- The Soft Landing

- Posts

- ✈ Markets Bounce on Monday

✈ Markets Bounce on Monday

PLUS: Other Interesting News You Need To Watch Out For 👀

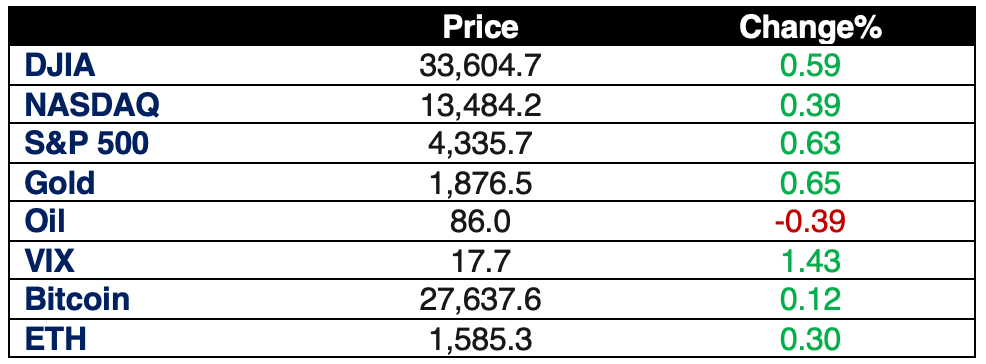

Stocks bounced back on Monday despite early pressure stemming from geo-political conflicts. The Dow Jones Industrial Average surged 0.59%, or 197.07 points, closing at 33,604.65. The S&P 500 also saw gains of 0.63%, concluding at 4,335.66, while the Nasdaq Composite added 0.39% and settled at 13,484.24. Initially, all major indexes had experienced declines, with the Dow down by 153.89 points and the S&P 500 down by 0.6% at their respective lows. The Nasdaq had pulled back as much as 1.15% before making a recovery.

Here’s A Look At The S&P 500 Heat Map:

Source: Finviz

Performance Of The Largest Stocks:

Apple $AAPL +0.9% é

Microsoft $MSFT +0.8% é

Google $GOOGL +0.6% é

Amazon $AMZN +0.2% é

Nvidia $NVDA -1.1% ê

Tesla $TSLA -0.3% ê

Facebook $META +0.9% é

Berkshire $BRK.B -0.3% ê

Eli Lilly $LLY +1.2% é

$UNH +0.3% é

Visa $V -0.3% ê

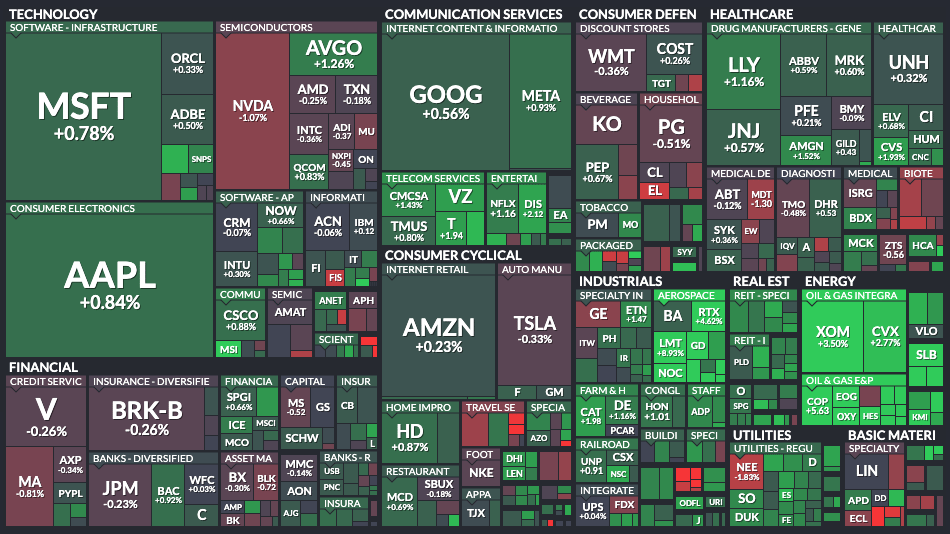

Fear & Greed Index

Source: CNN Business

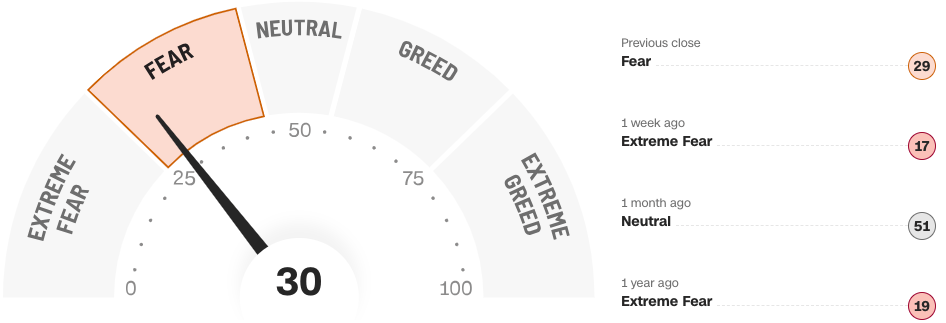

Chart Of The Day: Do You Utilize All Your Vacation Days? Maybe It’s Time to Relocate

