- The Soft Landing

- Posts

- ✈ Saudi Arabia Firm On Regional HQ Deadline

✈ Saudi Arabia Firm On Regional HQ Deadline

PLUS: Other Interesting News You Need To Watch Out For 👀

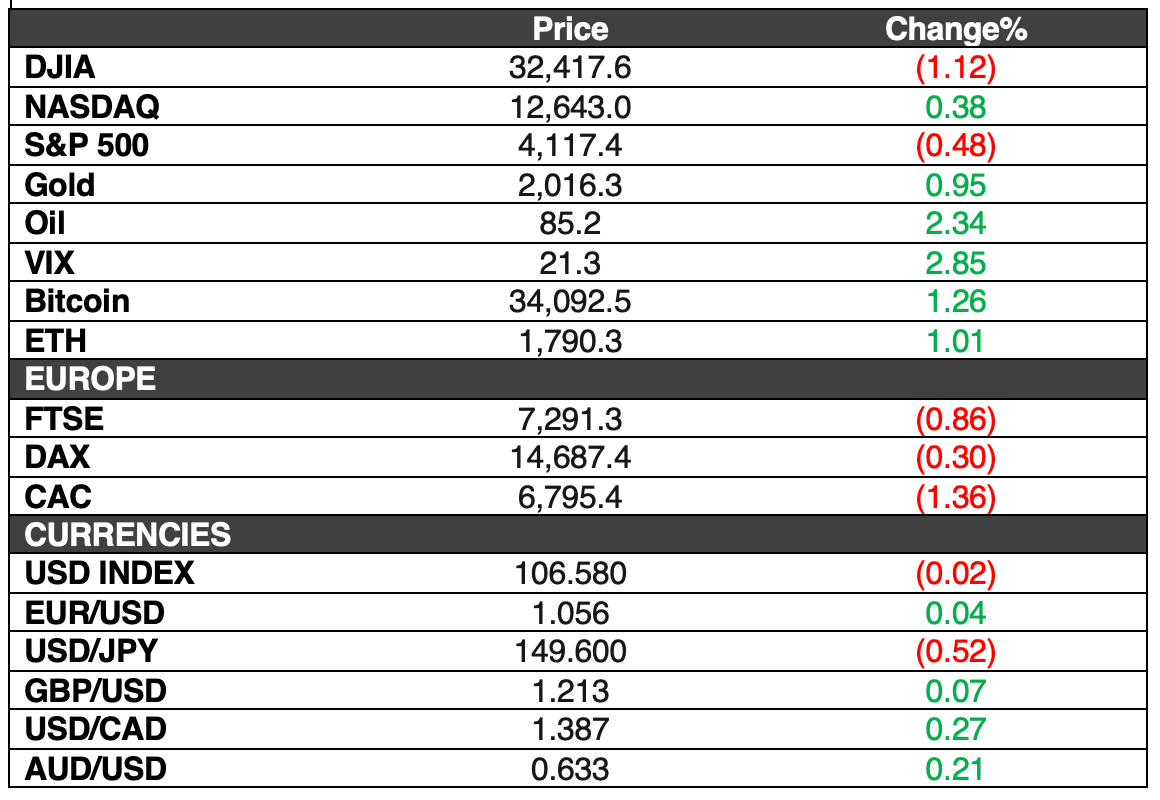

The stock market took a hit as fears of a looming recession prompted a renewed bout of selling. The Dow Jones Industrial Average stumbled by 366.71 points, or 1.12%, closing at 32,417.59. Simultaneously, the S&P 500 retreated by 0.48%, concluding the session at 4,117.37, marking a 10.3% drop from its peak on July 31, pushing it into correction territory.

JPMorgan Chase's stock was impacted by CEO Jamie Dimon's announcement of plans to sell 1 million shares in the coming year. However, the Nasdaq Composite bucked the trend, rising by 0.38% to reach 12,643.01, primarily driven by Amazon's impressive performance, which exceeded analysts' expectations for both revenue and earnings in Q3, triggering a more than 6% surge in its shares. This growth also influenced other megacap tech stocks like Microsoft to climb.

