- The Soft Landing

- Posts

- ✈ Bitcoin Hits $35k!

✈ Bitcoin Hits $35k!

PLUS: Other Interesting News You Need To Watch Out For 👀

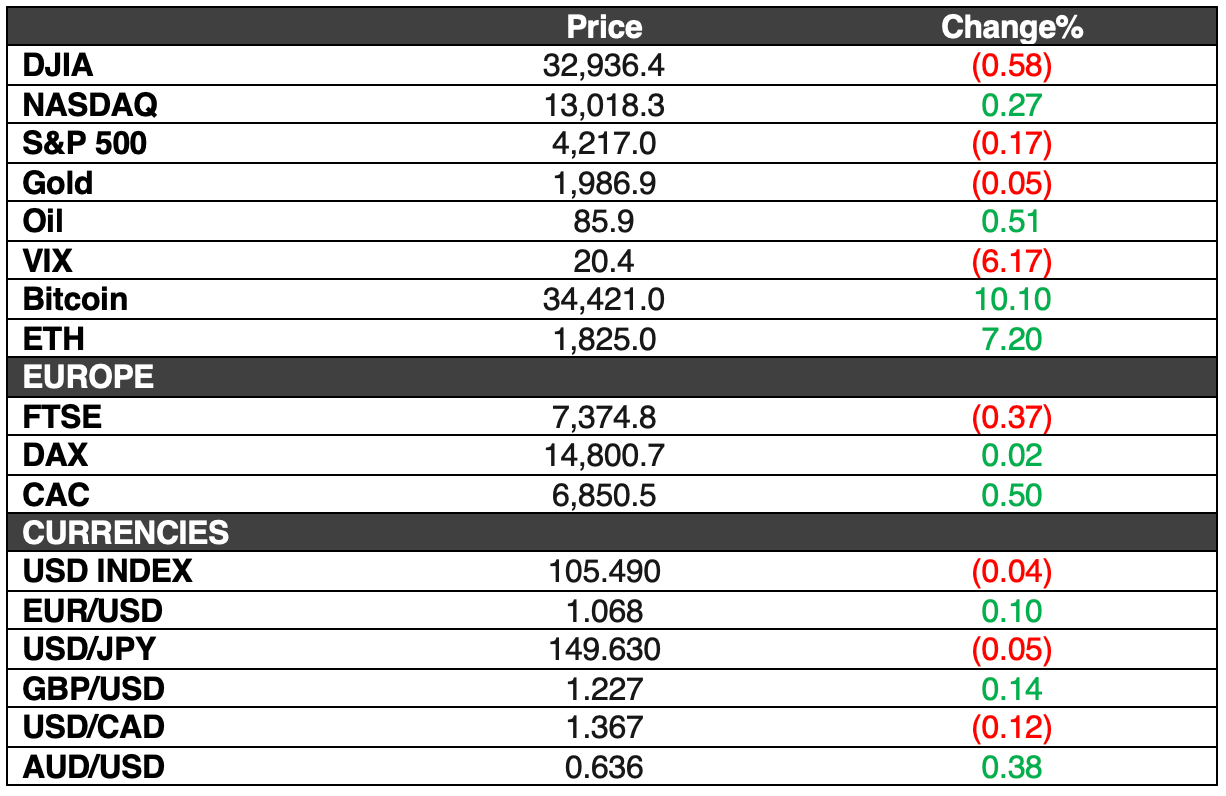

On Monday, the Nasdaq Composite saw a slight increase while the Dow Jones Industrial Average declined by 190.87 points (0.58%) to close at 32,936.41, and the S&P 500 slipped by 0.17% to 4,217.04. The Nasdaq Composite, which focuses on technology stocks, showed a gain of 0.27%, closing at 13,018.33.

Big moves in crypto. Bitcoin has risen more than 11% to reach $35,000, driven by optimism about potential approval of the first U.S. spot Bitcoin ETF. To put that in perspective, on Friday Bitcoin was trading at around $29,500!

