- The Soft Landing

- Posts

- ✈ Morgan Stanley - Good Time To Invest in Fixed Income

✈ Morgan Stanley - Good Time To Invest in Fixed Income

PLUS: Other Interesting News You Need To Watch Out For 👀

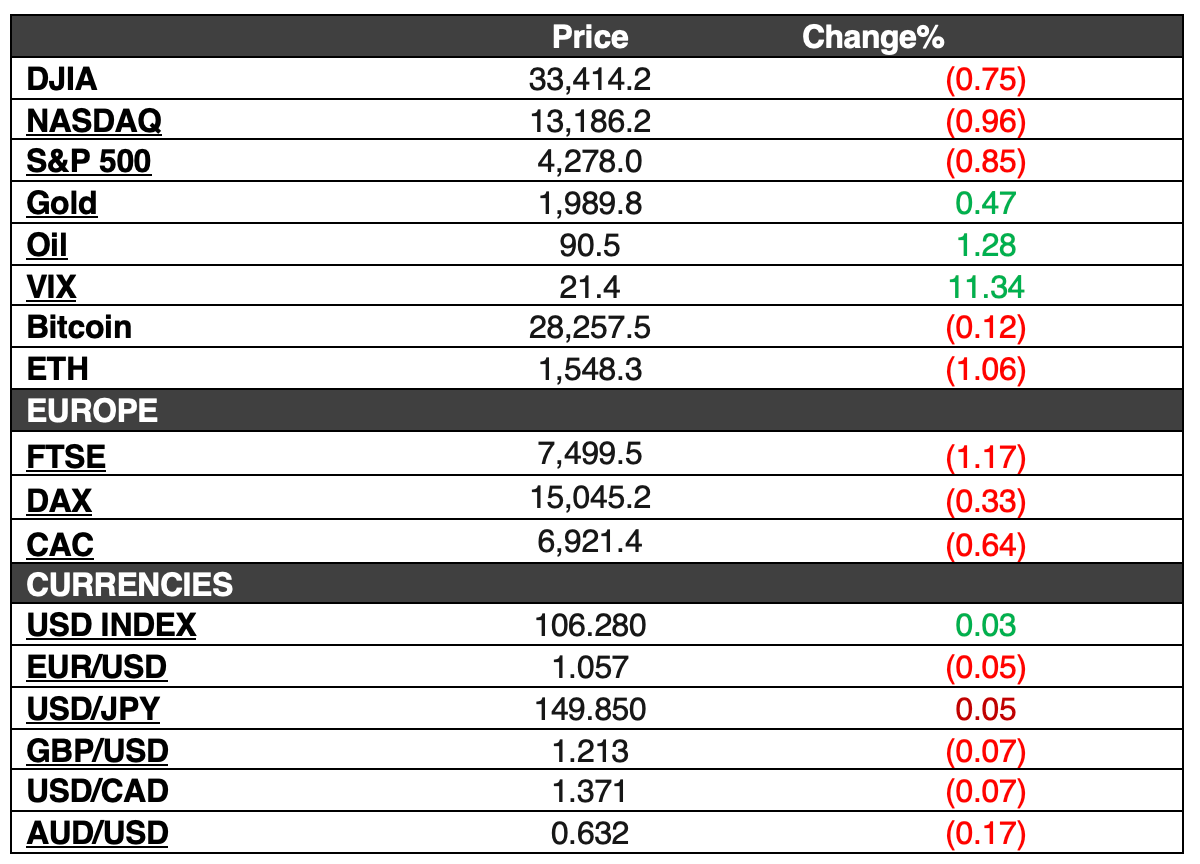

On Thursday, the markets dropped with the Dow Jones Industrial Average falling 250.91 points (0.75%) to close at 33,414.17. The S&P 500 also dropped 0.85% to 4,278, and the Nasdaq Composite ended 0.96% lower at roughly 13,186. This dip followed Federal Reserve Chair Jerome Powell's statements about persistent high inflation and the potential need for lower economic growth to combat it. Powell emphasized ongoing progress in achieving the Fed's dual mandate goals of maximum employment and price stability but also indicated that monetary policy was not overly restrictive. As a result, investors perceived a likelihood of the Fed maintaining its current interest rates at the upcoming policy meeting, with the market pricing in a 97% chance of unchanged rates.

