- The Soft Landing

- Posts

- ✈ Huawei Overtakes Apple

✈ Huawei Overtakes Apple

PLUS: Other Interesting News You Need To Watch Out For 👀

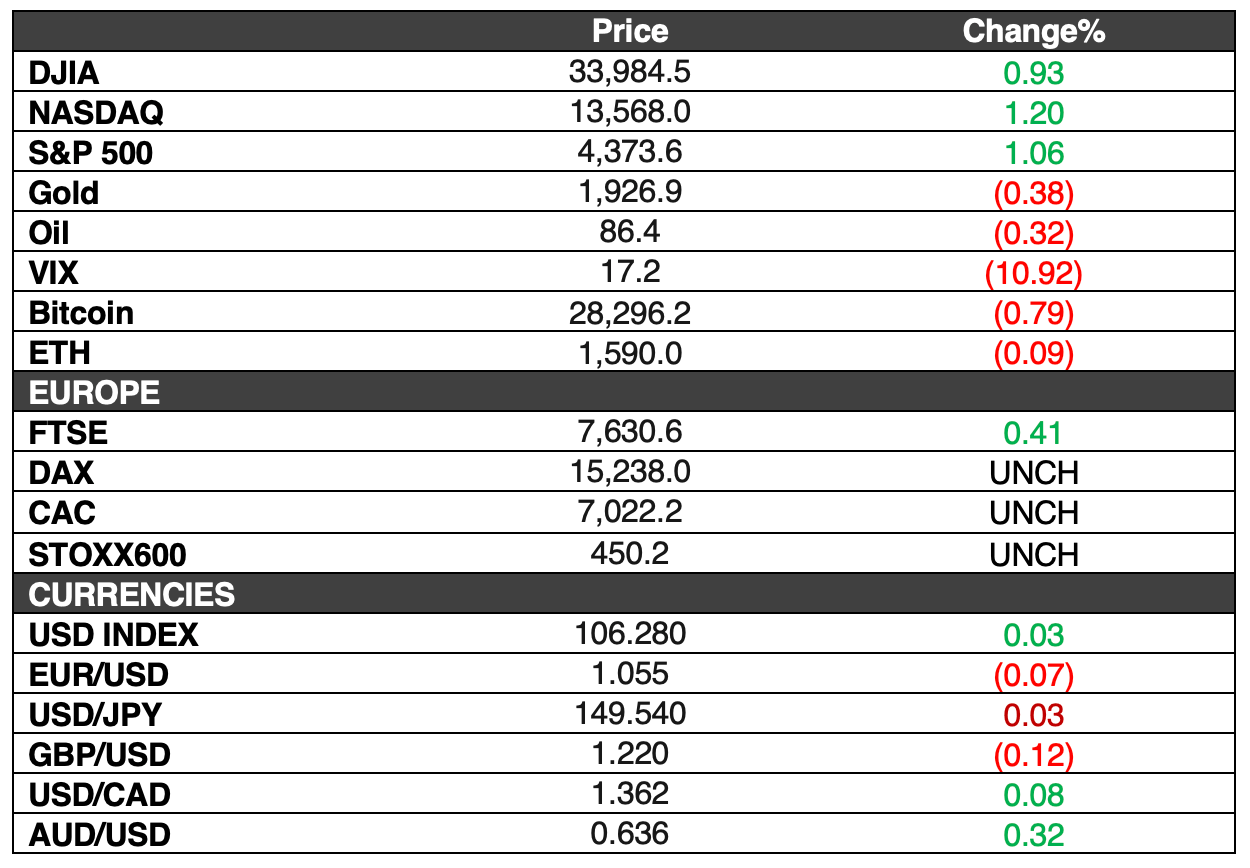

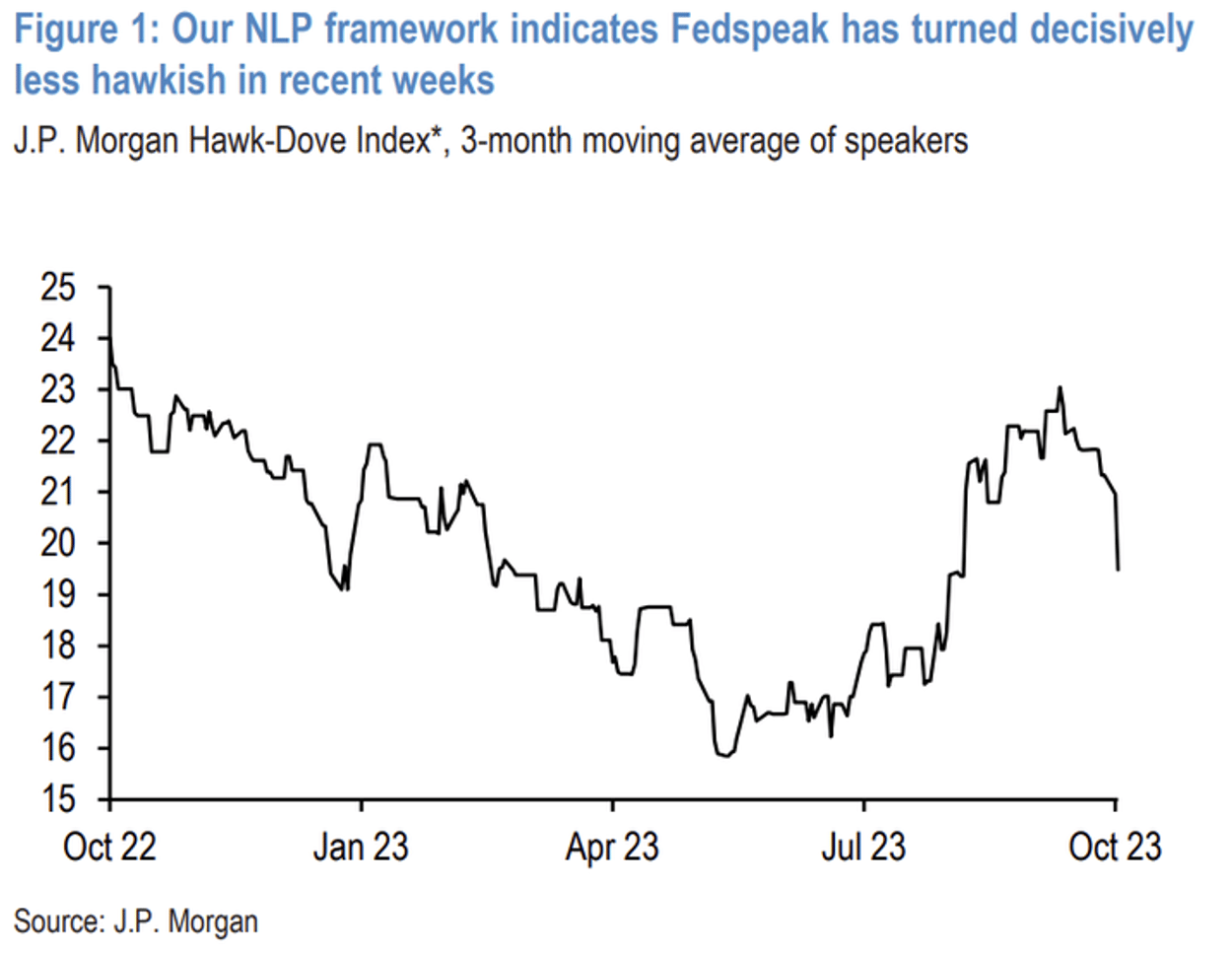

Markets closed higher on Monday as traders anticipated a wave of corporate earnings releases and brushed off an increase in Treasury yields. The Dow Jones Industrial Average saw a notable gain of 314.25 points, rising by 0.93% to close at 33,984.54, marking its best performance since September. The S&P 500 also experienced an uptick, climbing by 1.06% to end the day at 4,373.63. Meanwhile, the Nasdaq Composite added 1.2% to reach 13,567.98. Nike and Travelers Companies led the Dow's gains, with both stocks advancing approximately 2.1%. On Monday, all 11 S&P 500 sectors showed positive performance.

This week is expected to be pivotal for earnings, as 11% of the S&P 500 companies are slated to release their financial results. Some of the notable names scheduled to report this week include Johnson & Johnson, Bank of America, Netflix, and Tesla.

Here’s A Look At The S&P 500 Heat Map

Performance Of The Largest Stocks:

Apple $AAPL -0.1% ê

Microsoft $MSFT +1.5% é

Google $GOOGL +1.3% é

Amazon $AMZN +2.1% é

Nvidia $NVDA +1.4% é

Facebook $META +2.1% é

Tesla $TSLA +1.1% é

Berkshire $BRK.B +0.3% é

Eli Lilly $LLY +1.2% é

$UNH -0.3% ê

Visa $V +1% é

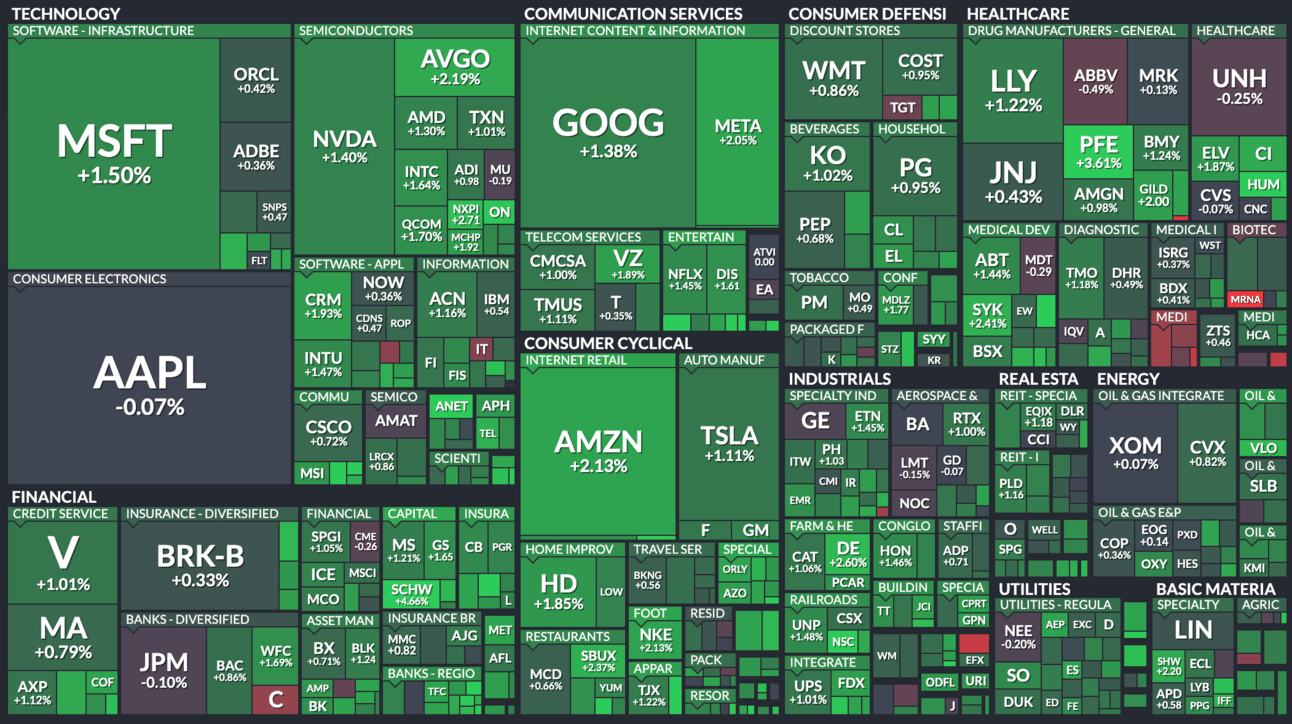

Fear & Greed Index:

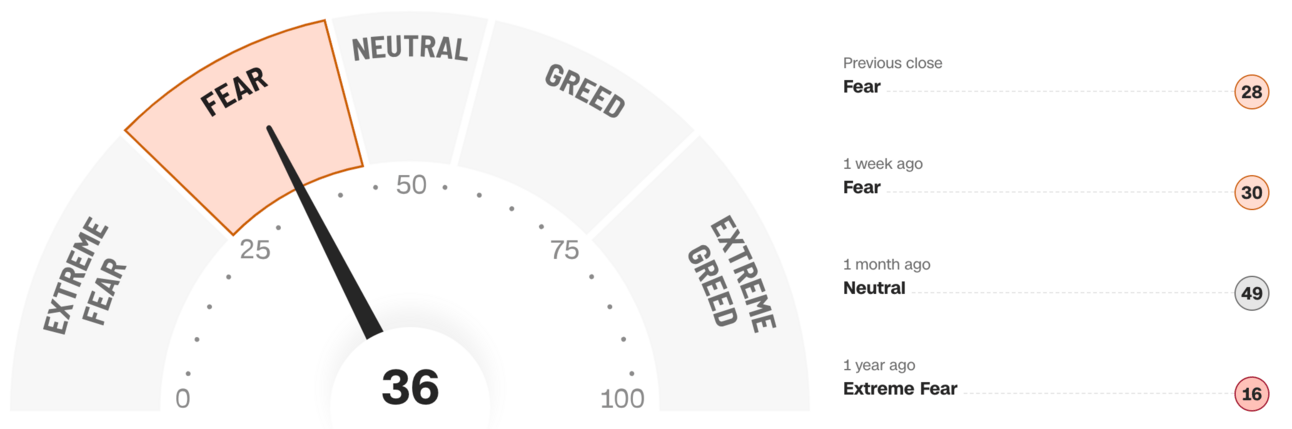

Chart Of The Day: JPMorgan Chart Shows Federal Reserve's Shifting Sentiment

JPMorgan's chart illustrates the shifting sentiment among Federal Reserve members regarding their future monetary policy actions. The chart reflects a significant decline in the JPMorgan Hawk-Dove index, which serves as a gauge of the Fed's sentiment. When the Fed, as a whole, leans more hawkish, the chart rises, signaling a likelihood of tighter monetary policy through actions like interest rate hikes or balance sheet reductions. Conversely, a declining chart indicates that the Fed is becoming more dovish, suggesting fewer or no additional rate hikes. In the current context, the sharp drop in hawkish sentiment observed over the past few weeks implies that the Fed might have concluded its series of rate hikes, following an aggressive tightening campaign that lifted benchmark rates from nearly 0% in March 2022 to approximately 5.25%-5.5% today.

In Other Interesting News:

Huawei Overtakes Apple in China: Apple's iPhone dominance in China has been disrupted as Huawei emerges as the new market leader. Analysts at Jefferies reported that Apple has experienced a significant double-digit decline in iPhone sales, particularly since the launch of the iPhone 15. In contrast, Android-based smartphones from Huawei, Xiaomi, and Honor have shown strong growth, enabling Huawei to secure the top spot in terms of market share.

Property Market Faces a "Great Reset": The commercial real estate market is currently experiencing a transformative phase referred to as the "Great Reset." Property valuations are adjusting, capital access is becoming constrained, and investment activity is dwindling. Over the next three years, more than $1.5 trillion of commercial real estate loans are set to mature. Traditional lenders and the securitization market are not offering a clear path for refinancing these loans, potentially causing further repricing of properties to reflect current economic conditions.

Adjustable-Rate Mortgages Regain Popularity: As 30-year fixed-rate mortgage rates reached levels not witnessed in over two decades, prospective homebuyers are exploring alternative options, particularly adjustable-rate mortgages (ARMs). The 5/1 ARM, a popular ARM product, witnessed its average rate drop to 6.33% from 6.49%. This led to a 15% increase in ARM applications, signifying that some buyers are opting for lower monthly payments, given the current high mortgage rate environment. The uptick in ARM interest reflected the shifting dynamics in the mortgage market.

Analysts Suggest Dividend Stocks: In a period marked by growing economic uncertainties and potential headwinds, analysts recommend two dividend-yielding stocks as safe investment options. Blackstone Secured Lending, a business development company (BDC) under the Blackstone asset management umbrella, maintains a substantial portfolio of investments, primarily composed of first lien senior secured loans. Furthermore, Equitrans, a midstream company in the oil and gas sector, presented solid financial results in its latest report, exceeding earnings forecasts. Both companies offer dividend yields of up to 11%, making them attractive choices for investors seeking stable income amid a volatile financial landscape.

LinkedIn Cuts Nearly 700 Employees: LinkedIn, under Microsoft's ownership, initiated a workforce reduction that affected approximately 700 employees. This reduction was most pronounced in the engineering department, with additional cuts occurring in the finance and human resources divisions. The decision to cut staff comes as LinkedIn's year-over-year revenue growth has decelerated for eight consecutive quarters, posting just 5% growth in the second quarter. Despite a continually expanding user base, LinkedIn has encountered challenges in maintaining revenue growth.

Australia's Central Bank Considers Rate Hike: The Reserve Bank of Australia (RBA) considered a rate hike of 25 basis points during its October meeting, in an attempt to combat persistently high inflation. Inflation remained well above the RBA's target range of 2% to 3%, and there were concerns that it would persist for some time. Services price inflation continued to exert upward pressure, and rising fuel prices further contributed to elevated headline inflation. However, the central bank also acknowledged the changing dynamics in the Australian labor market, noting it had reached a "turning point." Simultaneously, signs of slowing output growth added complexity to the RBA's policy decisions.

Sheikh Jassim Withdraws from Manchester United Bid: Sheikh Jassim bin Hamad al Thani, the Qatari businessman, withdrew from the bidding process to acquire Manchester United. Despite offering a valuation exceeding the club's $3.3 billion market value on the New York Stock Exchange, his bid did not meet the Glazers' expectations. The Glazers, who have been the club's owners since 2005, were not satisfied with Sheikh Jassim's offer, and he subsequently exited the negotiations. Meanwhile, Sir Jim Ratcliffe is nearing an agreement to purchase a 25% stake in the club, potentially reshaping its ownership structure.

Disclaimer: This is not financial advice, the newsletter is strictly educational and is not investment advice.