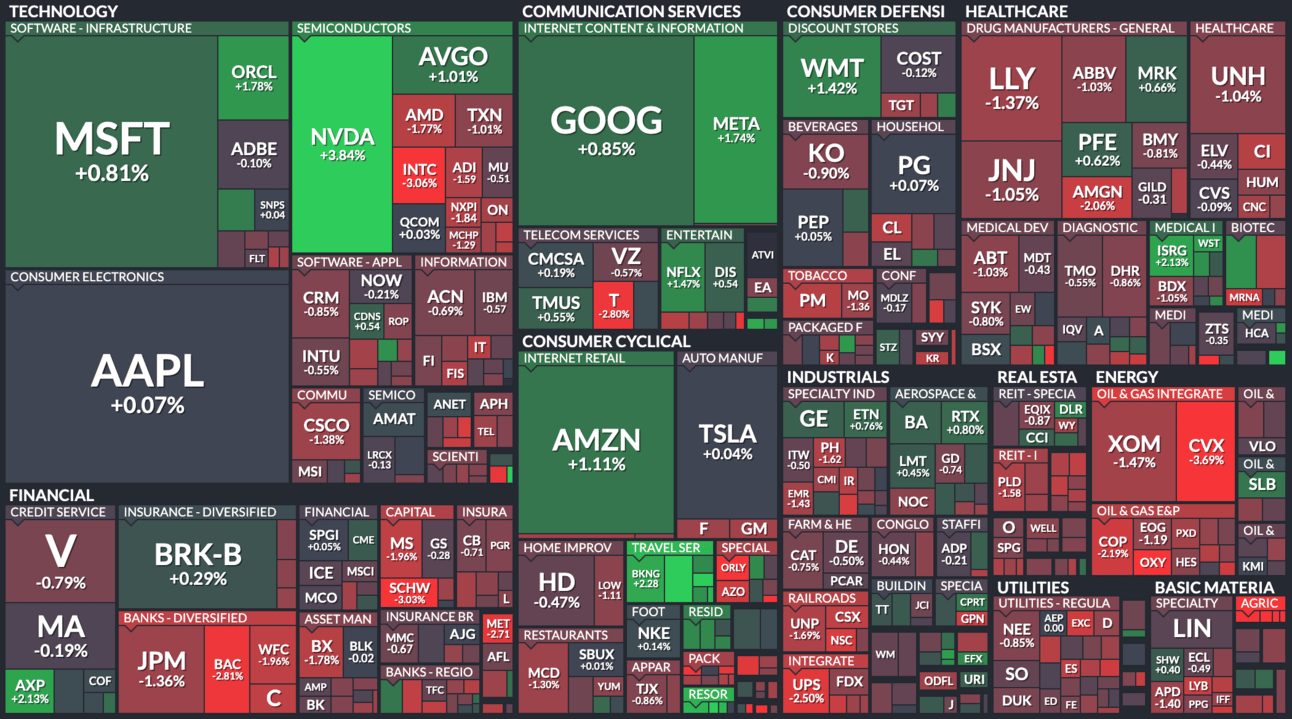

Here’s A Look At The S&P 500 Heat Map

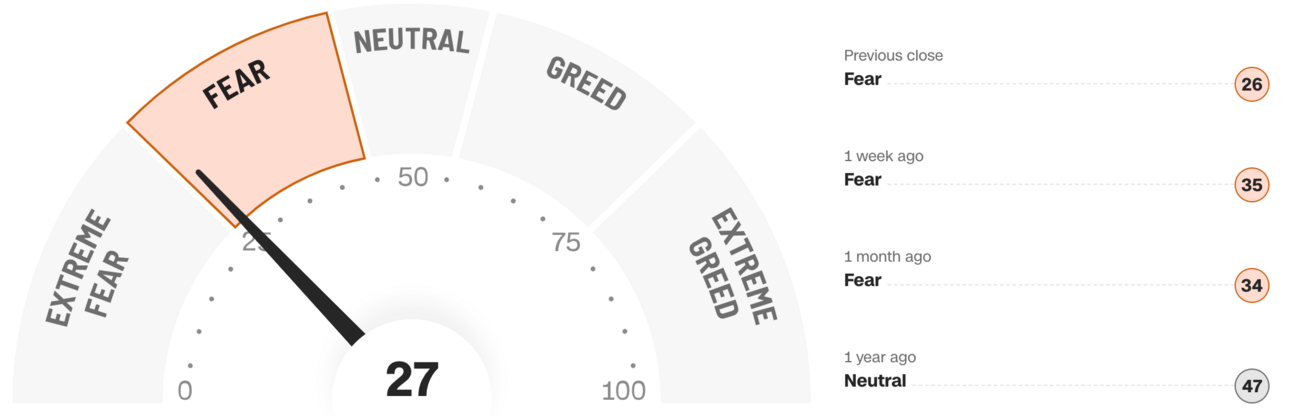

Fear & Greed Index: FEAR (…NEARING EXTREME FEAR 😱)