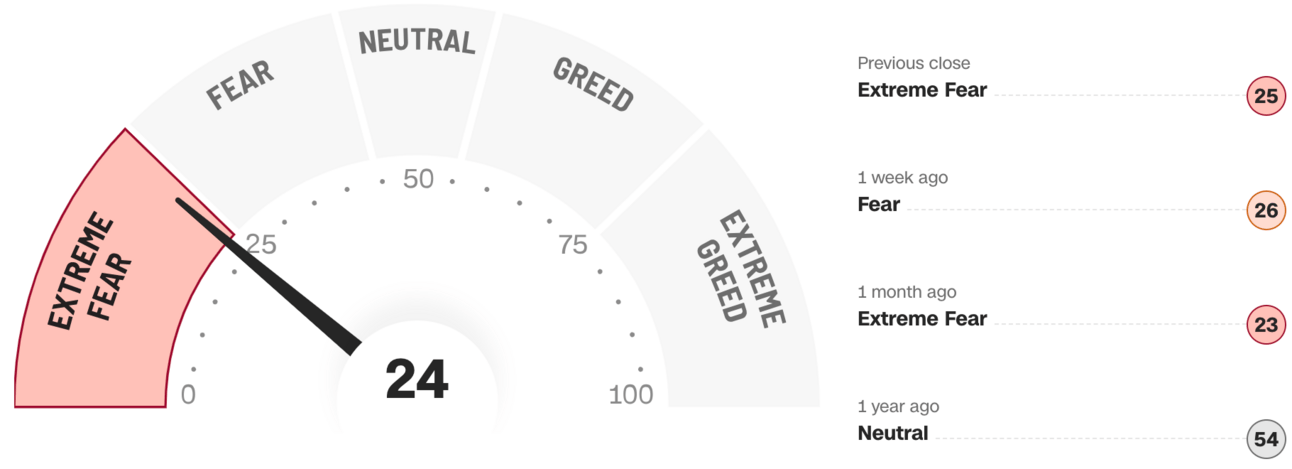

Here’s A Look At The S&P 500 Heat Map:

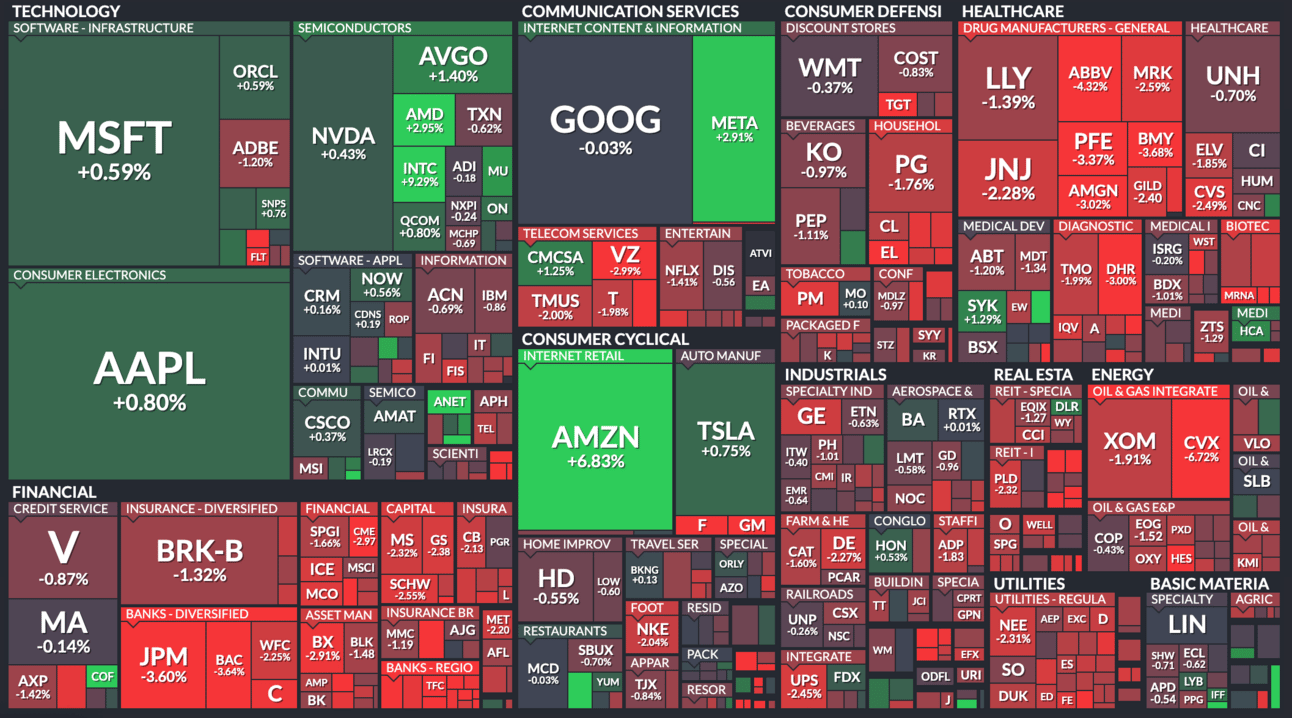

Fear & Greed Index: EXTREME FEAR 😱

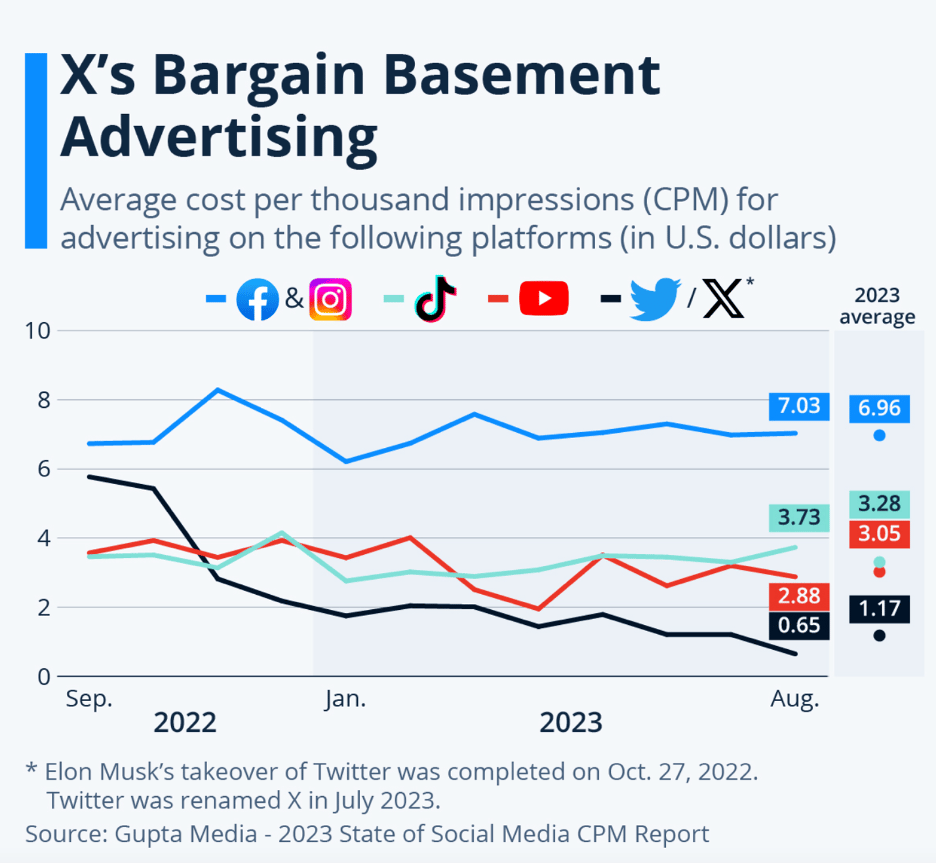

Chart Of The Day: X Faces Struggles in Ad Revenue

A report from marketing agency Gupta Media has shed light on the challenges faced by the social media platform X, formerly known as Twitter, since its acquisition by entrepreneur Elon Musk in October 2022. The study delves into the Cost Per Thousand Impressions (CPM), a metric used to gauge advertising space's value. Notably, a drop in CPM is typically linked to a decline in advertising revenues, while an increase, such as during events like Black Friday and Cyber Monday, usually correlates with rising ad sales. X has experienced a sharp decline in CPM, plummeting by over 75% since Musk took over, hitting $0.65 in August 2023 from $5.77 in September 2022. Musk acknowledged a 50% drop in ad revenues during Q2 results last July, with X witnessing the most significant annual CPM decline among all the platforms analyzed. This decline can be attributed to reduced moderation teams, a surge in misinformation and hateful content, and growing concerns among advertisers, many of whom have suspended their advertising activities on the platform.

In Other Interesting News:

October Marked as Worst Month for Stocks in Five Years: Equities have had a challenging October, with the VIX at 20 and stocks on the verge of their worst October performance in five years. Investors, including professional money allocators and hedge funds, are adopting a more defensive stance. They are reducing equity exposure to levels last seen during the 2022 bear market, with large short positions on single stocks. The S&P 500 has experienced multiple declines exceeding 1% in October, pushing the index into correction territory.

Global Bond Rout Poses "Tremendously Dangerous" Outlook for Stocks: A bond rout driven by surging bond yields is creating a precarious situation for equities, warns David Neuhauser, CIO of Livermore Partners hedge fund. This new era of higher interest rates has upended the status quo of the past decade-and-a-half. Neuhauser describes this situation as "tremendously dangerous" for stocks and suggests it could be especially challenging given the extended period of low interest rates prior to the shift.

