- The Soft Landing

- Posts

- The Soft Landing ✈

The Soft Landing ✈

Russell 2000 Goes Red

Despite a bit of political drama and a near-government shutdown scare, the Dow Jones Industrial Average only slipped 74.15 points, or 0.22%, ending at 33,433.35 on Monday. Meanwhile, the S&P 500 was pretty flat at 0.01%, closing at 4,288.39. On the brighter side, the Nasdaq Composite was in high spirits, dancing its way up by 0.67%, marking its fourth consecutive day of positivity at 13,307.77.

Now, the Russell 2000, which focuses on small-cap stocks dropped 1.6% on Monday, causing it to dip 0.3% year-to-date. It's the first time in 2023 that this index turned red, why is this important you might say? Well the Russell 2000 is a collection of 2000 small cap companies. The average market capitalization is around $2.98 billion, as of the end of August. To put it in perspective, if you want to join the exclusive S&P 500 club, you'd better bring a market cap of at least $14.5 billion.

Now, let's talk about performance. While the S&P 500 has been strutting its stuff with an impressive 11.69% year-to-date increase, the Russell 2000 decided to take a little detour. Its recent dip reminds us that the spotlight has been shining mostly on the big players this year.

But here's the interesting part: Investors often see the Russell 2000 as the mirror reflecting the true state of the U.S. economy. Why? Well, those smaller firms in the index are like the canaries in the economic coal mine. They're more sensitive to the ups and downs of the broader economic picture. Unlike giants like Apple, they don't have mountains of cash to weather storms, and they can't simply hike up prices when inflation comes knocking. So, their performance can be a more realistic representation of the market.

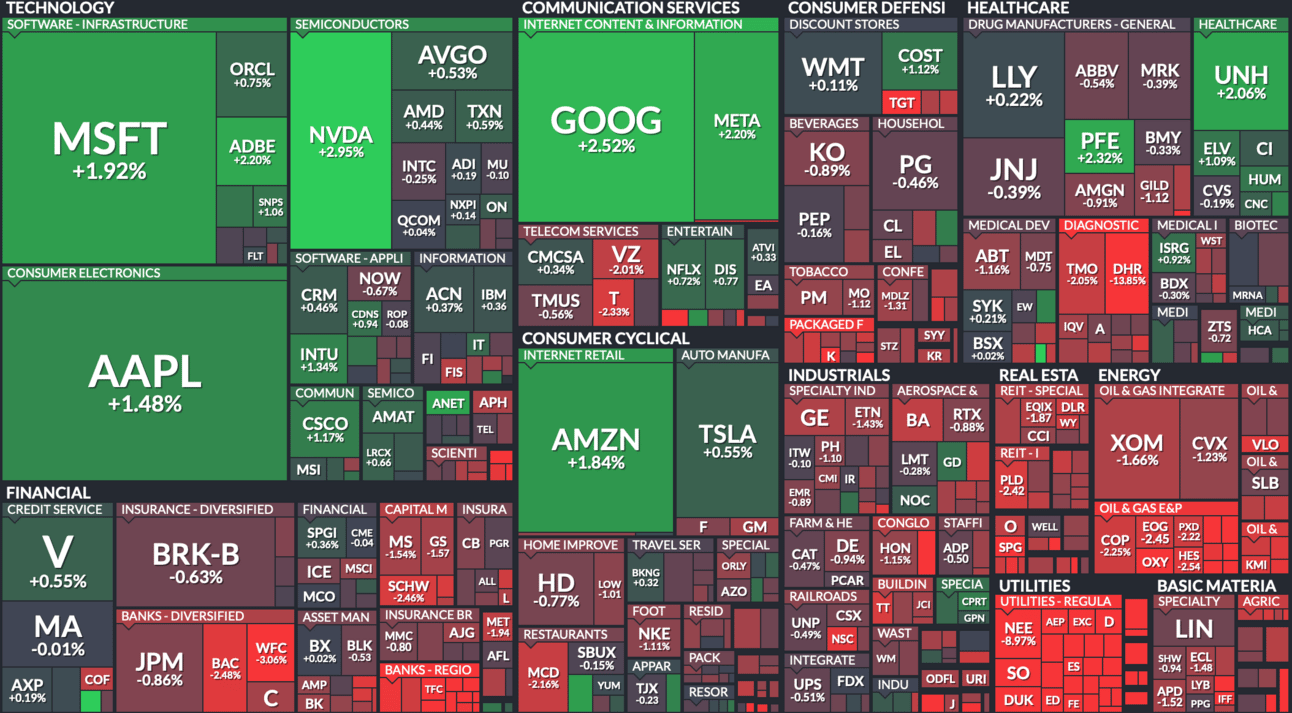

Here’s a look at the stock heatmap:

Other interesting news in the world of business:

Tesla's Delivery Dip: Tesla hit a speed bump in the third quarter, delivering 435,059 vehicles, which is about 6.6% fewer than the previous quarter. The company chalked this decline up to "planned downtimes for factory upgrades." It also fell short of Wall Street's delivery expectations.

Bond Yield Warning: J.P. Morgan Asset Management's David Lebovitz warns that rising bond yields, if they continue to outpace expectations, could lead to a financial catastrophe. The uncertainty surrounding how the U.S. economy would react to significantly higher interest rates raises concerns.

Ackman's Economic Outlook: Bill Ackman of Pershing Square has weighed in on the U.S. economy, saying it's "still solid, but it's definitely weakening." Rising Treasury yields are putting additional pressure on this slowdown, with Ackman anticipating the 30-year yield testing mid-5% and the 10-year inching toward 5%.

Stocks Unfazed by Rates: While the Federal Reserve is pledging to keep interest rates higher for longer, Goldman Sachs believes some stocks are immune to the negative impact of these rates on corporate profitability. These resilient stocks appear to have strategies that shield them from the usual drawbacks of high borrowing costs and reduced future earnings value.

Homebuyers' Advice in a Volatile Market: Financial experts from Ramsey Solutions provide advice for navigating the volatile real estate market, especially in the face of rising mortgage rates. They stress the importance of budgeting and planning in these challenging times. The average rate on the benchmark 30-year home loan reached its highest level since the year 2000, increasing from 7.19% last week to 7.31% this week, according to the latest data by Freddie Mac.

The 'Google Web' Trap: Microsoft CEO Satya Nadella made an interesting point during his testimony in the U.S. government's antitrust trial against Google. He noted that there's a "Google web" overshadowing the open web, where many publishers tailor their content and advertising to cater to Google's products. This highlights Google's substantial influence on web publishing.

World Bank's Growth Forecast Trimmed: The World Bank has adjusted its GDP growth forecast for developing East Asia and the Pacific due to China's weaker-than-expected economic recovery. It now expects 5% growth in 2023 (down from 5.1%) and 4.5% in 2024 (down from 4.8%) for this region.

UBS's Tokenized Money Market Fund: Swiss bank UBS has initiated a live pilot of a tokenized version of its variable capital company (VCC) fund. This move is part of Project Guardian, led by Singapore's central bank, aiming to bring real-world assets to the blockchain. UBS aims to enhance market liquidity and access for clients through this initiative.