- The Soft Landing

- Posts

- ✈ Markets Take Another Dip 📉

✈ Markets Take Another Dip 📉

PLUS: Other Interesting News You Need To Watch Out For 👀

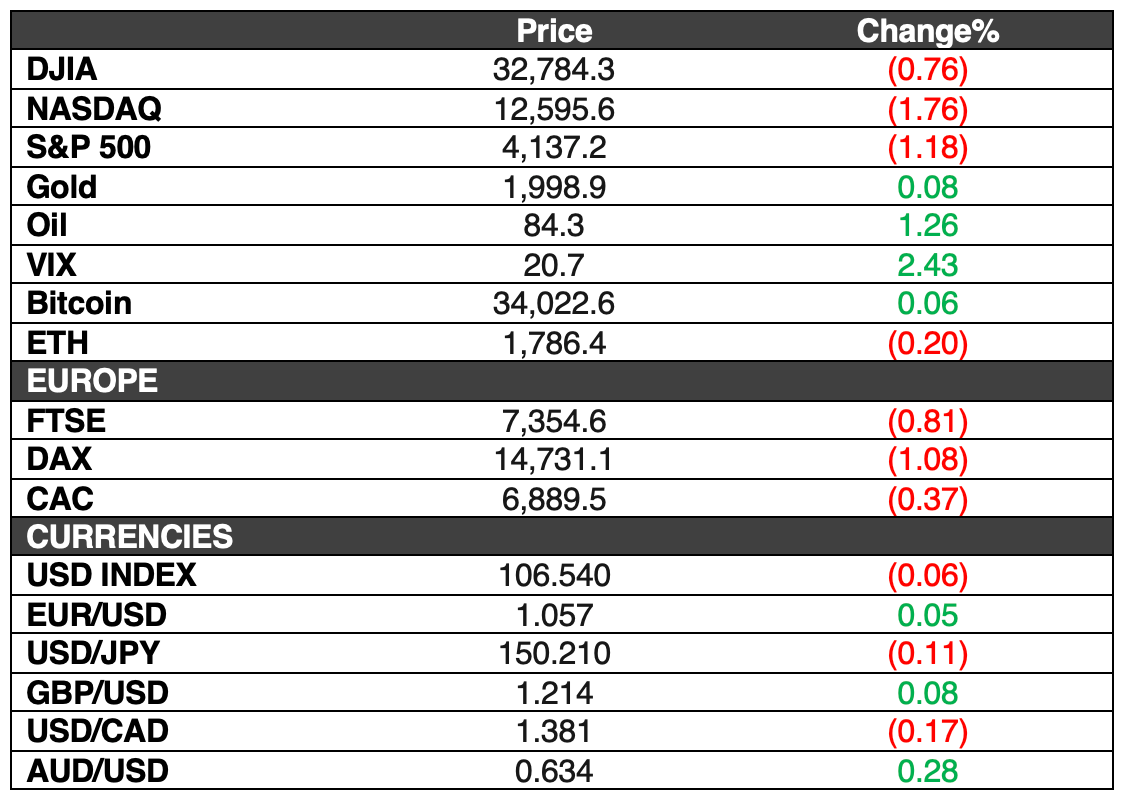

The Nasdaq Composite slid further into correction territory as Meta provided a disappointing forecast. The tech-heavy index fell by 1.76%, closing below its 200-day moving average at 12,595.6. Meanwhile, the S&P 500 dipped 1.18% to finish at 4,137.23, and the Dow Jones Industrial Average lost 0.76%, closing at 32,784.3. During the trading session, the S&P 500 briefly entered correction territory, ending nearly 10% below its closing high from July.

The Nasdaq Composite officially entered correction territory, having declined by more than 10% from its year-high closing level, following a 2.4% decrease the previous day.

Crypto also cooled on Thursday, following a substantial rally earlier in the week driven by expectations of a spot Bitcoin ETF. Bitcoin declined approximately 2% in the past 24 hours, trading just above $34,000, as investors seized the opportunity to take profits after its nearly 20% surge over the previous week. Ether remained relatively steady, trading near $1,790.