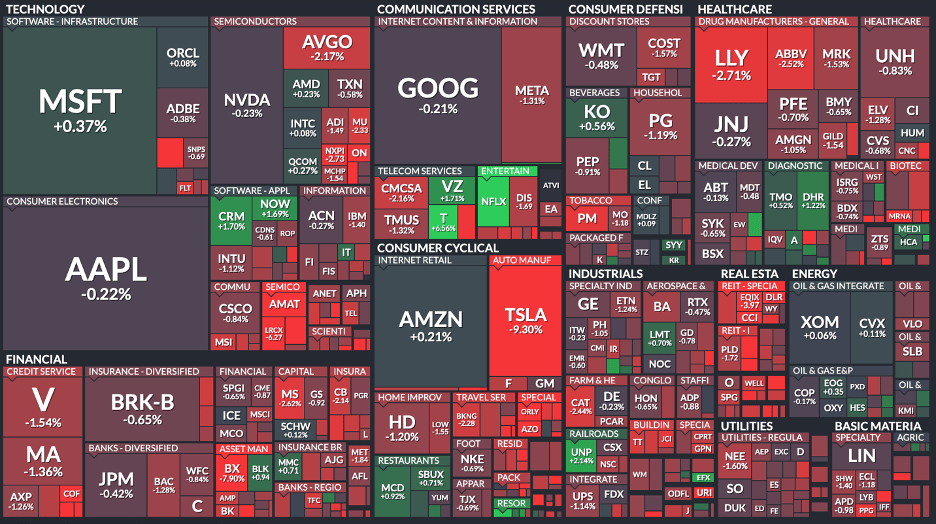

Here’s A Look At The S&P 500 Heat Map

Performance Of The Largest Stocks:

Apple $AAPL -0.2%

Microsoft $MSFT +0.4%

Google $GOOGL -0.2%

Amazon $AMZN +0.2%

Nvidia $NVDA -0.2%

Facebook $META -1.3%

Tesla $TSLA -9.3%

Berkshire $BRK.B -0.7%

Eli Lilly $LLY -2.7%

$UNH -2.7%

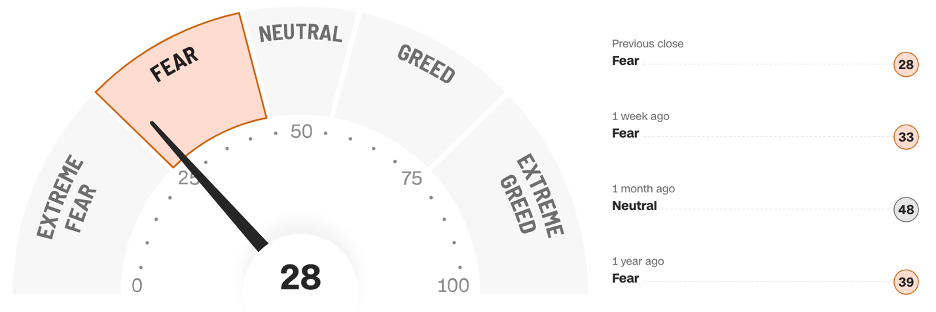

Fear & Greed Index: FEAR (NEARING EXTREME FEAR 😱)

