- The Soft Landing

- Posts

- ✈ Markets Rally Continues - Treasury Yields Drop

✈ Markets Rally Continues - Treasury Yields Drop

PLUS: Other Interesting News You Need To Watch Out For 👀

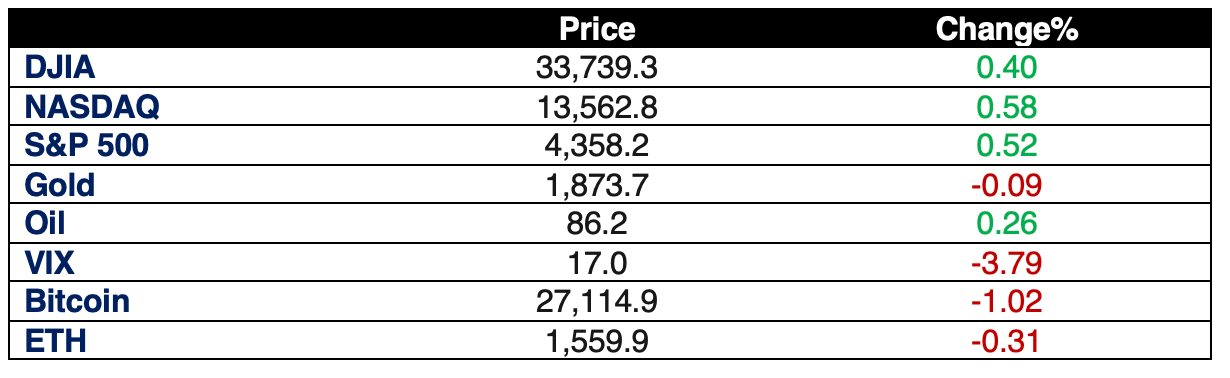

Markets continued rallying with U.S. stocks rising on Tuesday, boosted by falling Treasury yields and easing oil prices. Smallcap companies continued their winning streak, with the Russell 2000 index rising by 1.14%, surpassing the S&P 500's 0.52% gain by more than double. Impressively, the Russell 2000 has managed to climb 2.8% since October 3, while its larger counterpart, the S&P 500, has experienced a 3.0% rise during the same period.

Although the smallcap benchmark is still 11.5% below its 52-week high achieved on February 2, it's inching its way back up, whereas the S&P 500 trails by 5.4% compared to its 52-week high dating back to July 27. This week, in the first two trading days alone, smallcaps are showing their enthusiasm with a 1.7% increase, outpacing the S&P 500's 1.2% gain. It looks like the little guys are having a moment to shine! 🚀

Europe’s regional Stoxx 600 index soared 1.96% as travel stocks rebounded 3.9% from yesterday’s sell-off. Separately, European gas prices spiked because of a damaged gas pipeline between Finland and Estonia.

Here’s A Look At The S&P 500 Heat Map:

Source: Finviz

Performance Of The Largest Stocks:

Apple $AAPL -0.3% ê

Microsoft $MSFT -0.4% ê

Google $GOOGL -0.3% ê

Amazon $AMZN +1% é

Nvidia $NVDA +1.2% é

Tesla $TSLA +1.5% é

Facebook $META +1.1% é

Berkshire $BRK.B +0.9% é

Eli Lilly $LLY +1.3% é

Visa $V +0.9% é

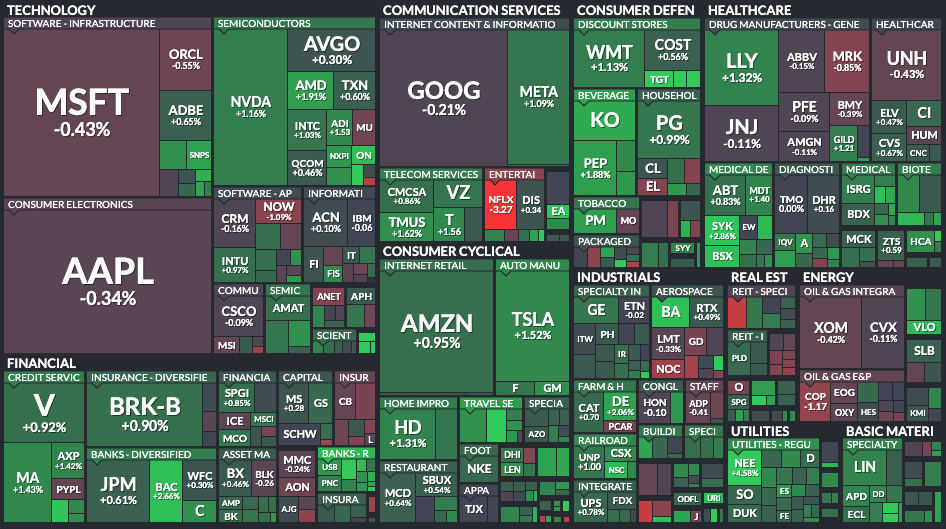

Fear & Greed Index

Source: CNN Business

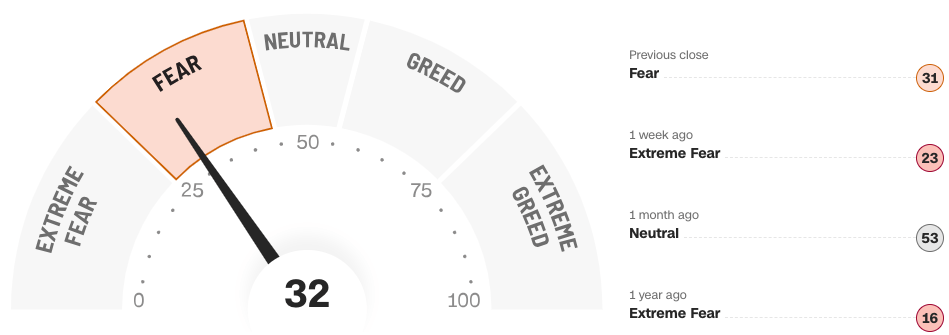

Chart Of The Day: Socks and Birkenstocks?

Source: Statista

Here’s a look at Birkenstock’s customer base. Birkenstock, much like Crocs, has successfully evolved beyond its practical origins, making its sandals a fashion statement while retaining its core customer base. These comfortable sandals are no longer limited to healthcare professionals, soccer moms, and the elderly; they've become a favorite among fashion models and celebrities. The brand appeals to a diverse customer base, with customers spanning various age and income groups, although the very young and affluent are less common buyers. Surprisingly, more than 70 percent of Birkenstock customers are female, even though the brand's sandals are often considered unisex.

In Other Interesting News:

Junk Government Bonds Dominate After US Downgrade: Following Fitch Ratings' downgrade of the US to AA+, junk-rated government debt exceeds top-rated debt for the first time. Only $5 trillion of government debt globally is still rated AAA. The increased proportion of junk-rated bonds in the market reflects both the US downgrade and the overall shift in global bond ratings.

Birkenstock Prices Its IPO: Birkenstock priced its IPO at $46 per share, valuing the company at around $8.64 billion, slightly below its initial target of up to $9.2 billion. The stock will trade on the NYSE under the ticker "BIRK." Despite the slight deviation from the target, the IPO is expected to provide Birkenstock with substantial capital for future growth and expansion.

Samsung Electronics Profit Drop by 78%: The South Korean chip giant expects a 78% drop in operating profit for the quarter ended September, with revenue of approximately 67 trillion South Korean won ($50.02 billion). This is a 78.7% year-on-year decline, but slightly higher than analyst expectations. Despite the profit drop, Samsung's share price surged, demonstrating a decoupling of stock performance from the company's financial results.

China’s Consumer Spending Not Back to Pre-Pandemic Levels: China's consumer spending remains below pre-pandemic levels, with retail sales growth less than 3% a year since the start of the pandemic. UBS predicts consumption growth may pick up to 5% or 6% by the end of 2024, compared to 9% before the pandemic. While spending is gradually recovering, it's still a long way from returning to pre-pandemic levels due to low consumer confidence and other economic factors.

Self-Healing Smartphone Displays Could Be Here Sooner Than You Think: Analyst firm CCS Insight predicts that smartphones with self-healing displays could be on the market by 2028, using a nano-coating to repair scratches. LG was one of the early adopters of self-healing technology back in 2013. This technological advancement could revolutionize the smartphone industry and reduce repair costs for consumers.

Nike Remains Favorite Brands Among Teens: Nike remains the favorite brand for both male and female teens for the 12th year in a row. Among other brands, American Eagle and Lululemon rank second and third, with Shein moving up to fourth place. In footwear, Converse and Adidas follow Nike as top choices. These brand preferences among teens offer valuable insights into the fashion and retail industry's evolving trends and consumer demographics.

How Often Do You Wash Your Jeans?: Levi Strauss CEO Charles Bergh clarified that he doesn't advocate never washing jeans but spot cleans them and washes them in the shower when needed. Many denim enthusiasts avoid frequent washing to maintain shape and color, believing it extends the lifespan. This approach to denim care not only preserves the jeans' integrity but also aligns with sustainable and eco-friendly practices in the fashion industry.

Bankman-Fried Trial Saga Continues: In the fraud trial of FTX co-founder Sam Bankman-Fried, star witness Caroline Ellison, former CEO of Alameda Research, testified that Bankman-Fried orchestrated the siphoning of customer funds to back risky investments, potentially bankrupting FTX and Alameda. Her testimony provides critical insights into the alleged fraudulent activities within the cryptocurrency exchange sector and the potential repercussions for those involved.

Bitfinex Share Buyback: Bitfinex's owner is exploring a $150 million share buyback to gain greater control as regulatory scrutiny on the crypto industry intensifies. The buyback signals a proactive effort by Bitfinex to adapt to the evolving regulatory landscape and maintain control over its operations and governance.

UK FCA Crypto Alerts: The UK's Financial Conduct Authority (FCA) issued 146 alerts within the first 24 hours of its new crypto marketing regulations coming into force, urging businesses and consumers to exercise caution when dealing with cryptocurrency promotions. This proactive approach reflects the FCA's commitment to protecting consumers in the rapidly evolving cryptocurrency market.

Disclaimer: This is not financial advice, the newsletter is strictly educational and is not investment advice.