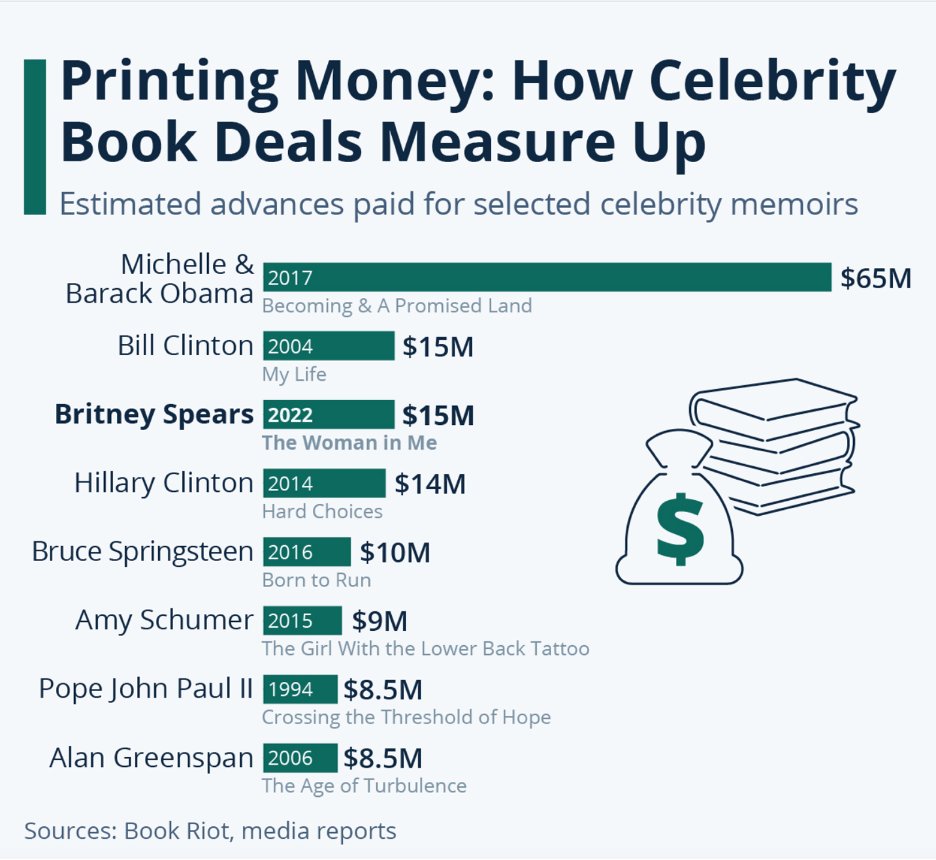

Chart of The Day: It Pays To Write (Especially If You Were Previously The President!)

Statista

Britney Spears, who saw the termination of her 13-year conservatorship in 2022, signed a book deal with Simon & Schuster for a tell-all memoir reportedly worth at least $15 million. The book, titled 'The Woman in Me', is scheduled for release on October 24, coinciding with the 25th anniversary of her hit "...Baby One More Time." While her $15 million deal is substantial, it falls short of the $65 million deal the Obamas secured in 2017 but aligns with Bill Clinton's $15 million advance for “My Life”. It also surpasses Hillary Clinton's $14 million earnings for “Hard Choices” in 2014.

In Other Interesting News:

Bitcoin Hits $35,000 for First Time Since 2022 on ETF Optimism: Bitcoin has risen more than 11% to reach $35,000, driven by optimism about potential approval of the first U.S. spot Bitcoin ETFs. Asset managers like BlackRock and Fidelity are competing to offer these products. This development could expand cryptocurrency adoption. Additionally, a federal appeals court's decision has solidified Grayscale Investments' position in creating a spot Bitcoin ETF, hinting that the SEC may relent in approving such products.

