- The Soft Landing

- Posts

- ✈ Blowout Job Numbers

✈ Blowout Job Numbers

PLUS: Other Interesting News You Need To Watch Out For 👀

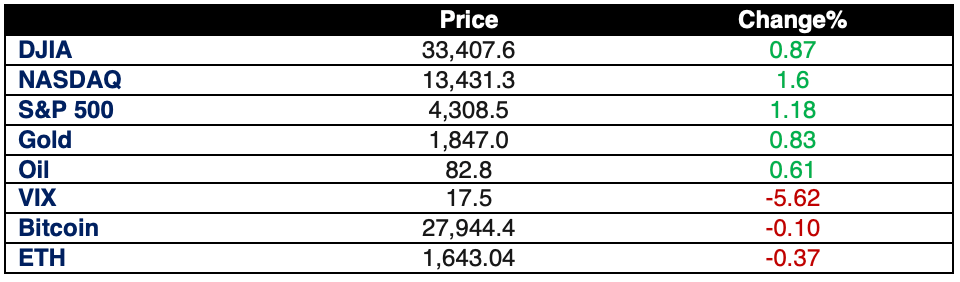

Stocks had a strong rally on Friday, even in the face of rising Treasury yields. The Dow Jones Industrial Average closed up 288.01 points, or 0.87%, at 33,407.58, while the S&P 500 gained 1.18% to reach 4,308.50. The Nasdaq Composite performed even better, rising 1.60% and closing at 13,431.34.

In September, the U.S. economy added 336,000 jobs, exceeding expectations from economists polled by Dow Jones, who had predicted 170,000 jobs. However, wage growth was lower than expected for the month. Stocks experienced a remarkable turnaround on Friday, initially dropping in response to the strong jobs report, with the Dow falling as much as 272 points at its lowest point before surging by more than 400 points during the rally. Both the Nasdaq and the S&P 500 also faced declines of 0.9% at their lowest points in the day.

Treasury yields saw an initial surge after the report, with the 10-year Treasury rate reaching its highest level in 16 years. While the benchmark rate later eased from these levels, it remained up around 6 basis points at 4.78%.

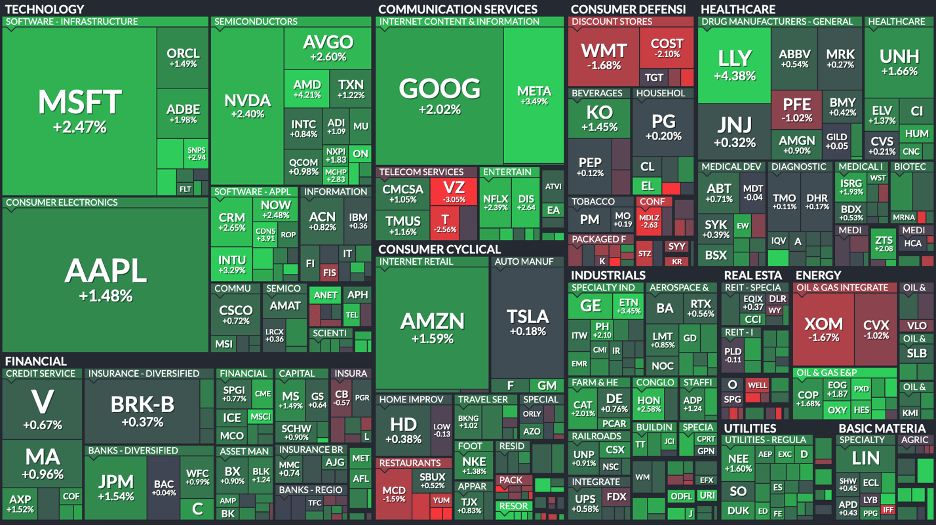

Here’s a Look at the S&P 500 Heat Map:

Performance of the Largest Stocks:

Apple $AAPL +1.5% é

Microsoft $MSFT +2.5% é

Google $GOOGL +2% é

Amazon $AMZN +1.6% é

Nvidia $NVDA +2.4% é

Tesla $TSLA +0.2% é

Facebook $META +3.5% é

Berkshire $BRK.B +0.4% é

Eli Lilly $LLY +4.4% é

Visa $V +0.7% é

$UNH +1.7% é

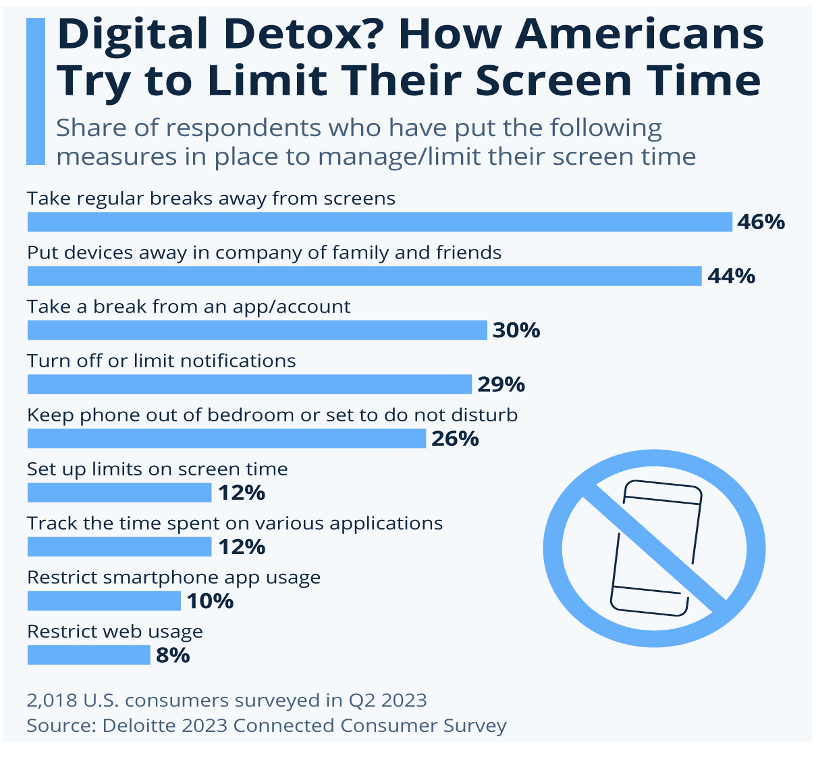

Chart of the Day: Are You Concerned About Your Screen Time?

Source: Statista

As smartphones become all-in-one tools for our daily lives, some folks are starting to wonder if they're overdoing it. Deloitte's 2023 Connected Consumer survey finds that younger Americans (aged 18-40) are especially worried about the effects of their screen time. Around 53% of them find it hard to cut back on phone usage, and 51% fear it's taking a toll on their physical health, while 47% worry about their emotional well-being. Meanwhile, their older counterparts (aged 41 and up) seem to be a bit more chill about it, perhaps because they aren't as glued to their screens.

To strike a balance between their digital and physical lives, many are taking action. In fact, a whopping 80% of U.S. smartphone users have put some boundaries in place. These can range from taking breaks from screens to stashing away devices during quality time with family and friends. Interestingly, only 12% have actually set screen time limits, a feature now available on iOS and Android devices. So, while we might occasionally wrestle with our smartphone habits, it seems like we're finding ways to make peace with our digital sidekicks.

In Other Interesting News:

Stellar Jobs Report in the U.S: The U.S. job market surprised everyone with a robust gain of 336,000 jobs in September, exceeding expectations. This marked the strongest monthly employment increase since January and came after upward revisions for both August and July job numbers. The leisure and hospitality sector played a significant role in driving this impressive job growth.

Tesla Trims Model 3 and Model Y Prices: Tesla made price adjustments to some of its popular models in the U.S. following lower-than-expected Q3 deliveries. The starting price for the Model 3 dropped to $38,990, down from $40,240, while the Model Y Performance now starts at $52,490, reduced from $54,490.

Goldman Sachs Says 2 Stocks Could Double: Goldman Sachs maintains its optimistic outlook on the stock market despite concerns over rising interest rates and bond yields. The investment bank predicts that the S&P 500 will reach 4,500 by year-end, citing modest earnings per share growth and a stable valuation multiple. Their stock picks include Moderna, known for its mRNA vaccine technology and diverse vaccine portfolio, and Organon, focused on women's health and reproductive medicine.

UK Investigates Snap's AI Chatbot: Snapchat parent company Snap is under investigation by the UK's Information Commissioner's Office (ICO) due to privacy concerns related to its AI chatbot, My AI. The ICO's preliminary findings suggest potential risks associated with the chatbot, especially for users aged 13 to 17. Snap will have an opportunity to address these concerns before a final decision is made.

OpenAI Explores Developing AI Chips: OpenAI, the organization behind ChatGPT, is considering the development of its own artificial intelligence (AI) chips. Internal discussions have revealed that the company is exploring this possibility to address the shortage of expensive AI chips it currently relies on. While no final decision has been made, OpenAI is actively evaluating its options, including building its proprietary AI chips, establishing closer collaboration with chip manufacturers like Nvidia, and diversifying its supplier base beyond Nvidia.

Hedge Funds Maintain Bullish Oil Bets: Despite recent market turbulence, hedge funds have held on to their bullish oil wagers. The level of bets on rising oil prices remains at its highest in 19 months. Even though some positions were unwound, oil market sentiment among hedge funds remains positive.

Key Takeaways from Sam Bankman-Fried’s First Week in Court: The fraud trial of Sam Bankman-Fried, founder of FTX, has kicked off with some notable developments. Here are the key highlights from the trial's first week:

Alameda's Special Privileges: Testimony from former FTX employees has shed light on the intertwined financial operations of FTX and Alameda, two ostensibly separate companies founded by Bankman-Fried. Alameda engaged in complex, high-risk crypto market bets, akin to a traditional hedge fund, while FTX served as the customer-facing platform for crypto trading, generating revenue through trading fees.

What SBF Said as FTX Foundered: Prosecutors aim to demonstrate that Bankman-Fried not only misappropriated customer funds for personal luxuries but also deceived investors, clients, and the public. In November 2022, as FTX customers rapidly withdrew their funds, Bankman-Fried publicly claimed that FTX and customer assets were "fine". However, evidence presented in court suggests that FTX's financial health was deteriorating, with insufficient assets to cover client holdings due to Alameda's withdrawals.

Star Witness Awaits: Caroline Ellison, former CEO of Alameda and Bankman-Fried's on-and-off girlfriend, is expected to testify in the coming week. She is considered the prosecution's star witness due to her leadership at Alameda and her personal knowledge of Bankman-Fried's actions. Ellison, who pleaded guilty to multiple fraud charges as part of a plea deal, is expected to address critical moments, including an audio recording where she mentions borrowing money from FTX customer accounts to repay lenders, implicating Bankman-Fried in the decision-making process.

This is not financial advice.