- The Soft Landing

- Posts

- ✈ Bitcoin Holding On

✈ Bitcoin Holding On

PLUS: Other Interesting News You Need To Watch Out For 👀

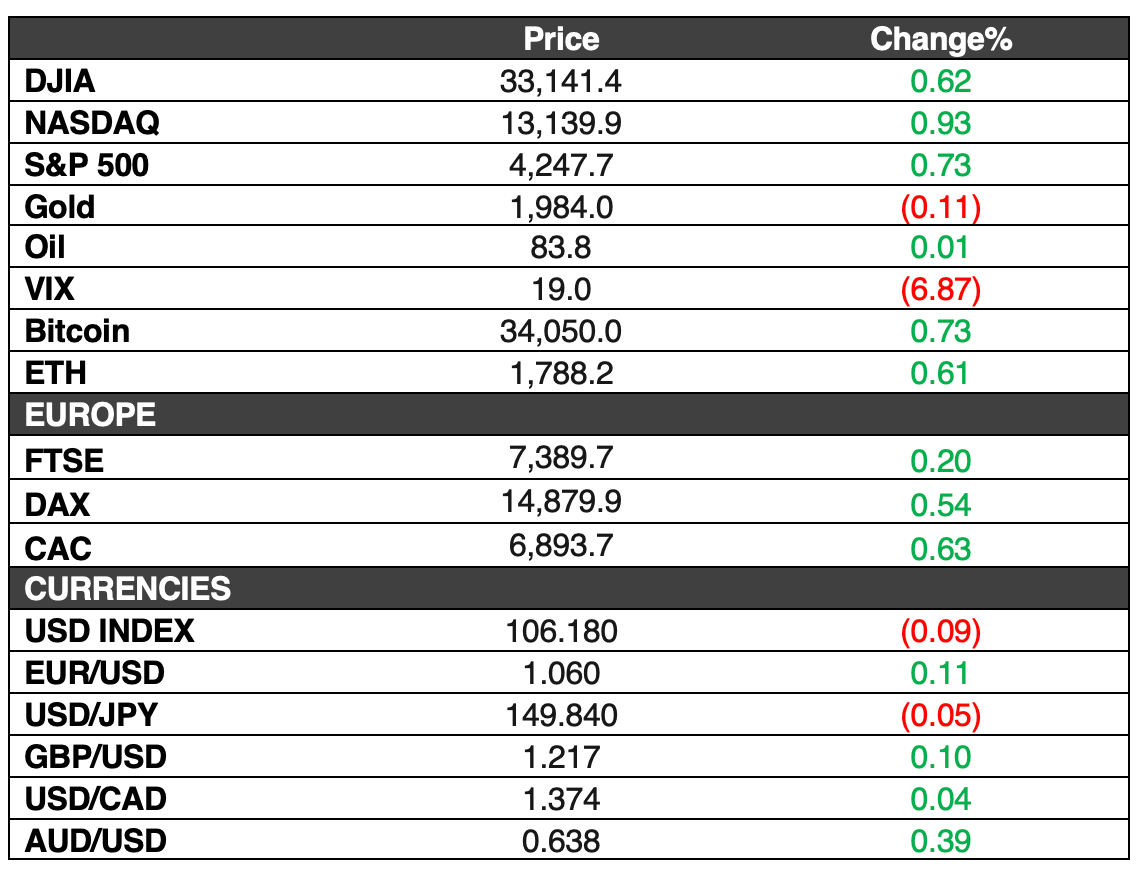

On Tuesday, the stock market experienced gains. The Dow Jones Industrial Average increased by more than 0.6% to close at 33,141, the S&P 500 rose by over 0.7%, and the Nasdaq Composite climbed by 0.9% closing at 13,140. Investors were awaiting a wave of earnings reports from major tech companies and other corporations.

The largest cryptocurrency, Bitcoin, saw an increase in value on Tuesday. It was trading at around $33,647, reflecting a 6.5% increase from its level on late Monday. Earlier in the day, it reached as high as $35,059, the highest intraday level since May 2022. This surge in Bitcoin's value had a positive impact on crypto-related stocks, with Coinbase Global (COIN) gaining 6.3% and Microstrategy (MSTR) increasing by more than 12%.

