- The Soft Landing

- Posts

- ✈ JPMorgan CEO Warns this is 'The Most Dangerous Time'

✈ JPMorgan CEO Warns this is 'The Most Dangerous Time'

PLUS: Other Interesting News You Need To Watch Out For 👀

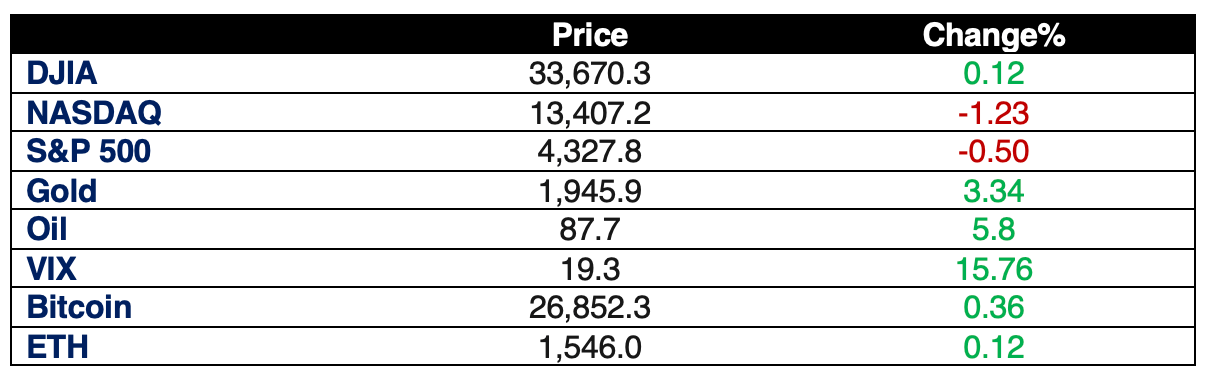

Stocks faced pressure on Friday due to a spike in oil prices and rising inflation concerns, capping off a volatile week. The S&P 500 declined by 0.50%, closing at 4,327.78, and the Nasdaq Composite experienced a more significant drop of 1.23%, ending at 13,407.23. The Dow Jones Industrial Average was the exception, rising by 0.12%, or 39.15 points, to close at 33,670.29. For the week, both the S&P 500 and Dow posted gains, with the S&P 500 increasing by 0.45% for its second consecutive positive week and the Dow advancing by 0.79%. The Nasdaq, however, saw a 0.18% decline for the week.

