- The Soft Landing

- Posts

- ✈ This Currency Is Now The World’s Top Performer

✈ This Currency Is Now The World’s Top Performer

PLUS: Other Interesting News You Need To Watch Out For 👀

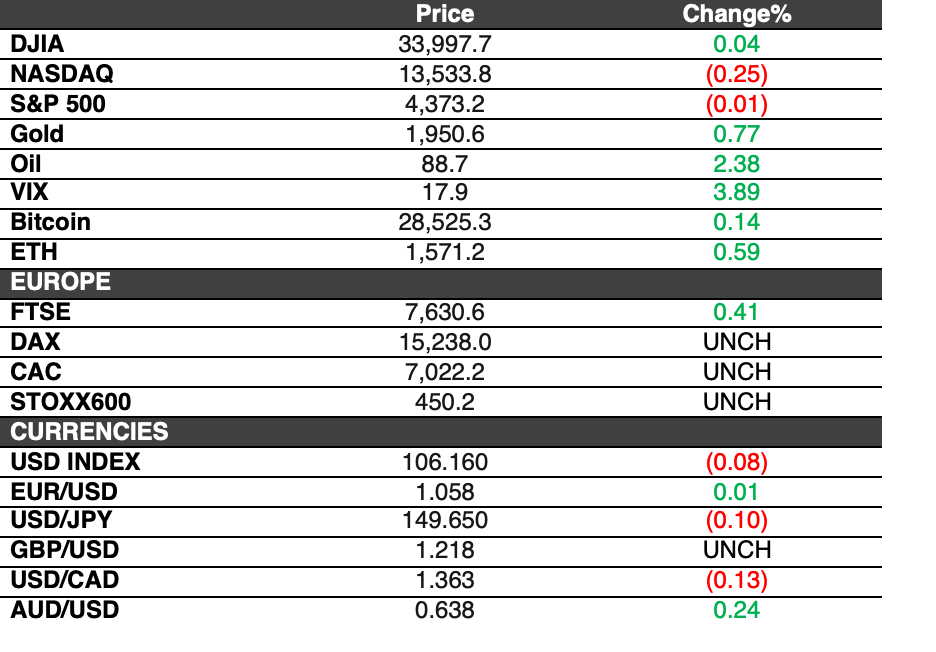

On Tuesday, the U.S. stock market showed mixed results with the Nasdaq ending lower, while the Dow and S&P 500 were nearly flat. This followed the Biden administration's announcement of plans to halt shipments of advanced artificial intelligence chips to China, which affected shares of chipmakers and created uncertainty in the tech sector.

The S&P 500 closed with a marginal decrease of 0.1%, finishing at 4,373.20. The Dow Jones Industrial Average added 13.11 points, or less than 0.1%, reaching 33,997.65. However, the Nasdaq composite declined by 0.3%, losing 34.24 points to end at 13,533.75.

The bond market experienced an increase in Treasury yields due to a report indicating that consumers spent more at U.S. retailers than anticipated, which suggests a robust economy. However, this uptick in spending could also contribute to inflationary pressures, potentially influencing the Federal Reserve's decision to maintain higher interest rates.

For the week:

The S&P 500 recorded a 1% increase, adding 45.42 points.

The Dow saw a 1% gain, with an increase of 327.36 points.

The Nasdaq marked a 0.9% rise, with 126.51 additional points.

For the Year:

The S&P 500 has gained 13.9%, equivalent to 533.70 points.

The Dow has risen by 2.6%, accumulating 850.40 points.

The Nasdaq has displayed impressive growth, surging by 29.3% with an increase of 3,067.26 points.