S&P 500 Predicted to Surge 18% as Fed May End Rate Hikes: John Stoltzfus, the chief investment strategist of Oppenheimer, maintains a year-end S&P 500 price target of 4,900, indicating an 18% surge by the end of the year. This forecast is based on the belief that the Federal Reserve is likely to conclude its rate hike cycle, with a fed funds rate currently at 5.25%-5.5%. The economy has demonstrated resilience despite aggressive rate hikes to curb inflation, with GDP growing by 4.9% in the third quarter.

Federal Reserve Likely to Maintain Rates as Inflation Persists: The Federal Reserve is expected to announce that it will leave interest rates unchanged after its upcoming meeting. Despite Fed Chair Jerome Powell acknowledging that inflation remains high, economists and central bankers anticipate that rates will remain elevated. As a result, consumers should not expect relief from high borrowing costs.

US Inflation Accelerates as Consumer Spending Exceeds Expectations: In September, inflation picked up, with the core personal consumption expenditures price index rising by 0.3%, and personal spending exceeded expectations, climbing by 0.7%. This report from the Commerce Department indicates that consumers are sustaining their spending even as prices rise.

Saudi Arabia Firm on Ultimatum for Regional Headquarters Move by 2024: Saudi Arabia is resolute in its ultimatum that foreign companies relocate their regional headquarters to the kingdom by January 1, 2024, or risk losing access to government contracts. This move was announced in February 2021, prompting surprise among investors and expatriates. Faisal Al Ibrahim, Saudi minister of economy and planning, confirmed that the plan is proceeding, adding that there will be benefits and incentives for companies complying with the relocation.

Automakers, Including Ford and GM, Wary of US EV Market: Despite a nearly 50% increase in US electric vehicle (EV) sales year-over-year, major automakers are expressing caution. Ford CEO Jim Farley emphasizes the need to be cost-competitive in the EV business, noting that many US EV buyers are reluctant to pay premiums over gas or hybrid vehicles. This sentiment echoes the concerns raised by General Motors earlier.

Sam Bankman-Fried Testifies About FTX Collapse: In his testimony, Sam Bankman-Fried, former FTX mogul, doubled down on the claim that FTX's failure was due to mistakes rather than malfeasance.

Disclaimer: This is not financial advice, the newsletter is strictly educational and is not investment advice.