- The Soft Landing

- Posts

- ✈ Markets Bounce Back

✈ Markets Bounce Back

PLUS: Other Interesting News You Need To Watch Out For 👀

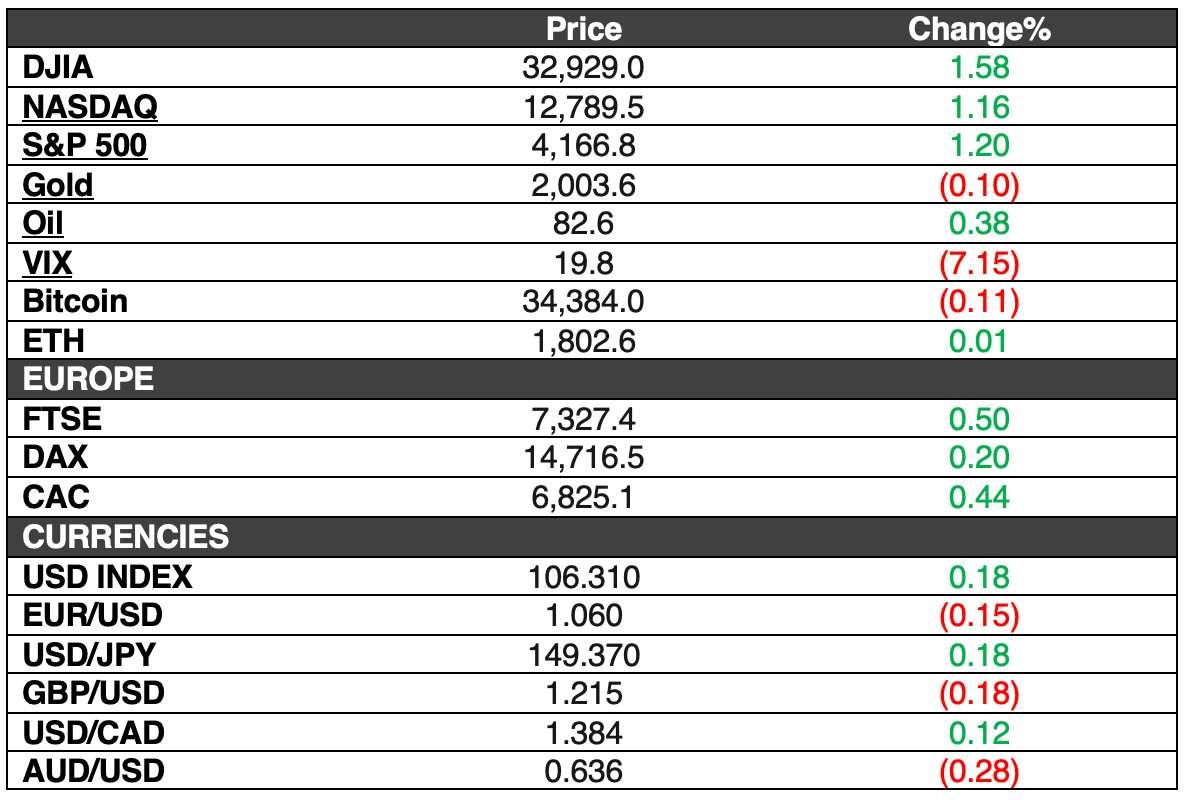

On Monday, stock markets staged a strong rally, marking a significant rebound. The Dow Jones Industrial Average surged by 511.37 points, or 1.58%, closing at 32,928.96, marking its most substantial single-day gain since June 2. The S&P 500 joined the rally, jumping 1.2% to reach 4,166.82, emerging from correction territory and registering its most robust performance since late August. The Nasdaq Composite also posted gains, rising by 1.16% to reach 12,789.48.

Among the notable sector performances, Communication Services shone brightly, surging by over 2%, marking its best single-day performance since late August. Key tech giants, Amazon and Meta Platforms, showed gains of 3.9% and 2%, respectively. These bullish moves followed a challenging week for the S&P 500, which had fallen 2.5%, entering correction territory by declining more than 10% from its 2023 closing high.