Statista

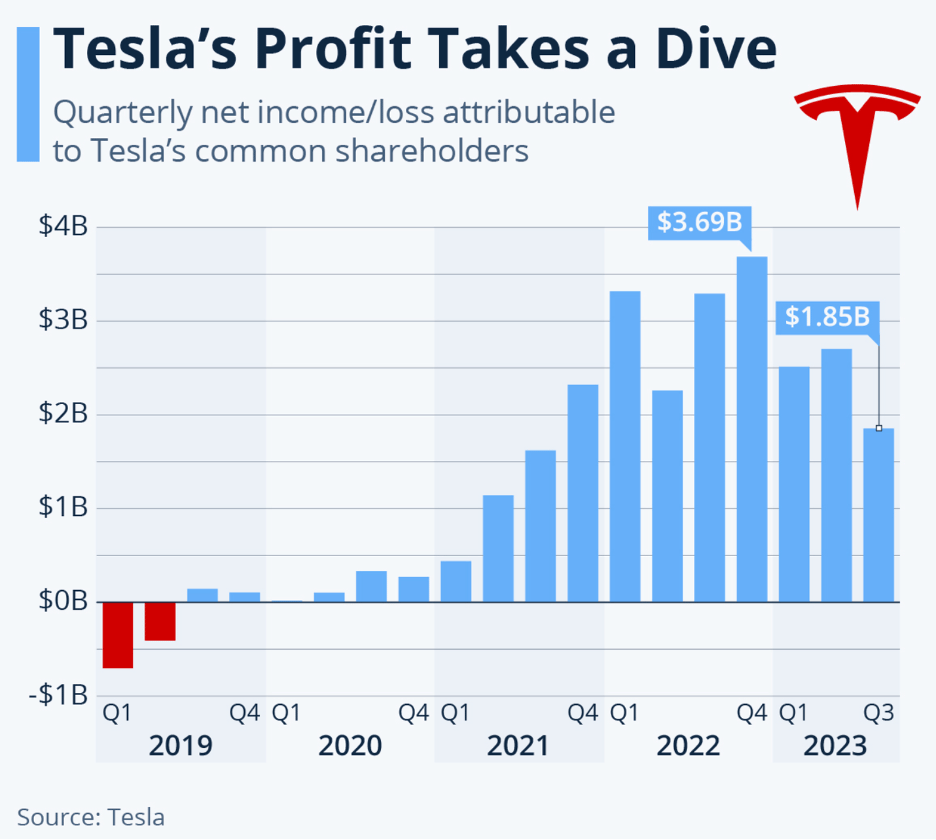

When Tesla joined the S&P 500 in December 2020, it met the profitability criterion, marking a turning point for the electric car maker, which had faced financial challenges in the past. However, in 2023, the company is encountering profitability issues once again. In its latest financial report, Tesla disclosed a net income of $1.85 billion, the lowest since Q3 2021. This decline is a departure from the upward trend the company had experienced previously. The war's impact on consumer sentiment and increased operating expenses related to projects like the Cybertruck and AI, as well as factory upgrades, are contributing to Tesla's current profitability challenges.

In Other Interesting News:

Powell addresses inflation and interest rates: Federal Reserve Chairman Jerome Powell acknowledged the moderation of inflation but reaffirmed the Fed's unwavering commitment to its 2% target. In a speech, Powell refrained from committing to specific policy changes but emphasized the importance of vigilance in pursuing the central bank's goals. He stressed that despite recent progress in reducing inflation, more time and evidence are required to ensure a sustainable decline. The central bank's position is that some economic growth moderation may be necessary to bring inflation down to the desired level.

Bond King Jeffrey Gundlach prefers the current bond market: Jeffrey Gundlach, founder of DoubleLine Capital, expressed satisfaction with the current bond market. He contrasted it with the low-yield environment of 2016 when achieving a 5% annual yield on bonds required investing in riskier assets. Now, rising bond yields present the opportunity for higher returns on fixed-income investments, with T-bills offering security due to being backed by the U.S. government. The yield on the one-year Treasury bill was noted at 5.47%.

Morgan Stanley suggests US Treasuries at 5% are a good investment: Morgan Stanley Investment Management recommends that investors consider entering the market when 10-year US Treasury yields reach 5% or higher. This suggestion is based on the current economic conditions, where benchmark U.S. yields are nearing the 5% threshold. The decision to invest is weighed against conflicting factors such as geopolitical tensions in the Middle East, which drive demand, and the increasing supply of U.S. securities due to a growing budget deficit. U.S. 10-year yields have risen over 30 basis points, reaching 4.98%, the highest since July 2007.

U.S. housing market affordability issues, according to Redfin: A new report from Redfin reveals that Americans need to earn over $114,627 to afford a median-priced home, marking a 15% year-over-year increase. This puts homeownership out of reach for many, especially when compared to the median household income of $74,580 in 2022. Renting is also becoming more expensive in various markets. While the national data highlights the growing affordability crisis, regional variations, particularly in expensive markets like New York City, exacerbate the problem.

Mortgage rates approach 8%: Mortgage rates have continued their ascent, with the 30-year fixed-rate mortgage averaging 7.63%. This increase, up from 7.57% the previous week, has pushed rates toward the 8% mark. The elevated rates not only impact prospective homebuyers but also affect home builders in the U.S.

Binance relaunches Bitcoin SV, triggering a price surge: Binance, a leading cryptocurrency exchange, relaunched Bitcoin SV (BSV) through a USDⓈ-M BSV Perpetual Contract with 50x leverage. This move resulted in a 30% surge in BSV's price and over $500,000 in short position liquidations. The decision to relist BSV on the platform follows a tumultuous period that began when Binance delisted BSV in April 2019 amid disputes over BSV creator Craig Wright's claims and alleged attacks on Twitter users.

Bitcoin ETF approval anticipated by year-end, with a shift in SEC stance: The evolving digital asset landscape and a growing push for regulatory clarity are expected to lead to a shift in the U.S. Securities and Exchange Commission's stance on Bitcoin Exchange-Traded Funds (ETFs) by the end of 2023. Mike Novogratz, CEO of Galaxy Digital, pointed out the intellectual inconsistency in the SEC's current position, which allows futures ETFs but not cash-based ones. There is strong demand from the public and industry giants for Bitcoin ETFs, and SEC Chairman Gary Gensler is facing mounting pressure to meet this demand. Public sentiment, regulatory filings, and the potential positive market response all contribute to optimism regarding Bitcoin ETF approval.

Crypto transactions surge, moving $800 million in 17 hours: An exceptional development in the cryptocurrency sector witnessed transactions totaling $800 million in Bitcoin, Ripple's XRP, and Ethereum within just 17 hours on Wednesday. The surge began with Coinbase receiving a significant inflow of Bitcoin and continued with substantial transactions between unidentified wallets. The central role played by Coinbase in these transactions highlights its importance in the crypto market. In addition to Bitcoin, Ripple's XRP and Ethereum also experienced significant movement in this extraordinary event.

Disclaimer: This is not financial advice, the newsletter is strictly educational and is not investment advice.