- The Soft Landing

- Posts

- ✈ More Recession Warnings?

✈ More Recession Warnings?

PLUS: Other Interesting News You Need To Watch Out For 👀

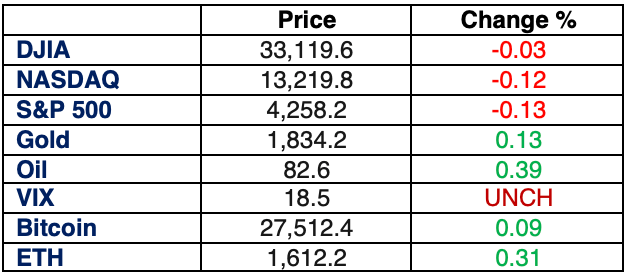

Investors experienced a relatively subdued session on Thursday, with slight declines in major stock indices. Here are the takeaways:

The Dow Jones Industrial Average fell by around 10 points, representing a 0.03% decrease.

The S&P 500 saw a 0.1% decline.

The Nasdaq Composite also recorded a 0.1% decrease.

Investor attention was primarily focused on the upcoming release of the September jobs report. Economists surveyed by Dow Jones had anticipated that the U.S. economy would have added approximately 170,000 jobs in the previous month, down from the 187,000 jobs added in the month prior. Additionally, the unemployment rate was expected to decrease from 3.8% to 3.7%.

The bond market continued to be a point of concern for many investors, with hopes that a somewhat softer jobs report might alleviate the pressure on bond yields. The 10-year U.S. Treasury yield had recently reached a 16-year high, briefly touching 4.884% before settling above 4.7%. Rising bond yields have been a source of volatility for the equity markets.

Market Close:

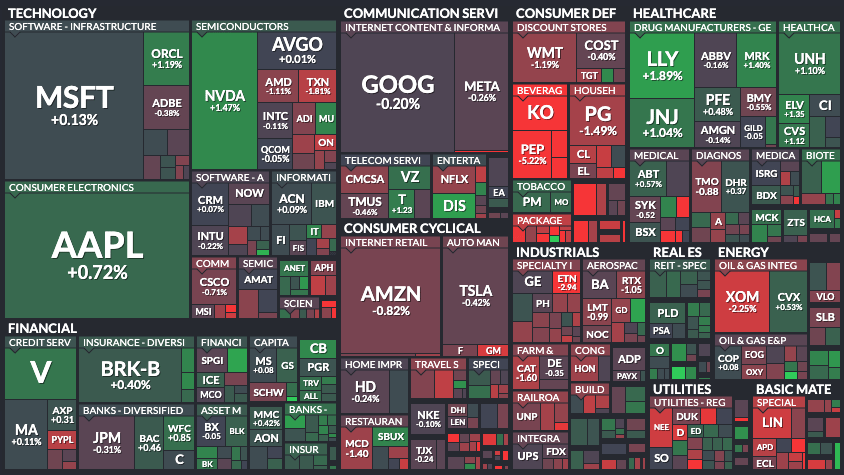

Here’s a look at the S&P 500 heat map:

Chart of the Day: 2030 World Cup will be played in 3 continents!

Source: Statista

In a groundbreaking move, FIFA has awarded the hosting rights for the 2030 World Cup to Spain, Portugal, and Morocco, marking the first time the tournament will span three continents and six nations. This unprecedented format, designed to celebrate the centenary of the inaugural World Cup held in Uruguay in 1930, has stirred both excitement and concerns.

In other interesting news:

Market Plunge Warning: JPMorgan's Marko Kolanovic is warning of a potential 20% sell-off in the S&P 500 due to high-interest rates. He suggests that parking cash in money market and short-term Treasurys yielding 5.5% is a protective strategy against this scenario. Kolanovic also highlights the possibility of a near-term bounce, which hinges on upcoming economic reports.

SEC Sues Elon Musk: The Securities and Exchange Commission (SEC) is suing Elon Musk over his alleged refusal to testify in an investigation into his purchase of X (formerly Twitter) last year. The probe aims to determine if Musk violated securities laws during his Twitter acquisition. This legal battle marks Musk's latest clash with federal regulators.

JPMorgan Considers Saudi Bonds: JPMorgan Chase & Co. is considering adding Saudi Arabia's local-currency bonds to its emerging-market index, potentially attracting more foreign portfolio investment to the Kingdom. This move could fund significant diversification projects in Saudi Arabia away from oil.

Wealthy Flock to Singapore: Singapore is becoming a magnet for the wealthy and asset managers. Prominent figures like Ray Dalio and Ken Griffin have set up operations in Singapore, drawn by its favorable tax policies and political stability. The influx of finance professionals was also driven by the escape from Hong Kong's strict "zero-COVID" policies.

Sweden's Pension Fund Crisis: Sweden's largest pension fund, Alecta, has faced turmoil after incurring significant losses linked to the collapse of Silicon Valley Bank in the U.S. Surging interest rates are now pressuring the fund's major holding in a Swedish landlord. The departure of key executives, including Chairwoman Ingrid Bonde, has added to the fund's challenges.

Dubai's Luxury Property Market - World’s Busiest: Dubai has solidified its status as the world's busiest luxury property market, with buyers investing $1.59 billion in high-end properties during the third quarter. This surge in luxury property transactions has set new records, with 277 sales for homes worth $10 million or more in the first nine months of the year.

Crypto CEO's Trial Begins: Sam Bankman-Fried, the former CEO of FTX, is on trial in New York, facing allegations of massive fraud. Prosecutors claim he stole billions from clients and investors. Bankman-Fried's defense team contends that he was acting in "good faith".

Ethereum Futures ETFs Gain Momentum: Ethereum Futures Exchange Traded Funds (ETFs) are gaining traction in terms of trading volume and investor interest, with assets in these ETFs exceeding $15.6 million. VanEck's Ethereum Strategy ETF (EFUT) has emerged as a leader in this space. This growth in assets for Ethereum Futures ETFs is seen as a positive development for the broader crypto market.