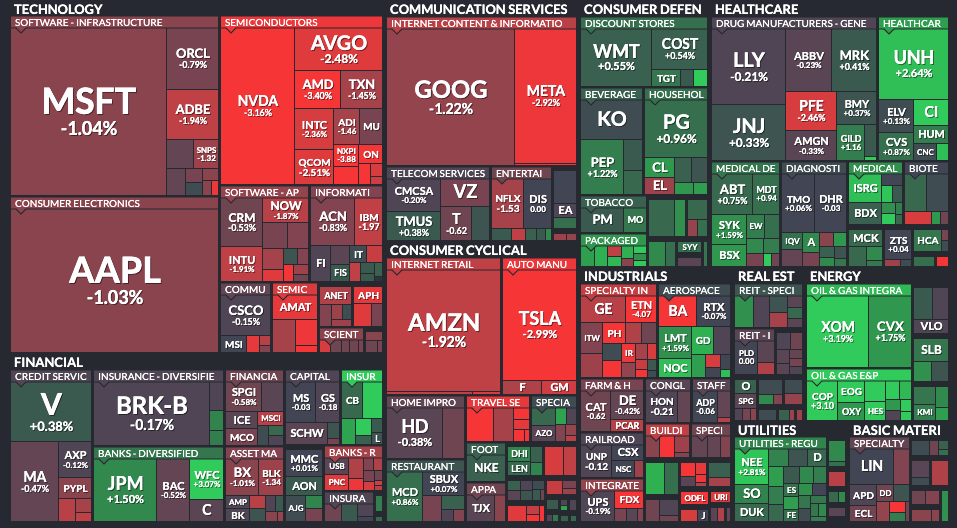

Here’s A Look At The S&P 500 Heat Map

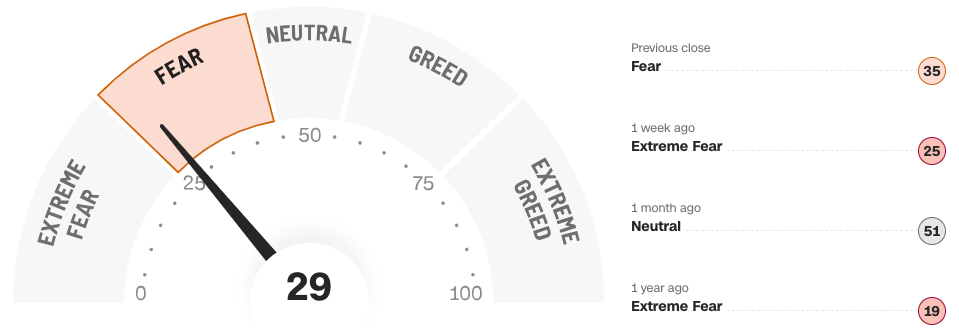

Fear & Greed Index:

Chart Of The Day:

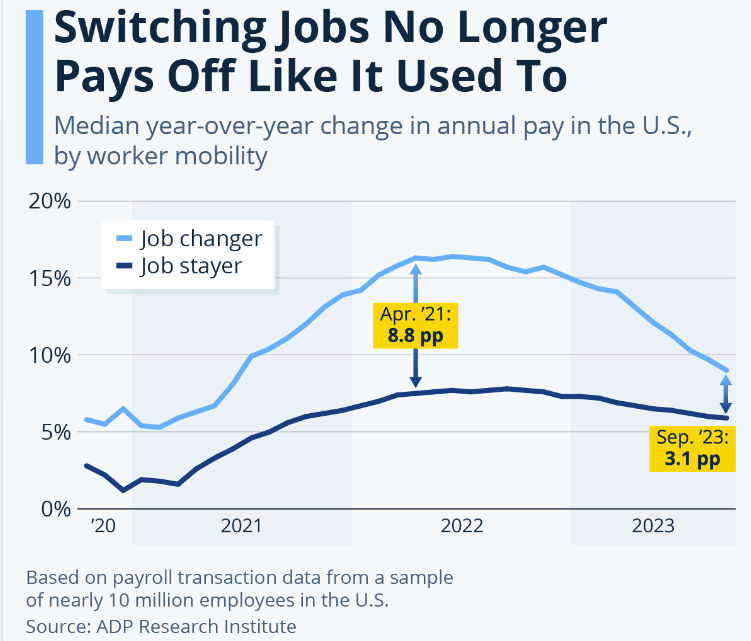

The "Great Resignation," which saw over 50 million Americans leave their jobs in 2022, was driven in part by labor shortages that prompted employers to offer higher wages. Switching jobs often resulted in significantly higher salaries for workers who sought new opportunities. According to ADP Pay Insights, data based on almost 10 million U.S. employees, job switchers enjoyed median year-over-year pay increases of 15 to 16.5% for most of 2022. Those who remained in their current positions received lower average pay increases, typically between 7 and 8%, half of what job switchers received.

In recent months, the labor market has started to show signs of cooling, with job openings decreasing from historically high levels and fewer unfilled positions across industries. As the labor supply and demand imbalance gradually corrects itself, wage growth has slowed. This slowdown has been more noticeable among job changers, resulting in a smaller gap between pay increases for job switchers and job stayers. While there was an 8.8 percentage point difference between the two in April of the previous year, the gap in median pay increases had shrunk to 3.1 percentage points by September 2023.

Consequently, the number of Americans quitting their jobs has notably declined, signaling the end of the "Great Resignation," which was one of the more unexpected labor market trends in the post-pandemic era.