"The bond vigilante is coming back," UBS strategist says: The bond vigilantes are returning as investors sell in anticipation of higher long-term interest rates and growing fiscal deficits. The yield on the 10-year U.S. Treasury note exceeded 5% for the first time since 2007. Investors responded to Federal Reserve Chairman Jerome Powell's commitment to maintaining tight monetary policy to address inflation concerns and anticipated economic resilience. Some suggest that the 10-year yield might continue to rise.

Bill Ackman covers bet against Treasurys, says ‘too much risk in the world’: Bill Ackman disclosed he closed his short position on long-term Treasurys, believing that increasing geopolitical risks would drive investors toward bonds as a safe haven. His initial short position aimed to profit from rising long-term inflation, and it proved profitable as the 30-year Treasury yield climbed more than 80 basis points. Following his announcement, the 30-year Treasury yield fell to 5.01%.

Vanguard bets on long-term US Treasuries after 'cruel summer' for bond investors: Vanguard expresses bullishness on longer-term U.S. Treasuries following the bond market's challenging summer. Rising Treasury yields have led Vanguard to believe that the Federal Reserve is nearing the end of its rate-hiking cycle and anticipates a potential economic slowdown in the next year. The appeal of long-term bonds could increase as the economy enters a mild recession, leading the Fed to cut interest rates.

Treasury selloff will end in Q4 as oil prices spike - Goldman Sachs: Goldman Sachs strategists predict that an economic slowdown due to higher oil prices and the resumption of student loan payments will drive 10-year Treasury yields lower in the fourth quarter. Treasury yields have surged, reaching near-record levels. Goldman Sachs argues that rising debt costs will lead the federal government to cut spending, potentially triggering a recession.

‘Big Short’ Investor Steve Eisman Advises Investors to Dive Into Stocks Benefiting From the U.S. Government’s Spending Spree: Steve Eisman, famous for predicting the 2007–2008 housing crisis, believes there is no impending housing crisis and has adopted an investing strategy called "revenge of the old school." He's investing in bonds and stocks from traditional industries, capitalizing on the U.S. government's increased spending initiatives. He sees this as the first industrial policy in decades and suggests investors can benefit from it.

Apple, caught by surprise in AI boom, expected to spend $1 billion per year to catch up: Apple plans to invest $1 billion annually to catch up with competitors in developing generative artificial intelligence products. Companies like Google, Microsoft, and Amazon have already introduced such products, while Apple's AI has been primarily used for image enhancement and text correction. Apple's new focus will include integrating AI into Siri, Messages, and Apple Music, creating auto-generated playlists and aiding app developers using AI in Xcode.

Wall Street hikes forecasts for anti-obesity drug sales to $100 billion and beyond: Analysts predict that the market for new weight loss drugs like Wegovy and Mounjaro will be substantial. Citi raised its estimate for incretin drug sales to $71 billion by 2035, while Guggenheim suggests a $150 billion to $200 billion opportunity. These drugs are gaining attention for managing insulin levels, aiding weight loss, and showing potential benefits in cardiovascular health, sleep apnea, and chronic kidney disease.

Chevron agrees to buy Hess for $53 billion: Chevron is set to acquire Hess in a deal worth $53 billion plus debt. This merger will bolster Chevron's access to U.S. shale production in the Permian Basin, as well as add to its assets in Guyana. It allows Chevron to boost production over the next decade and aligns with its commitment to "lowering carbon," despite criticism from environmental advocates.

ESG investing is dying on Wall Street: Data indicates a decline in ESG investing, with U.S. ESG funds experiencing flat to negative inflows since Q1 2022. AUM in ESG funds decreased from $339 billion to $315 billion by the end of Q3 2023. Experts, like Robert Jenkins of Lipper, suggest that ESG investing is problematic because it attempts to measure qualitative factors in a quantitative manner. Consequently, responsible investing in a broader context is being considered instead.

Disclaimer: This is not financial advice, the newsletter is strictly educational and is not investment advice.