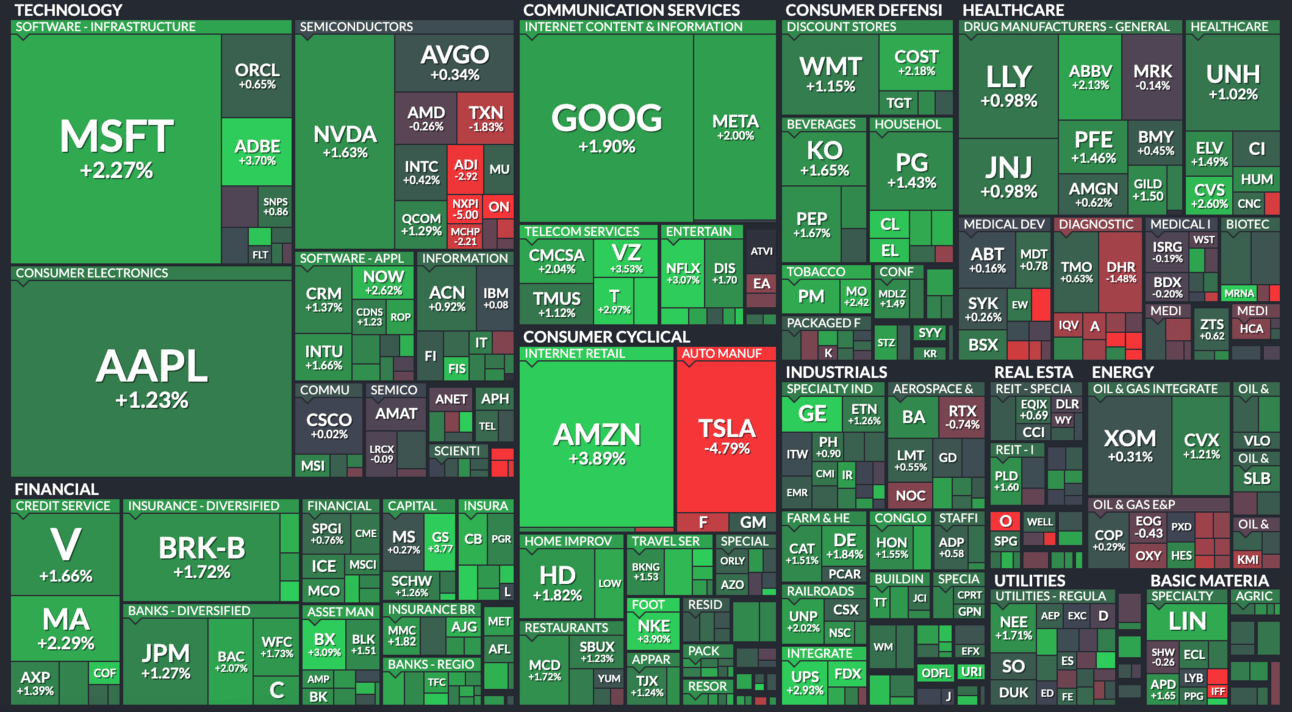

Here’s A Look At The S&P 500 Heat Map:

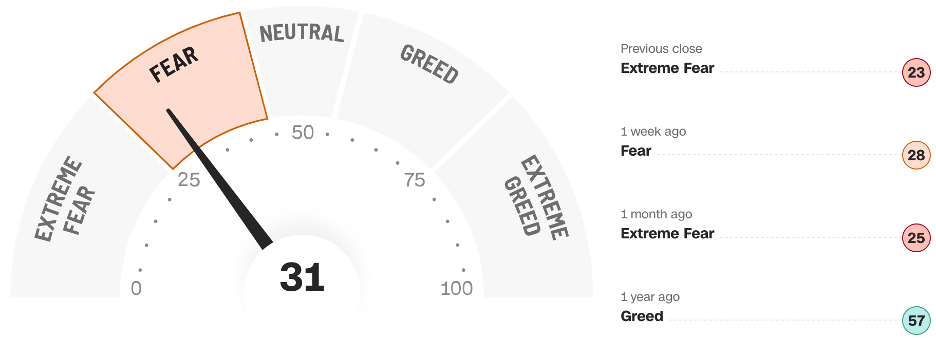

Fear & Greed Index: FEAR

Chart of the Day:

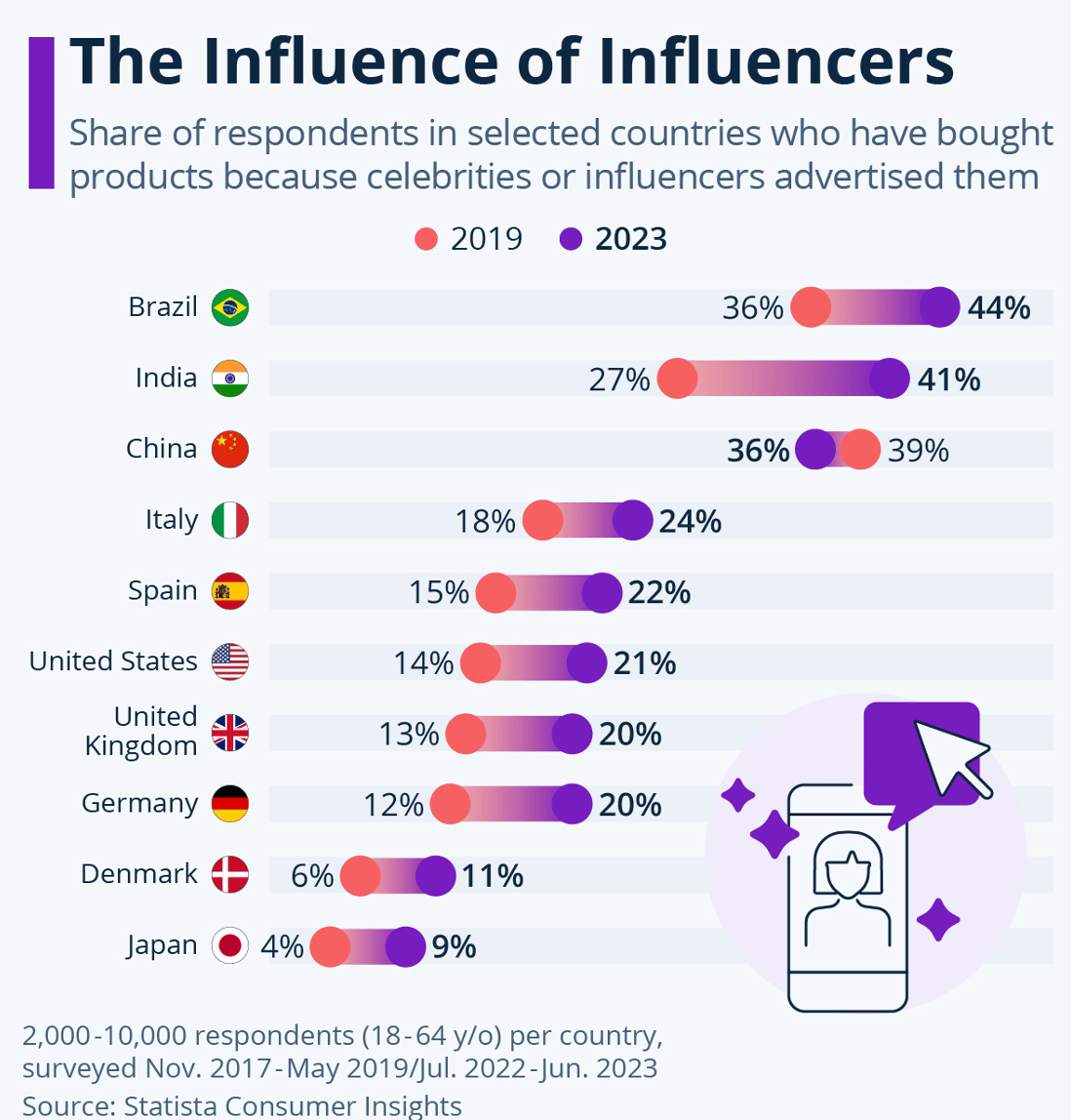

Influence from social circles and influencers greatly impacts purchasing decisions worldwide. Data from Statista Consumer Insights reveals that influencers hold significant sway over consumer choices, with the most substantial influence observed in Brazil, China, and India. Among these countries, Brazil, and India have witnessed a growing impact of influencers on purchasing decisions, while in China, although there has been a slight reduction, their influence remains substantial.