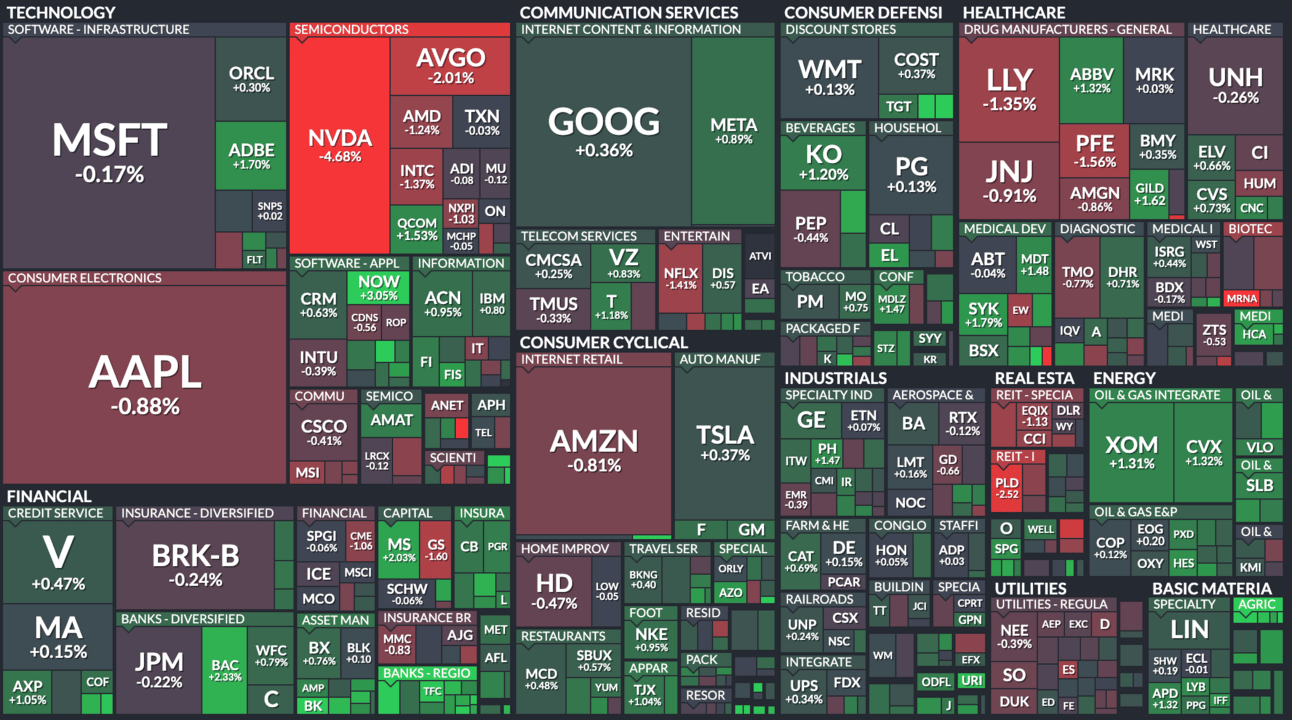

Here’s A Look At The S&P 500 Heat Map

Performance Of The Largest Stocks:

Apple $AAPL -0.9% ê

Microsoft $MSFT -0.2% ê

Google $GOOGL +0.4% é

Amazon $AMZN -0.9% ê

Nvidia $NVDA -4.7% ê

Facebook $META +0.9% é

Tesla $TSLA +0.4% é

Berkshire $BRK.B -0.2% ê

Eli Lilly $LLY -1.4% ê

$UNH -0.3% ê

Visa $V +0.5% é

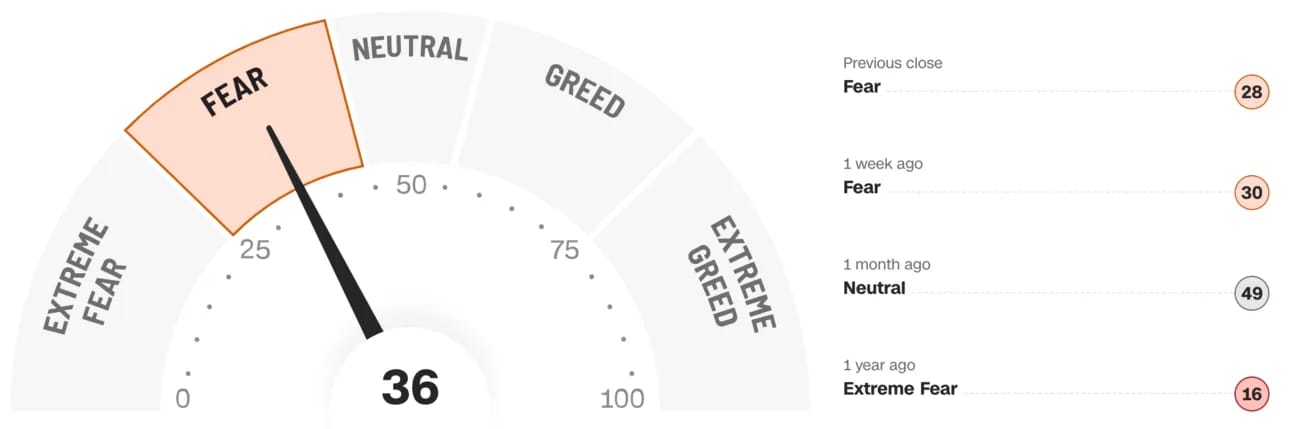

Fear & Greed Index:

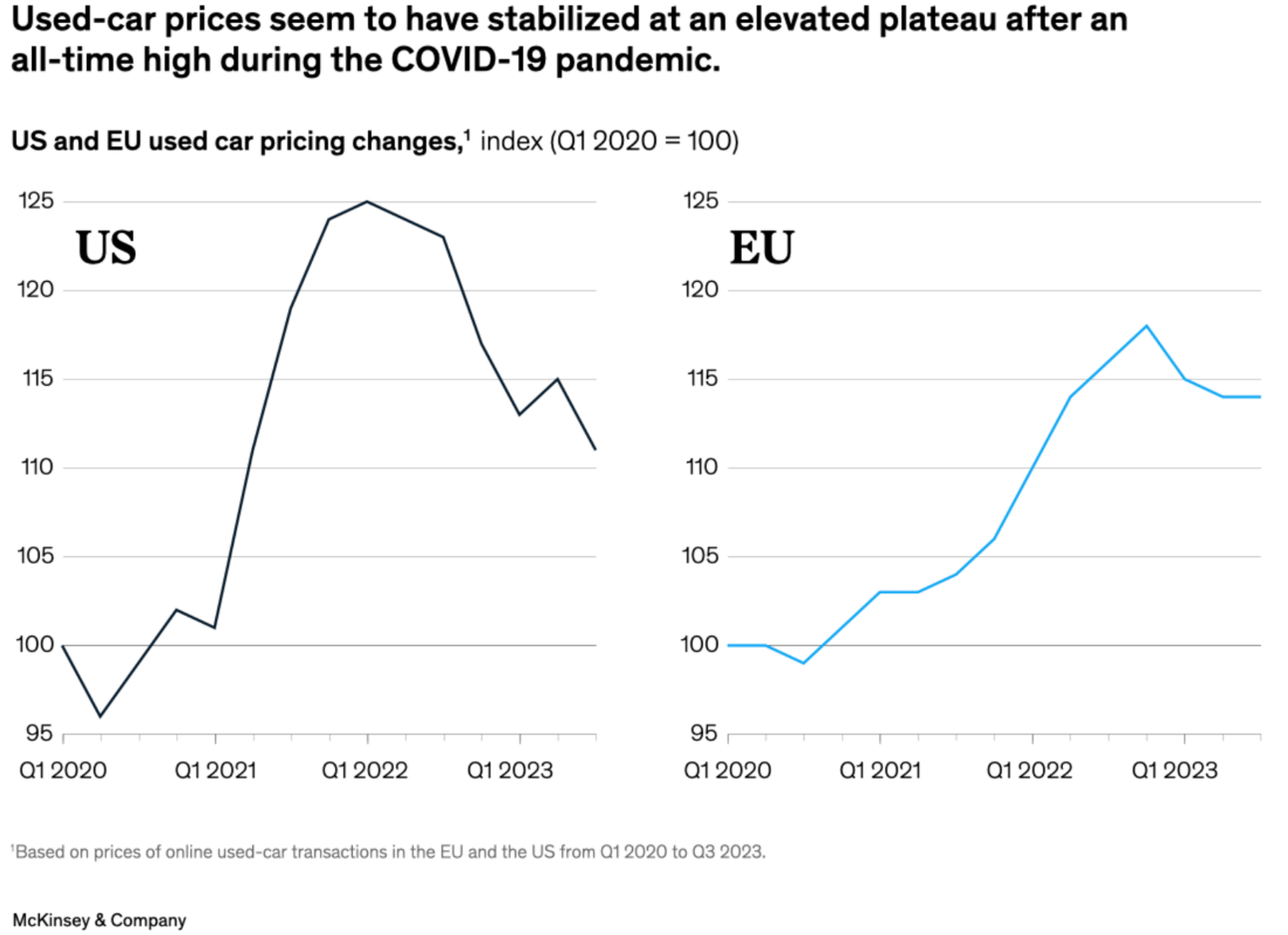

Chart Of The Day: Time to Buy A Used Car?