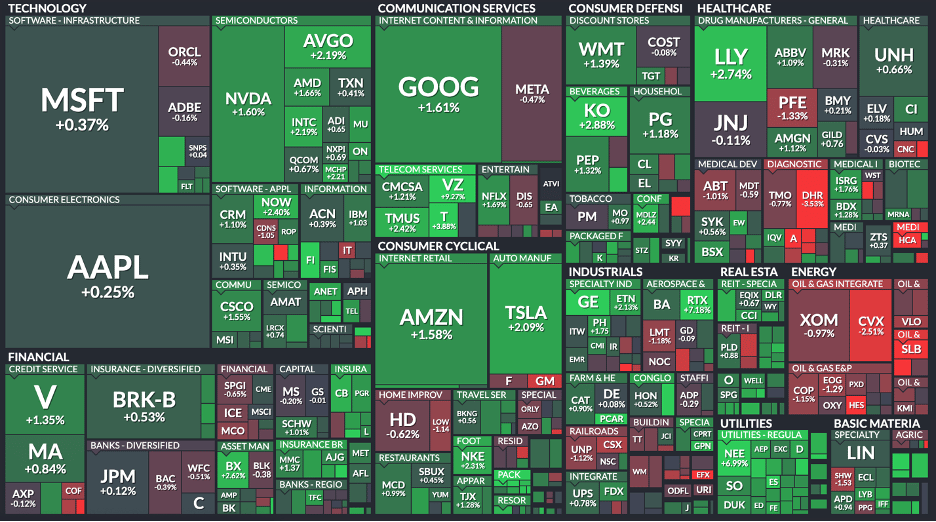

Here’s A Look At The S&P 500 Heat Map

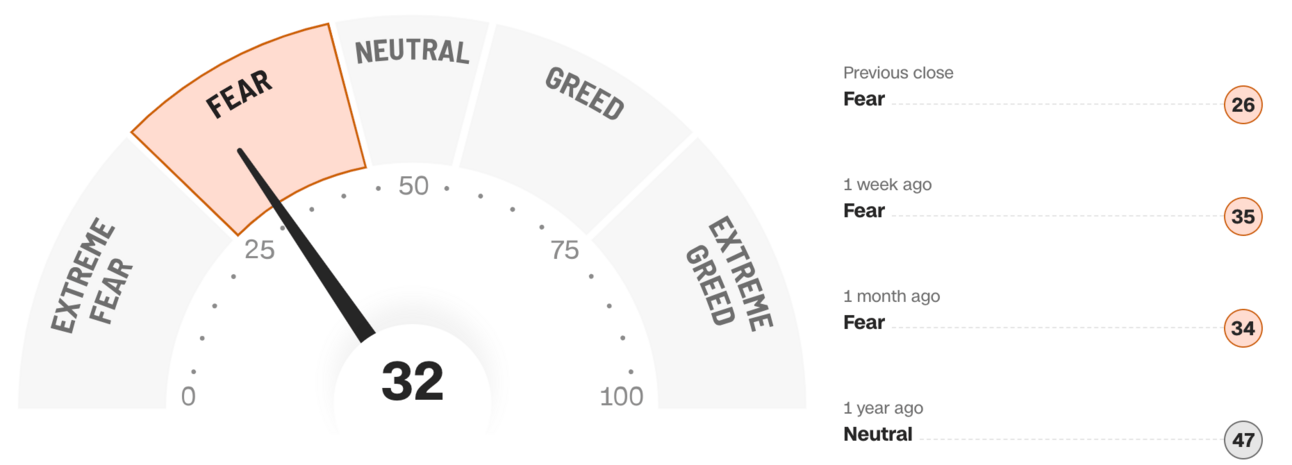

Fear & Greed Index: FEAR

Statista

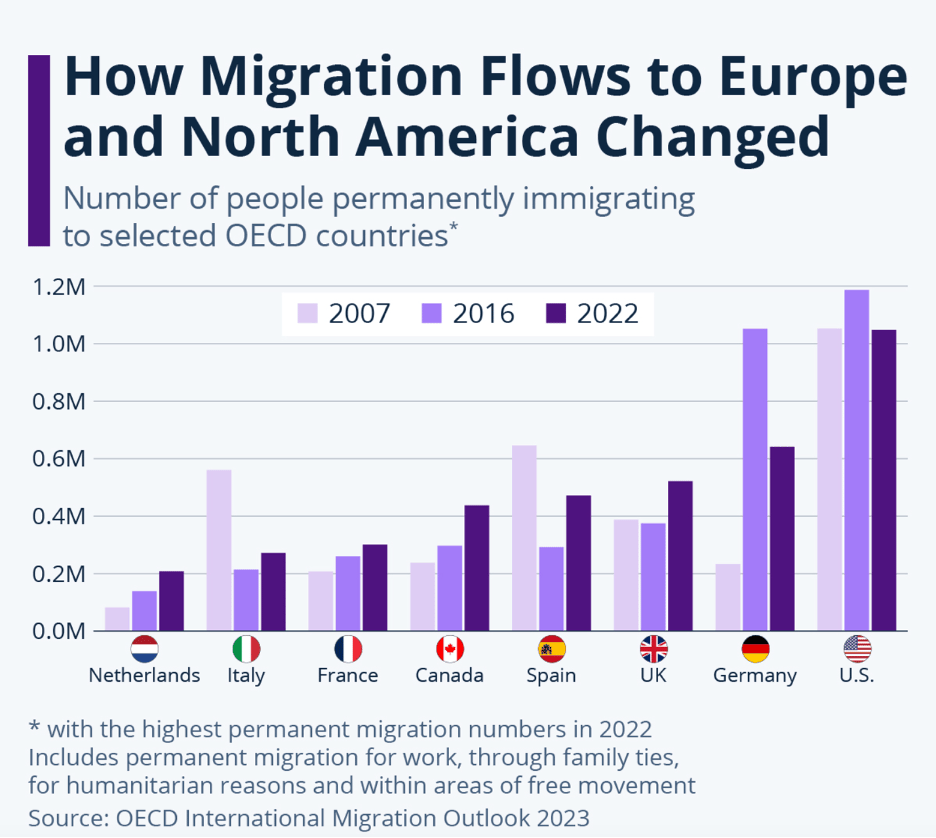

Permanent migration to OECD countries reached a historic high of 6.1 million people in 2022, with developed nations like Canada, France, the Netherlands, and the UK seeing the highest numbers of permanent immigrants in decades. International students and asylum seekers also hit record levels, with the US seeing a notable surge in asylum applications.

Family ties played a significant role in permanent immigration, constituting around 40% of all new immigrants across the OECD, with the US at 69% in 2022. In the EU, 26.4% entered through family ties, and 37.5% took advantage of the EU's free movement area.

While 2022 was remarkable, some countries, like Germany in 2016, saw higher numbers during previous years due to humanitarian reasons. Notably, Spain and Italy experienced peak migration in 2007, following a surge in arrivals and eased immigration laws.

Certain countries, including Australia, the Czech Republic, Japan, South Korea, Norway, and Sweden, have maintained their permanent immigration levels below pre-pandemic figures, driven by government policies and attitudes toward migration.

In Other Interesting News:

Alphabet's Q3 Earnings: Alphabet's Q3 revenue grew by 11%, marking a shift to double-digit expansion after four quarters of single-digit growth. Despite strong overall results, Alphabet's shares plummeted nearly 7% in extended trading due to the cloud business missing analysts' estimates. Earnings per share stood at $1.55, surpassing the expected $1.45 per share, and revenue reached $76.69 billion, exceeding expectations of $75.97 billion. The double-digit increase in revenue comes after four quarters of single-digit expansion.

Snap's Q3 Earnings Beat: Snap, the owner of Snapchat, reported Q3 earnings that beat expectations, leading to an over 11% surge in after-hours trading. The company has faced challenges due to Apple's App Transparency Tracking and a slowdown in digital advertising. Despite these challenges, Snap's Q3 results offer a positive outlook for the social messaging company's future.

Apple's Upcoming Event Announced: Apple announced an event for October 30, with expectations of new Mac laptops being unveiled. This event is scheduled for 8 p.m. ET, later than Apple's usual afternoon launches. Reports suggest that Apple may introduce faster M3 chips to boost Mac sales, which saw a 7% year-over-year decline in the June quarter.

