- The Soft Landing

- Posts

- ✈ Mortgage Rates Hit 7.57%

✈ Mortgage Rates Hit 7.57%

PLUS: Other Interesting News You Need To Watch Out For 👀

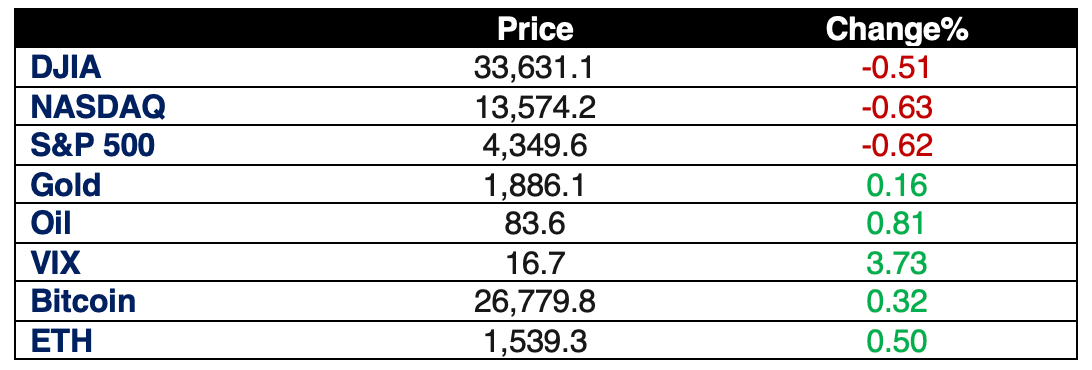

Stocks experienced a decline on Thursday, as rising Treasury yields raised concerns about persistent U.S. inflation. The Dow Jones Industrial Average decreased by 0.51% or 173.73 points to close at 33,631.14. The S&P 500 also fell by 0.62%, concluding at 4,349.61, while the Nasdaq Composite, known for its tech-heavy composition, saw a 0.63% drop, finishing at 13,574.22. This decline marked the end of a four-day winning streak for major indexes.

Fresh inflation data prompted a surge in Treasury yields, with the 10-year rate increasing by almost 11 basis points to 4.70%, and the 2-year Treasury yield trading at 5.06% after a rise of over 6 basis points. The recent surge in yields, which reached a 16-year high, has been unsettling for stocks. Some investors believe that higher yields may persist, contributing to the equity market's decline on Thursday.

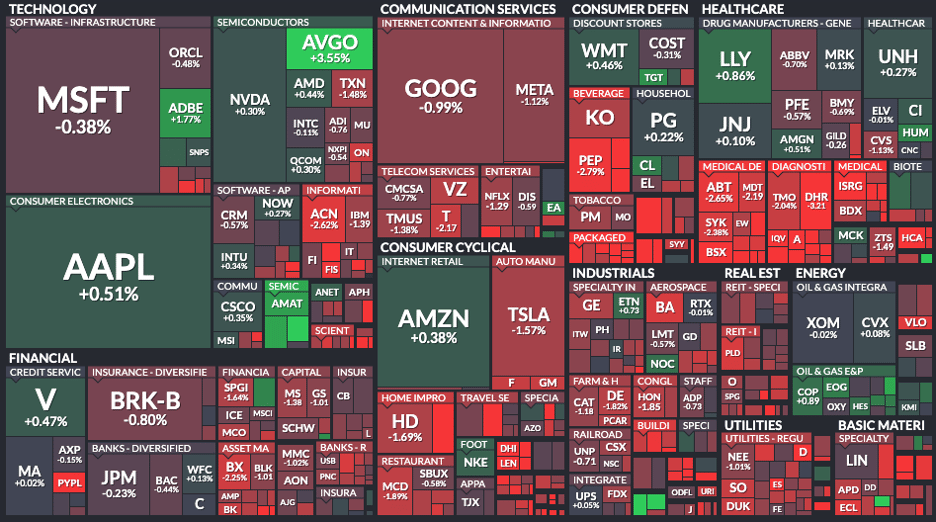

Here’s A Look At The S&P 500 Heat Map

Finviz

Performance Of The Largest Stocks:

Apple $AAPL +0.5% é

Microsoft $MSFT -0.4% ê

Google $GOOGL -1.1% ê

Amazon $AMZN +0.4% é

Nvidia $NVDA +0.3% é

Facebook $META -1.1% ê

Tesla $TSLA -1.6% ê

Berkshire $BRK.B -0.8% ê

Eli Lilly $LLY +0.9% é

Visa $V +0.5% é

$UNH +0.3% é

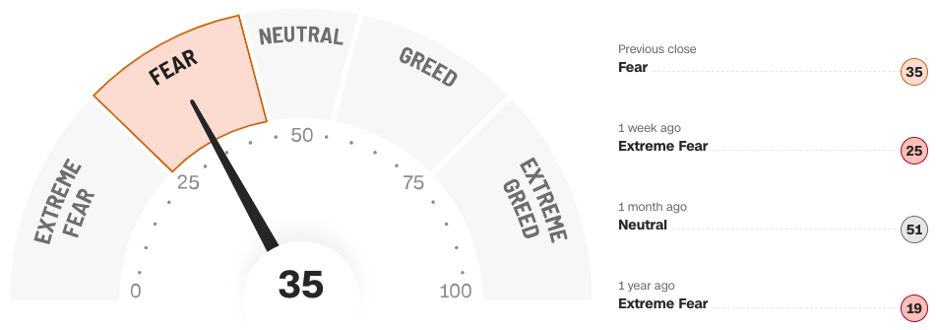

Fear & Greed Index:

CNN Business

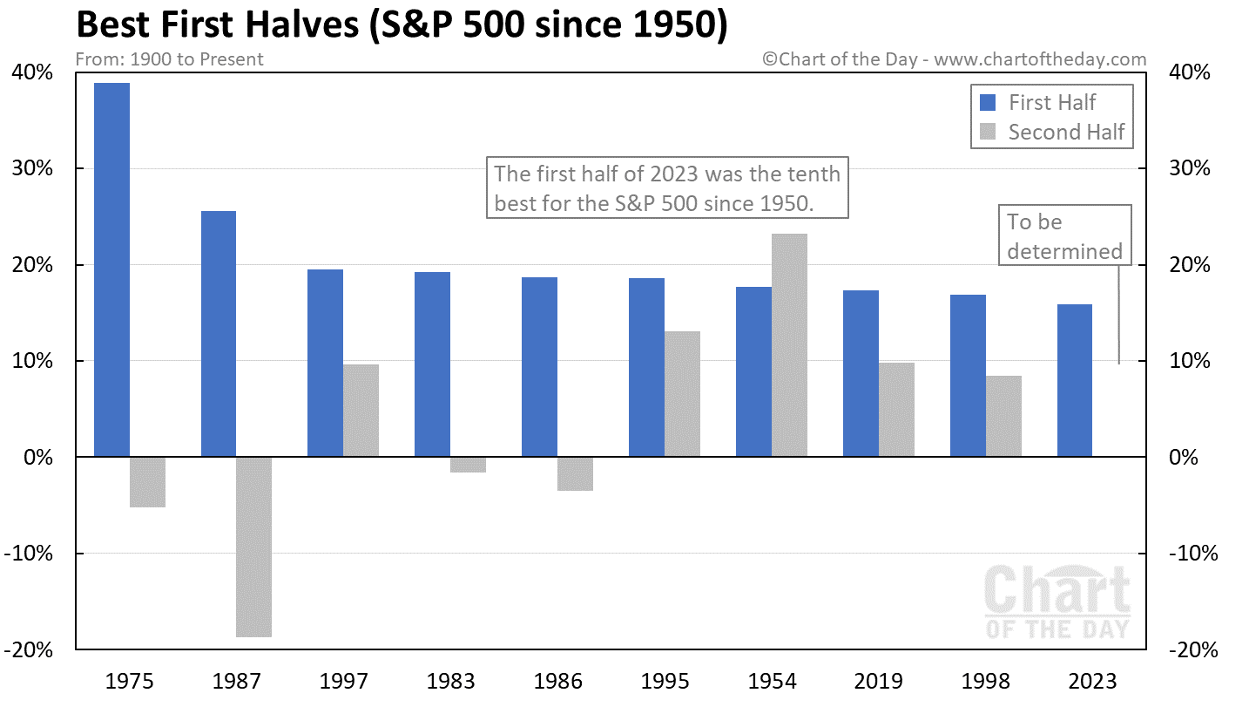

Chart Of The Day:

Chartoftheday

The first half of 2023 has shown a positive performance for stocks, with the S&P 500 recording a 15.9% gain during this period. To put this into context, historical data since 1950 indicates that this is the tenth best first half for the S&P 500 (highlighted by the blue columns on the chart).