Additionally, the trend of following influencers' recommendations in purchase decisions has been gaining traction in many other countries. Notably, Denmark and Japan have been somewhat less influenced by influencers, although their following has been on the rise in these nations as well. Among European countries, Italy leads the way, with 24% of respondents in 2023 reporting that they had made a purchase based on the recommendation of a celebrity or influencer, reflecting the substantial influence of these figures on consumer behavior.

In Other Interesting News:

Tesla Shares Fall on Panasonic Battery Warning: Tesla shares dropped nearly 5% following news that Panasonic, a key supplier, reduced battery cell production in Japan in September 2023. Concerns about softening demand for EVs, especially for higher-priced models not eligible for incentives, emerged. Tesla had highlighted pressure on keeping EV prices low due to interest rates during its Q3 earnings call, as well as challenges in the production of the Cybertruck.

Apple Announces New M3 Chips and Cuts MacBook Pro Price: Apple unveiled new PC chips, MacBook Pro laptops, and a new iMac model in preparation for the holiday season. The refreshed chips aim to boost Apple's Mac sales after a 7% decline in the June quarter due to a global PC slowdown. These new computers retain the designs of the previous models but feature upgraded chips. Apple also lowered the price of the entry-level 14-inch MacBook Pro to $1,599 with a less powerful M3 chip.

Pinterest Surges on Strong Q3 Results: Pinterest reported Q3 earnings that exceeded expectations, driving a 14% stock price increase in extended trading. The company's revenue reached $763.2 million, beating the $743.5 million estimate, and earnings stood at 28 cents per share (adjusted), higher than the expected 20 cents. Pinterest's global monthly active users increased 8% year-on-year to 482 million, surpassing the anticipated 473 million. The average revenue per user was $1.61, above the projected $1.59.

Cathie Wood Buys Declining Stocks: Renowned fund manager Cathie Wood capitalized on recent stock pullbacks, acquiring shares of companies like Block, Beam Therapeutics, and Verve Therapeutics. Despite the risks, these purchases represent potential bargains, although the stocks remain below their 50-day and 200-day moving averages, suggesting a bearish trend.

Treasury to Borrow $776 Billion in Q4: The U.S. Treasury Department announced plans to borrow $776 billion in the final three months of 2023, a decrease from the previous quarter. This development comes amid turbulence in the global bond market. The Q3 borrowing of $1.01 trillion was the highest ever for that quarter. The announcement led to a surge in bond yields and impacted the stock market.

Housing Market Heading for a 1980s-Style Recession, Wells Fargo Warns: The U.S. housing market faces challenges due to high mortgage rates, with the 30-year fixed mortgage rate reaching 8% in early October. Rising borrowing costs have impacted housing affordability, potentially pushing the housing sector into a recession. Despite overall economic resilience, the housing market remains vulnerable as financing costs are expected to stay elevated, dimming prospects for a housing rebound.

Tokenized U.S. Treasury Market Surges 600%: Tokenized versions of U.S. Treasuries witnessed substantial growth in 2023, surging from $100 million to $698 million. Ethereum outperformed Stellar as the leading blockchain for tokenized government bonds. Various protocols, including Ondo Finance, Maple, and Backed, saw significant growth. New protocols like Tradeteq and TrueFi's Adatp3r attracted millions in deposits, reflecting increased competition in this sector.

Crypto Funds Experience Largest Inflow in 15 Months: Crypto-focused investment funds gained $326 million in net inflows last week, the most significant weekly influx since July 2022. This rally is driven by optimism that the U.S. SEC will approve the first spot bitcoin exchange-traded fund (ETF). CoinShares anticipates the likelihood of a spot-based ETF in the coming months, marking a significant regulatory development in the crypto industry.

Deutsche Bank Trials SWIFT Alternative for Stablecoins: Deutsche Bank and Standard Chartered's SC Ventures are testing a system enabling blockchain-based transactions, stablecoins, and central bank digital currencies to interact, similar to SWIFT in legacy banking. They are experimenting with USDC stablecoin transfers on the Universal Digital Payments Network (UDPN), a permissioned blockchain system. This approach facilitates transactions across various networks, from public blockchain stablecoins to central bank digital currencies.

Disclaimer: This is not financial advice, this newsletter is strictly educational and is not investment advice.