During the tumultuous years spanning 2020 to 2022, the used car market faced a perfect storm of challenges, witnessing a surge in demand and persistent supply issues. These factors catapulted used car prices to unprecedented heights. However, a new chapter is unfolding as inflation exerts its grip on consumers' wallets, casting a shadow over the once-booming market. The result? Used car prices seem to have found their footing, marking a shift from the dizzying peak they achieved last year. It's a fascinating narrative of how global forces can shape consumer behavior and market dynamics.

In Other Interesting News:

Pakistani Rupee: World's Top-Performing Currency: The Pakistani rupee has rebounded remarkably from an all-time low to emerge as the world's best-performing currency. It depreciated to 307 rupees against the U.S. dollar in early September but has since strengthened by over 8% to 275 against the dollar. This exceptional rebound was largely attributed to the government's crackdown on illicit dollar trading.

China's Third-Quarter Growth Exceeds Expectations: China's economy showed resilience, with third-quarter growth of 4.9%, surpassing expectations and raising optimism about achieving or exceeding the government's target of around 5% for the year. Recent data indicates the stabilization of economic activity. In September, both retail sales and industrial production figures exceeded median forecasts. Despite this, the cumulative fixed asset investment for the first nine months was slightly below expectations.

Tim Cook Visits China Amid iPhone 15 Challenges: Apple CEO Tim Cook made an unexpected visit to China to attend a gaming event, emphasizing the market's importance for Apple. Cook cheered on gamers participating in the popular game "Honor of Kings," developed by TiMi Studio, owned by Tencent. This visit comes as Apple faces challenges with the iPhone 15, which received a lukewarm response. China represents Apple's third-largest market, and the success of mobile games like "Honor of Kings" is a significant revenue driver for the company's App Store in the region.

GM Delays Production of All-Electric Trucks: General Motors (GM) has announced a one-year delay in the production of all-electric trucks at its Michigan plant. GM aims to manage capital investments more effectively and implement improvements to enhance the profitability of new electric vehicles. The construction of next-generation EVs at the Orion Assembly in suburban Detroit will now begin by late 2025, instead of the initially planned date of next year. The factory currently produces Chevrolet Bolt EV models, which will cease production by the end of this year. This delay highlights the complexities automakers face as they transition to electric vehicles.

Strong Retail Sales in September: Despite concerns about high interest rates and economic weakening, U.S. retail sales for September demonstrated unexpected strength. Retail sales increased by 0.7% in the month, significantly exceeding the Dow Jones estimate of 0.3%. This performance was driven, in part, by rising gasoline station sales, up 0.9% as fuel prices accelerated. Even excluding automobile sales, retail sales increased by 0.6%, outpacing the projected 0.2% rise. The "control group," which influences GDP calculations, also rose by 0.6%. These figures indicated that consumers were managing to keep up with price increases.

Cathie Wood and BlackRock Have Common Investment Interests: Despite differing investment philosophies, both Cathie Wood's ARK Investment Management and BlackRock have identified common investment opportunities. They both hold positions in UiPath, a prominent provider of Robotic Process Automation (RPA) software and services, which assists organizations in automating repetitive tasks and processes. Teradyne, a corporation specializing in automated test equipment and industrial automation, is another shared investment. The convergence of these two influential institutions on these stocks suggests an intriguing investment thesis.

Rise of Lab-Grown Diamond Sales: Lab-grown diamonds are gaining popularity among consumers, driven primarily by cost considerations. These man-made diamonds offer significant cost savings compared to natural diamonds, with prices up to 73% lower for a diamond of the same size, cut, and clarity. This affordability allows buyers to opt for larger stones. Additionally, the ethical aspect of lab-grown diamonds, with no association with child labor or conflict diamonds, appeals to conscious consumers. Increased awareness and education about lab-grown diamonds are also contributing to their growing market share.

Elon Musk's X Tests Annual Subscription for Unverified Accounts: Elon Musk's X (formerly Twitter) is piloting a program called "Not a Bot" in New Zealand and the Philippines. New users in these regions are required to pay a $1 annual subscription to post and interact with content, although this fee is waived if they sign up for X's $3.99 per month premium subscription service. The test is aimed at reducing spam, manipulating the platform, and bot activity, and it enhances accessibility while involving a small fee. Existing users are unaffected by this trial. This development reflects ongoing efforts to improve user experience and platform integrity.

Disclaimer: This is not financial advice, the newsletter is strictly educational and is not investment advice.