In Other Interesting News:

JPMorgan CEO Jamie Dimon Warns of ‘The Most Dangerous Time’: JPMorgan Chase reported strong profits for the third quarter and its CEO, Jamie Dimon, delivered a stern warning about the dangers facing the world. Dimon expressed concern about multiple threats, stating, “This may be the most dangerous time the world has seen in decades.” He pointed to ongoing conflicts, highlighting the potential impacts on energy, food markets, global trade, and geopolitical relationships. Dimon also cited rising national debt and the largest peacetime fiscal deficits ever, which he believes raise the risks of sustained high inflation and interest rates.

Microsoft Completes $69 Billion Acquisition of Activision Blizzard: Microsoft has successfully closed its $69 billion acquisition of video game publisher Activision Blizzard after addressing concerns from regulators. This acquisition represents Microsoft's largest deal in its history. It includes a substantial portfolio of video game franchises, including Call of Duty, Crash Bandicoot, Diablo, Overwatch, StarCraft, Tony Hawk Pro Skater, and Warcraft. The acquisition provides Microsoft with a significant presence in the gaming industry.

Oil Prices Spike Nearly 6% Amid Geopolitical Tensions: Oil prices surged over 5% due to escalating tensions in the Middle East. U.S. West Texas Intermediate crude futures rose 5.8%, settling at $87.70 per barrel. International benchmark Brent crude futures climbed 5.7% to $90.89 per barrel, its best performance since April. This week, WTI crude recorded its largest weekly gain since September 1. Geopolitical factors are driving these price increases, raising concerns about oil supply disruptions.

China Grants Approval for Fully Autonomous Passenger-Carrying Air Taxis: Ehang, a Chinese drone manufacturer, has received approval from the Civil Aviation Administration of China for its fully autonomous drone, the EH216-S AAV, capable of carrying two passengers. This approval allows Ehang to operate passenger-carrying autonomous electric vertical take-off and landing (eVTOL) aircraft in China. Ehang claims to be the first in the world to receive this airworthiness certificate. The development marks a significant step toward self-driving air taxis becoming a reality in China.

Record Quarter for U.S. EV Sales, but Tesla's Market Share Narrows: In the third quarter, electric vehicle (EV) sales in the United States reached a record high of over 313,000 units, nearly a 50% increase from the previous year. This figure exceeded Q2 sales by around 15,000 units. The market share of EVs also reached its highest level ever, at 7.9%, up from 6.1% a year ago. This growth is attributed to higher inventory levels, improved product availability, and pricing pressure. Tesla, while remaining a leader in the market, is facing increased competition from other automakers, resulting in a narrowing of its lead.

Ferrari to Accept Cryptocurrency as Payment for Luxury Sports Cars: Ferrari has initiated the acceptance of cryptocurrency as payment for its luxury sports cars in the United States, with plans to extend the scheme to Europe following customer requests. This move represents a departure from the stance of most blue-chip companies, which have generally avoided accepting cryptocurrencies due to their high volatility and energy usage. The trendsetter in this regard, Tesla, initially accepted Bitcoin but later suspended it due to environmental concerns. Ferrari's Chief Marketing and Commercial Officer, Enrico Galliera, stated that cryptocurrencies have improved their environmental footprint through new software and greater use of renewable sources.

U.S. SEC Does Not Intend to Appeal Court Decision on Grayscale's Bitcoin ETF Application: The U.S. Securities and Exchange Commission (SEC) has decided not to appeal a court ruling that found its rejection of Grayscale Investments' application to create a spot bitcoin exchange-traded fund (ETF) to be incorrect. The court's decision in August ruled against the SEC, marking a significant development for the industry, which has been seeking approval for such products for a decade. The SEC's decision not to appeal suggests that it will now consider Grayscale's application, potentially paving the way for the introduction of a spot bitcoin ETF. This type of ETF would offer investors exposure to Bitcoin without requiring them to own the cryptocurrency directly.

Disclaimer: This is not financial advice, the newsletter is strictly educational and is not investment advice.