- The Soft Landing

- Posts

- ✈ Birkenstock Slides on Stock Market Debut

✈ Birkenstock Slides on Stock Market Debut

PLUS: Other Interesting News You Need To Watch Out For 👀

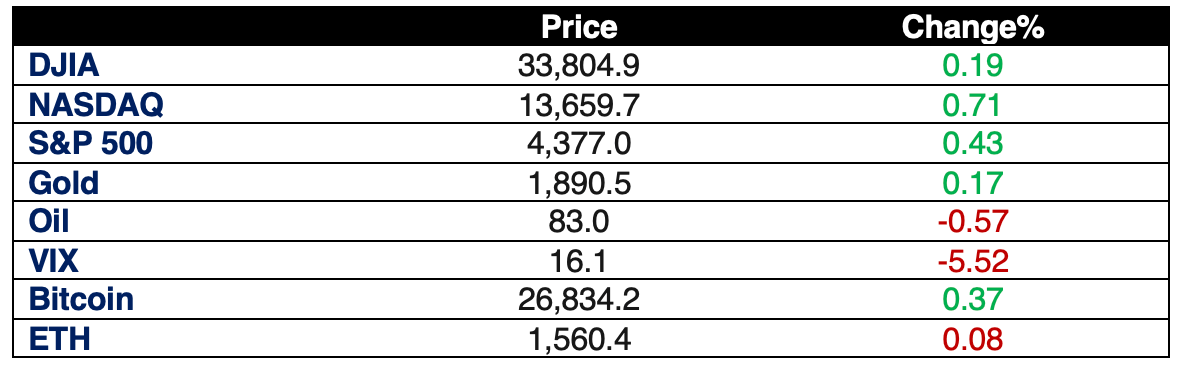

The major averages closed Wednesday’s main trading with modest gains, marking a fourth consecutive winning session. The Dow advanced 0.2%, while the S&P 500 added 0.4%. The tech-heavy Nasdaq Composite climbed 0.7%, closing above its 50-day moving average for the first time since September.

The consumer price report for September will be released Thursday morning. Economists surveyed by Dow Jones are forecasting a 0.3% month-over-month increase, and 3.6% rise from the prior year. Investors believe that the strength of inflation indicated in the report will play a key part in whether the Federal Reserve decides to maintain or raise interest rates at its two-day meeting beginning Oct. 31. The data comes following a stronger-than-expected producer price index for September.

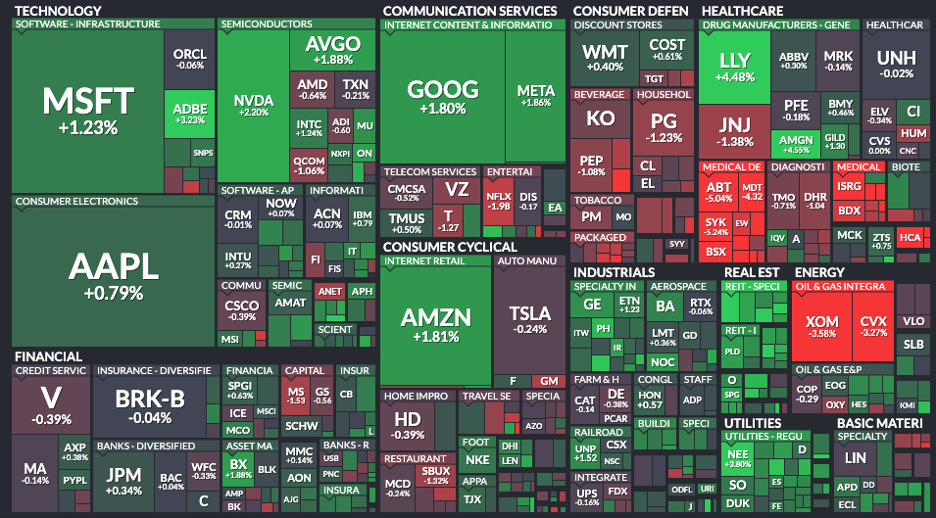

Here’s A Look At The S&P 500 Heat Map

Source: Finviz

Performance Of The Largest Stocks:

Apple $AAPL +0.8% é

Microsoft $MSFT +1.2% é

Google $GOOGL +1.8% é

Amazon $AMZN +1.8% é

Nvidia $NVDA +2.2% é

Facebook $META +1.9% é

Tesla $TSLA -0.2% ê

Berkshire $BRK.B -0.04% ê

Eli Lilly $LLY +4.5% é

Visa $V -0.4% ê

$UNH -0.02% ê

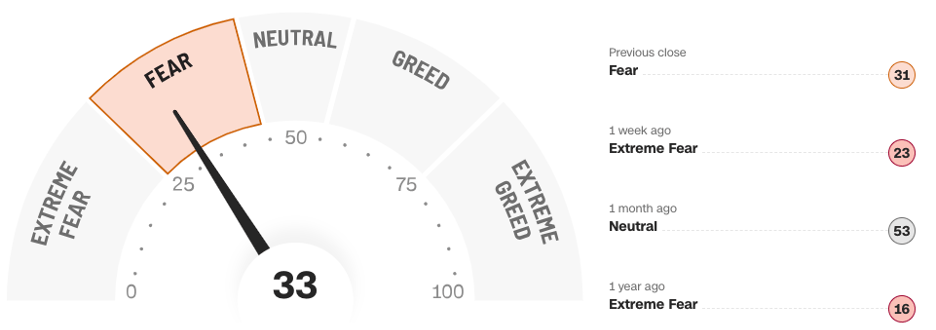

Fear & Greed Index:

Source: CNN Business

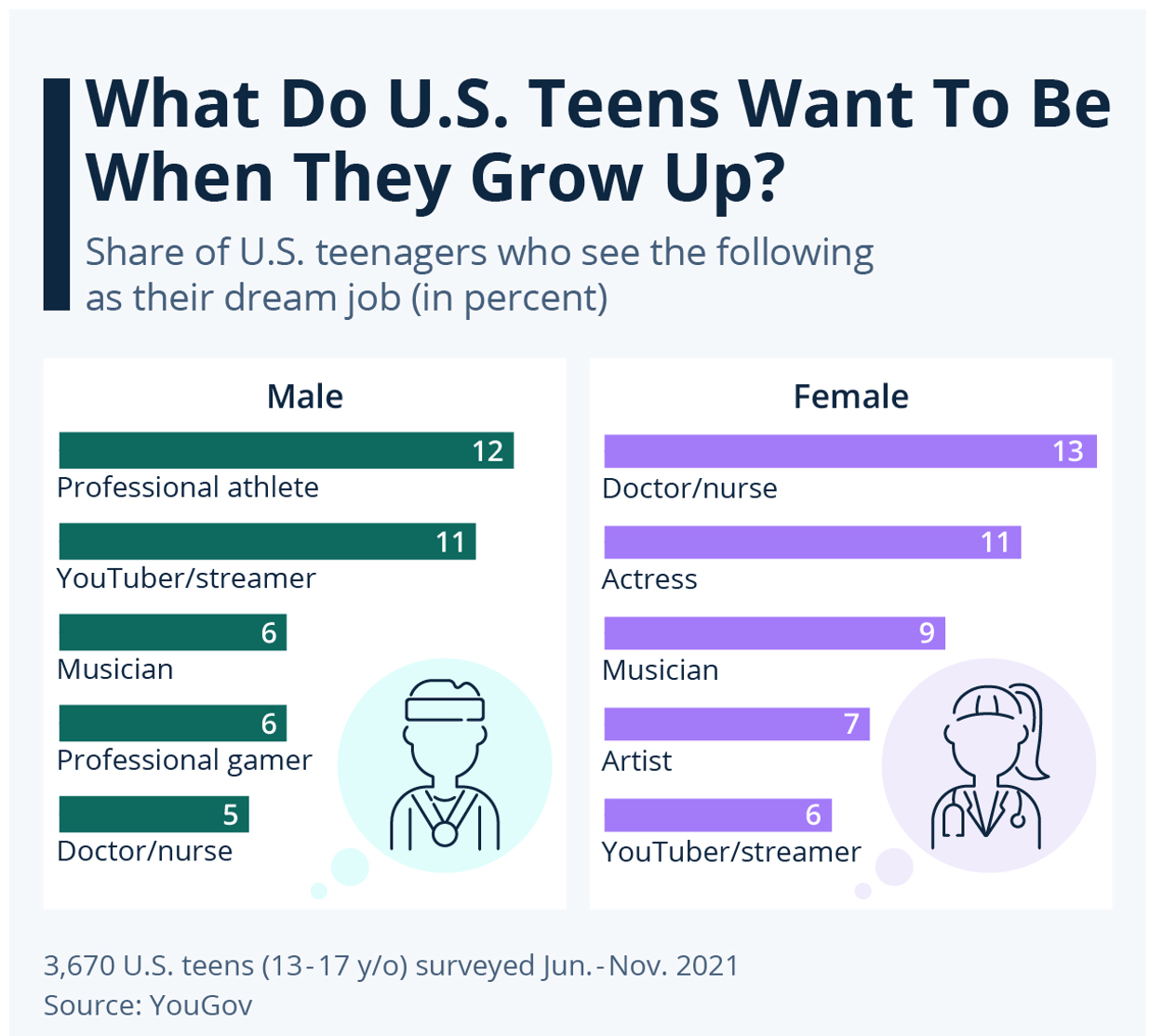

Chart Of The Day: What Did You Want To Be? Its No Longer Astronauts and Firemen

Source: Statista

The classic question, "What do you want to be when you grow up?" is taking on a new twist in the age of social media. A 2021 YouGov survey shows that American teenage boys and girls have some interesting similarities in their dream jobs, even if those aspirations seem worlds apart.