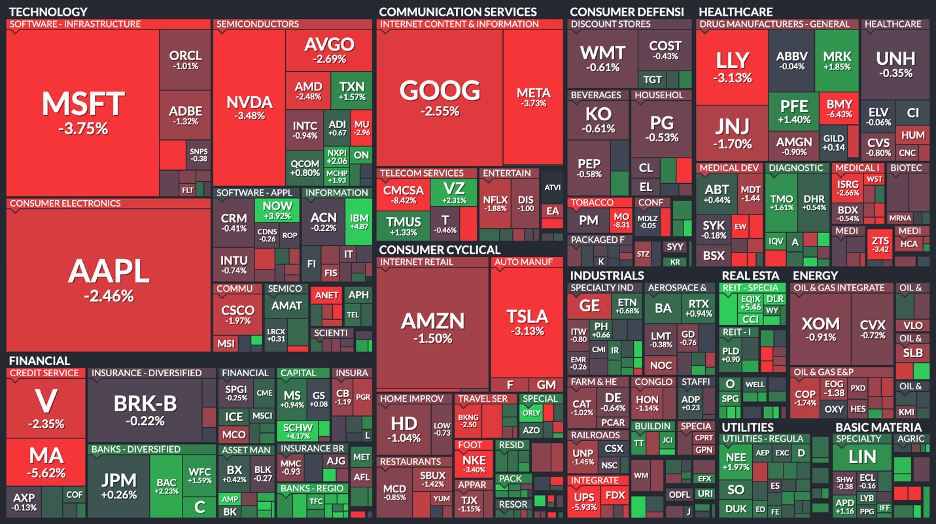

Here’s A Look At The S&P 500 Heat Map:

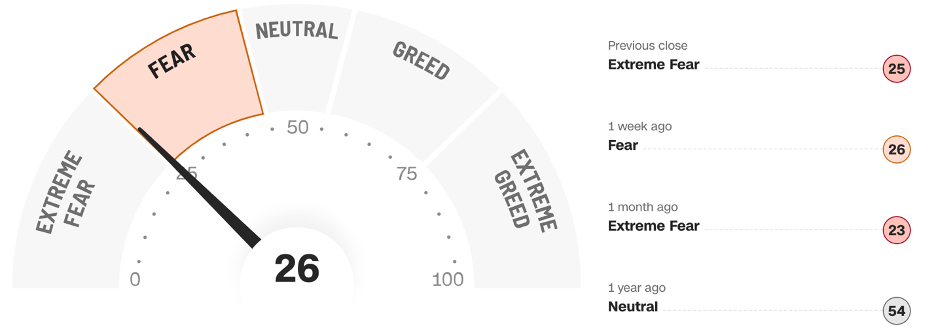

Fear & Greed Index: FEAR (…NEARING EXTREME FEAR 😱)

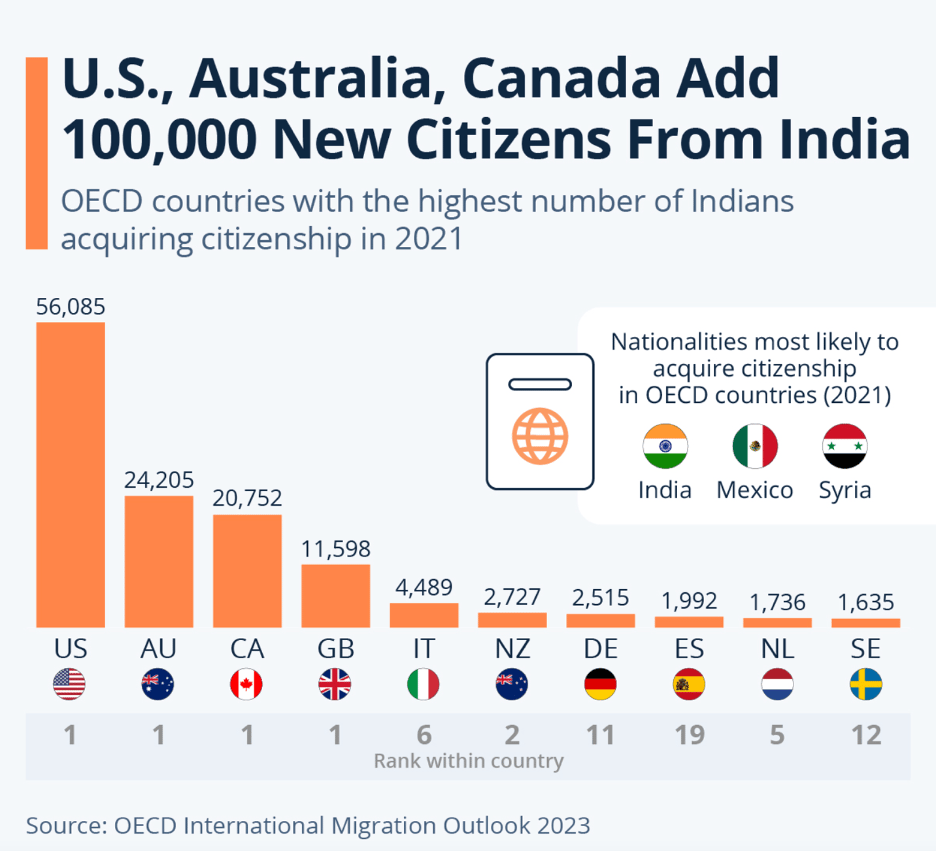

Chart Of The Day:

In 2021, a report from the OECD revealed that Indians were the most likely nationality to acquire the citizenship of OECD countries. Over 100,000 Indians became citizens of the United States, Australia, Canada, and more than 11,000 acquired UK passports, making India the top country of origin for new citizens in these nations. The Netherlands and Sweden also saw significant numbers, around 1,700 and 1,600 respectively. Despite a 15% drop compared to 2019 naturalization figures, India remained the most common former nationality of new OECD citizens, followed by Mexico and Syria, with the latter experiencing a 150% rise in new citizens after many Syrians left due to the civil war.

In Other Interesting News:

Amazon's Remarkable Q3 Performance: Amazon has delivered a stellar Q3 earnings report, significantly surpassing expectations with robust figures. Their earnings per share stood at 94 cents, outperforming the anticipated 58 cents according to LSEG. The revenue for the quarter soared to $143.1 billion, considerably surpassing the projected $141.4 billion by LSEG. In specific segments, Amazon Web Services generated $23.1 billion, just shy of the expected $23.2 billion. Their advertising sector made an impressive $12.1 billion, surpassing the estimated $11.6 billion. As they enter the critical holiday period, Amazon forecasts Q4 sales between $160 billion and $167 billion, while analysts expected $166.6 billion in revenue. This strong 13% revenue growth in Q3 hints at Amazon's resurgence following a challenging 2022 marked by soaring inflation and rising interest rates.

Ford's Q3 Disappointment: Labor Strikes Impact Earnings Guidance: Ford missed Wall Street's Q3 earnings expectations due to a labor strike that cost the company $1.3 billion. The labor strike, which lasted nearly six weeks, led to the withdrawal of Ford's previously announced earnings guidance, which included adjusted earnings between $11 billion and $12 billion.

BP Charges Ahead: $100 Million Deal with Tesla for EV Chargers: BP will purchase $100 million worth of electric vehicle chargers from Tesla to expand its EV charging network. These chargers are 250 kilowatt fast chargers, and they will be branded as "BP Pulse." BP currently operates 27,000 charging points and is planning rapid expansion.

US Consumer's Precarious Path: Are We on the Edge of a Financial Cliff?: The US consumer is facing financial challenges as indicators show they are running out of excess cash. Despite strong retail sales, the household savings ratio has declined, and real income growth has been negative for three consecutive months. This economic scenario arises as the GDP posts a robust 4.9% annualized gain in the third quarter.

Remote Work Under Scrutiny: Did the Pandemic Change Work Ethic? Stephen Schwarzman, CEO of Blackstone, suggested that people who worked remotely during the COVID-19 pandemic didn't work as hard as they claimed. The pandemic's remote work experience included juggling Zoom meetings, childcare, and household responsibilities for many Americans.

China Mourns: Former Premier Li Keqiang's Sudden Passing: China's former premier, Li Keqiang, passed away at the age of 68 due to a heart attack in Shanghai. Li completed two terms as premier before his death, and his economic-reform-oriented policies sometimes put him at odds with Chinese President Xi Jinping.

Hong Kong's Property Market: A Chill Despite Easing Measures: Despite easing property cooling measures, the property market in Hong Kong faces headwinds. A surprise reduction in the buyers' stamp duty from 15% to 7.5% was announced, but Hong Kong's property prices continue to decline by nearly 20% since their peak in August 2021. Data from real estate agency Midland Realty shows that the second-hand property market's average turnover ratio dropped from 8.7% to 3.7% between 2010 and 2023.

Sam Bankman-Fried's Testimony: FTX Founder's Defense Revealed: Sam Bankman-Fried, founder of FTX, testified that he believed Alameda Research was allowed to borrow customer funds deposited with FTX based on a "terms of service" document. These statements are part of ongoing legal proceedings where Bankman-Fried is accused of embezzlement. His reliance on advice from FTX lawyers is emphasized in his defense.

Crypto Cool Down: Bitcoin's Volatile Ride Continues: The cryptocurrency market experienced a cooling-off period after a recent rally fueled by spot bitcoin ETF anticipation. Bitcoin slipped about 2% over 24 hours to just above $34,000 following a nearly 20% jump over the past week. Ethereum traded flat near $1,790. Tokens like Chainlink and adventure gold faced significant declines influenced by trading platform activities.

Disclaimer: This is not financial advice, the newsletter is strictly educational and is not investment advice.