Jamie Dimon's Critique of Central Banks: JPMorgan Chase CEO Jamie Dimon cautioned against locking into a specific economic outlook, highlighting the recent poor forecasting track record of central banks, particularly the Federal Reserve. He emphasized preparing for various possibilities and probabilities rather than making singular predictions. Dimon's comments were made at the Future Investment Initiative summit in Riyadh, Saudi Arabia, where he noted that central banks had been "100% dead wrong" 18 months ago in their forecasts. This comes in the context of central banks missing the mark on key interest rates and core inflation projections.

California Revokes GM's Self-Driving Permit: The California Department of Motor Vehicles suspended Cruise, General Motors' self-driving subsidiary, from testing and operating fully autonomous vehicles without a safety driver. The decision was based on concerns regarding the safety of Cruise's autonomous technology and alleged misrepresentation of safety information. The suspension applies to vehicles with no safety driver, indicating that the manufacturer's vehicles are not deemed safe for public operation.

UK Abolishes Banker Bonuses Cap: The UK has eliminated the cap on banker bonuses, a rule that limited bonuses to two times annual base pay. This move aims to enhance the competitiveness of London's financial industry post-Brexit. The Prudential Regulation Authority announced that the cap would be scrapped from October 31.

Dubai Real Estate Market Continues to Outperform: Dubai's real estate market experienced its highest quarterly capital gains in a decade during Q3 2023. Villa prices increased by 19.8% year-over-year and 7.6% quarter-over-quarter, with some areas like Palm Jumeirah and Jumeirah Islands performing exceptionally well. Apartments also saw significant capital gains, with prices rising by 11% year-over-year and 4.8% quarter-over-quarter. The strong performance in the real estate market reflects robust demand.

Bitcoin's 3% Drop Due to BlackRock ETF Removal:

Bitcoin (BTC) witnessed a sudden 3% drop from its nearly $35,000 position after BlackRock's spot bitcoin ETF ticker, IBTC, was removed from the Depository Trust & Clearing Corporation's (DTCC) website. The ticker's recent appearance on the DTCC site had sparked speculation about an imminent approval for a spot bitcoin ETF, contributing to BTC's rapid surge from around $30,000 to over $35,000. Open interest for bitcoin futures on the Chicago Mercantile Exchange (CME) hit a record high of $3.4 billion on Monday, indicating increasing interest from institutional investors.

Disclaimer: This is not financial advice, the newsletter is strictly educational and is not investment advice.