For teenage boys, 12 percent dream of becoming professional athletes, while 11 percent want to be online content creators. More traditional roles like musician (six percent) and doctor or nurse (five percent) also make the top 5 list, although just barely. Among teenage girls, 13 percent aspire to be medical professionals, while 11 percent aim to be actresses.

The fact that "YouTuber," "streamer," or "vlogger" rank in the top five for both genders highlights the growing influence of online personalities. The influencer marketing industry has doubled since 2019, reaching a global value of $16.4 billion in 2022. The future is changing, with online stardom becoming a genuine aspiration for today's youth.

In Other Interesting News:

Birkenstock Slides More Than 12% in Stock Market Debut: Birkenstock made a lackluster market debut, with shares falling over 12% on the New York Stock Exchange. The stock opened at $41 per share, closing at $40.20 per share, resulting in a market value of $7.55 billion. This performance fell short of the initial price of $46 per share set on Tuesday. It's worth noting that the company originally aimed for a valuation of up to $9.2 billion.

Wholesale Inflation Surges 0.5% in September: Wholesale prices surged beyond expectations in September, with the producer price index (PPI) rising by 0.5%. This data, which outpaced the Dow Jones estimate of a 0.3% increase, indicates continued inflation pressures within the U.S. economy. While the core PPI, excluding food and energy, increased by 0.3%, matching the forecast of 0.2%, this release only caused a mild reaction in the markets, leading to slight declines in stock futures and Treasury yields.

IRS Demands Additional $29 Billion in Taxes From Microsoft: Microsoft faces a substantial tax dispute with the IRS, which has requested an additional $28.9 billion in back taxes from the tech giant. This dispute centers on how the company allocated its profits across various countries and jurisdictions from 2004 to 2013. It's worth noting that Microsoft claims that up to $10 billion in taxes it has already paid are not considered in the proposed IRS adjustments. As of September 30, 2023, Microsoft believes its allowances for income tax contingencies are adequate.

Fed Officials Hold ‘Restrictive’ Policy to Tackle Inflation: The Federal Reserve's September meeting minutes reveal a varied stance on the need for interest rate hikes. While there were differing opinions, there was consensus that a 'restrictive' policy must persist until inflation aligns with the 2% target. The minutes indicated that most participants believed that an additional rate increase is likely in the future, with some suggesting that no further increases may be needed. This data emphasizes the Fed's flexibility, basing decisions on incoming economic data rather than a predetermined path.

Consumer Challenges Highlighted by Former Walmart U.S. CEO: Bill Simon, the former CEO of Walmart U.S., has pointed out that consumers are facing numerous challenges that are impacting their spending habits. Inflation, higher interest rates, political polarization, federal budget issues, and global tensions. As retailers like Amazon, Walmart, and Target compete for consumer attention, they are discovering that consumers are becoming more price-sensitive due to the effects of inflation, leading to adjustments in their pricing strategies.

IMF Upgrades India’s Growth Forecast Amidst Challenges: The International Monetary Fund (IMF) has increased its growth forecast for India, projecting a 6.3% economic growth in 2023, up from the previous estimate of 6.1%. This optimism is driven by various factors, including increased consumption, infrastructure investments, and a rise in new business setups. However, economists are mindful of potential challenges, particularly geopolitical risks and inflation. According to Alicia Garcia-Herrero, chief economist for Asia Pacific at Natixis, India's positive long-term outlook, influenced by a youthful population and a growing middle class, is attractive to foreign investors.

State Wealth Fund Boosts Confidence in China's ‘Big Four’ Banks: China's sovereign wealth fund, Central Huijin Investment, recently increased its stake in four of the country's largest banks. This move is seen as a vote of confidence in China's stock market, fostering renewed market optimism. The shares of Bank of China, Agricultural Bank of China, Industrial and Commercial Bank of China, and China Construction Bank have experienced notable gains following this development.

Donald Trump Falls off Forbes 400 List with Estimated $2.6 Billion Net Worth: Former President Donald Trump's estimated net worth of $2.6 billion now falls below the threshold for inclusion in Forbes 400, a list of America's wealthiest individuals. Trump's net worth has declined by more than $600 million from the previous year, primarily due to the underwhelming performance of his social media venture, Truth Social.

Bankman-Fried's Image Concerns and Testimony: Testimony in the trial involving FTX's Sam Bankman-Fried has shed light on the significance he placed on his public image, including his distinctive hairstyle. The ongoing trial, featuring key witness Caroline Ellison, a former FTX employee, has revealed allegations of fraudulent practices, including funneling customer funds to a sister hedge fund, Alameda Research. The trial is providing insights into the inner workings of the crypto and financial industry, highlighting the challenges of maintaining a reputable image.

Coinbase Reports 52% Drop in Crypto Trading Volume: Coinbase Global Inc. reported a 52% decline in spot trading volume during the third quarter. With approximately $76 billion in spot trading volume, this represents a significant reduction from the previous year, demonstrating the waning interest of investors in cryptocurrencies. This decline reflects shifting market dynamics and preferences in the world of crypto trading.

Disclaimer: This is not financial advice, the newsletter is strictly educational and is not investment advice.