getir, Just Eat Takeaway.com, Instacart, and DoorDash saw their valuations decrease as demand softened when the world began to open up post-pandemic.

Ripple's Expansion in Asia-Pacific: Ripple has obtained a significant payments institution license in Singapore as part of its strategic expansion in the Asia-Pacific region. This development follows an initial in-principle approval granted by the Monetary Authority of Singapore in June. With the full license, Ripple can continue to offer regulated cryptocurrency payment services in Singapore, where it sees rapid growth potential.