Interestingly, many of the strong first halves were followed by somewhat less robust second halves, as indicated by the gray columns in the chart. This historical perspective suggests that while a strong start is promising, it may not always guarantee equally strong performance in the second half of the year.

In Other Interesting News:

Mortgage Rates Continue to Rise, Hitting 7.57%: Mortgage rates have increased for the fifth consecutive week with the 30-year fixed-rate mortgage averaging 7.57% in the week ending October 12 7.57%. This marks the highest point for mortgage rates since December 2000. These persistent rate hikes, combined with the ongoing rise in home prices due to limited housing inventory, are posing challenges for potential homebuyers. While the economy continues to grow, the housing market remains strained by affordability constraints, resulting in a three-decade low in purchase demand.

The Challenge of Achieving 2% Inflation: Although it might sound straightforward in theory, achieving the Federal Reserve's 2% inflation target is more complicated than it seems. The primary culprits are service and shelter costs, which have proven less cyclical and harder to control compared to other components that tend to fluctuate with the broader economy. Notably, factors like rent and medical care services exhibit stickier inflation patterns. Economist Steven Blitz suggested that achieving 2% inflation might require a recession, emphasizing the challenge in reaching this target. While annual inflation measured by the consumer price index decreased to 3.7% in September, there's still work to be done to reach the Fed's goal.

Warren Buffett's Shift From REITs to Housing Investments: Warren Buffett has sold his only real estate investment trust (REIT), STORE Capital Corp., which was acquired in a $14 billion transaction. Although there are no publicly traded REITs in Buffett's current portfolio, he has shifted his focus towards the housing market. Berkshire Hathaway purchased shares in three major U.S. homebuilders: D.R. Horton, Lennar Corp., and NVR Inc. These investments indicate Buffett's confidence in the housing sector and align with his long-term investment strategy.

BlackRock Invests in High-Yield Dividend Stocks: Despite challenging macroeconomic conditions, BlackRock believes that investment opportunities persist in the market. The company suggests that increased macroeconomic volatility creates greater divergences in security performance. One high-yield dividend stock that BlackRock is focusing on is Hannon Armstrong, a company dedicated to climate-positive investments. Additionally, BlackRock has identified Gaming and Leisure Properties, a unique real estate investment trust, which primarily leases properties to gaming and casino operators, as another appealing investment opportunity.

JPMorgan Chase's Upcoming Third-Quarter Earnings: JPMorgan Chase is preparing to release its third-quarter earnings report. Wall Street analysts anticipate earnings per share to be around $3.96, with a revenue estimate of approximately $39.65 billion. Investors and industry observers are keen to scrutinize these results for insights into how the financial sector has been affected by rising interest rates and mounting loan losses.

General Motors Faces Stock Slide Amid Strikes and Airbag Issues: General Motors' shares have faced a recent slide due to various factors, including a possible airbag issue and labor strikes in the automobile industry. The unionized labor strikes at major American automakers, including General Motors, Ford, and Chrysler, have contributed to stock declines. General Motors' market capitalization has fallen from $47 billion to $42 billion due to this decline, and the shares are now more than 50% down from their peak in January 2022. These developments present significant challenges to the automotive giant.

SPAC Returns Funds for Trump Social Media Deal: Digital World Acquisition Corp, the SPAC planning to merge with Donald Trump's media and technology firm, has decided to return $533 million raised for the deal to investors. This decision comes after some investors retracted $467 million in commitments. The SPAC had raised this money through a private investment in public equity (PIPE) transaction. The PIPE was supposed to provide $1 billion for Trump Media & Technology Group's merger with Digital World. However, regulatory delays led to the loss of PIPE investors.

Jeff Bezos Adds Mansion in Florida's "Billionaire Bunker": Jeff Bezos, the third-richest individual globally, is set to purchase a seven-bedroom mansion in Indian Creek, a man-made barrier island in South Florida, for $79 million. This acquisition, which offers a 7.1% discount from its original listing price of $85 million, adds to Bezos' real estate portfolio in the region. This purchase demonstrates Bezos's continued interest in luxury real estate investments.

Disclaimer: This is not financial advice, the newsletter is strictly educational and is not investment advice.