Source: Statista

A 2023 survey by Expedia challenges the notion of Asian workaholics, revealing that employees from Japan and Hong Kong, on average, have requested four additional days off beyond their 2022 vacation allowance. This resulted in longer actual vacation periods compared to workers in Germany and France. In the United States, where the statutory leave is nonexistent, employees still leave an average of 1.5 vacation days unused. Singapore, which offers an average of 17 vacation days, sees an average of 2.5 days unused. Germany and France report an average of four and 5.5 unused days, respectively, with both countries providing 28.5 vacation days by law. Furthermore, in the U.S., Germany, and France, 10 to 14 public holidays are added to the total vacation days, while Japan enjoys 16 public holidays.

In Other Interesting News:

Tesla's China EV Sales Decline: Tesla faced an 11% year-over-year drop in the month of September for their China-made electric vehicles, with 74,073 China-made EVs sold during the month. Sales for China-made Model 3 and Model Y vehicles specifically dropped 12% from August to September.

Tim Cook's Apple Stock Sale: Apple CEO Tim Cook executed his largest stock sale in over two years, selling 270,000 shares, generating approximately $88 million in gross proceeds (about $41.5 million after taxes). Cook's stock sale coincides with a recent decline in Apple's stock price following a broader market downturn, although the company remains the most valuable in the world. This marks Tim Cook's most significant sale of Apple shares since August 2021 when he divested $750 million worth of Apple stock before taxes. Notably, despite this recent sale, Tim Cook's overall ownership stake in Apple remained unchanged in the past week, as he received an equivalent number of shares as part of his annual compensation package.

Historic U.S. Bond Market Selloff: The turmoil in the bond market, which has seen a more severe downturn than any in recorded history, is now spreading, with significant consequences. Bank of America Corp. strategists recently analyzed US bond market data dating back 236 years. Their analysis suggests that the past three years have witnessed an unprecedented and prolonged period of bond market losses. While the accuracy of data from early post-colonial years is uncertain, the fact that this represents the worst performance in 236 years is striking. It serves as a stark reminder of the substantial financial turmoil triggered by unexpected inflation and interest rate increases, with consequences such as the downfall of Silicon Valley Bank and three other regional lenders, requiring government intervention to stabilize the situation.

Not All Bad News In The Bond Markets - Catastrophe Bonds Are Outperforming: While bond markets globally have been under pressure due to rising interest rates and concerns about deficits, catastrophe bonds have thrived. Investors in this market have seen double-digit returns, reaching as high as 16% this year. These bonds offer higher yields as Treasury yields rise, making them an attractive option.

Country Garden's Debt Repayment Issues: Chinese real estate developer Country Garden Holdings is struggling with its debt obligations, particularly offshore repayments, including U.S. dollar-denominated notes. The company recently missed a debt repayment of HKD 470 million ($60 million), raising concerns about creditors demanding faster debt repayments or pursuing enforcement action.

Saudi Aramco's Carbon Capture Test: Saudi oil giant Aramco has announced a partnership with Siemens Energy AG to develop a small-scale direct air capture (DAC) "test unit" in Saudi Arabia. The DAC technology aims to extract and manage CO2 emissions from the atmosphere. However, DAC is considered one of the more expensive carbon capture methods, and its long-term effectiveness is a subject of debate.

Persistent Housing Inventory Shortage: The U.S. housing market continues to face a severe inventory shortage. In September, the total number of homes for sale, including those under contract but not yet sold, decreased by 4% compared to the previous year. This persistent shortage contributes to rising home prices and poses challenges for prospective buyers.

Luvly's Flat-Pack Electric Car: Swedish startup Luvly has introduced a ready-to-assemble electric car designed to reduce carbon emissions associated with shipping. This lightweight vehicle, weighing under 450 kilograms (992 pounds), has a range of 100 kilometers (62 miles) and is intended for urban commuting. While Luvly's cars are delivered flat-packed, they must be assembled by licensed car plants to be road-legal.

Big Day in the FTX Trial! Caroline Ellison's Testimony Is Expected Today: Caroline Ellison, the former CEO of Alameda Research, is set to be a star witness in the fraud trial of FTX co-founder Sam Bankman-Fried. Her testimony which is expected today will shed light on the inner workings of FTX and Alameda Research and their alleged involvement in siphoning customer funds. Ellison has pleaded guilty and is cooperating with federal prosecutors in the case.

Disclaimer: This is not financial advice, the newsletter is strictly educational and is not investment advice.