- The Soft Landing

- Posts

- Billionaire Investor Predicts US Recession in Q4

Billionaire Investor Predicts US Recession in Q4

PLUS: Other Interesting News You Need To Watch Out For 👀

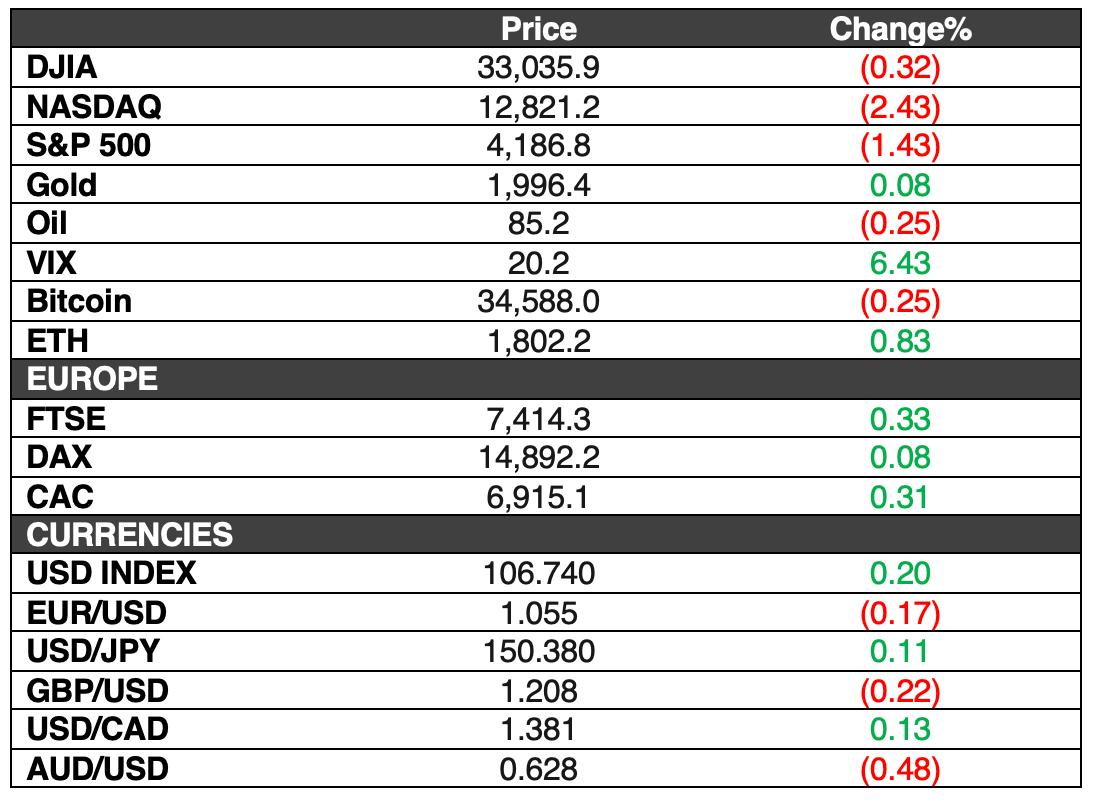

The S&P 500 experienced a 1.43% decline, closing at 4,186.77 on Wednesday, marking the first time since May that it broke below the crucial 4,200 technical support level. This drop occurred as the benchmark 10-year Treasury yield surged by nearly 11 basis points to approximately 4.95%, with it briefly surpassing 5% earlier in the week, causing concerns among investors and negatively impacting technology shares. The Nasdaq Composite had its worst day since February 21, falling 2.43% to end the session at 12,821.22, while the Dow Jones Industrial Average also dipped by 0.32% to 33,035.93.

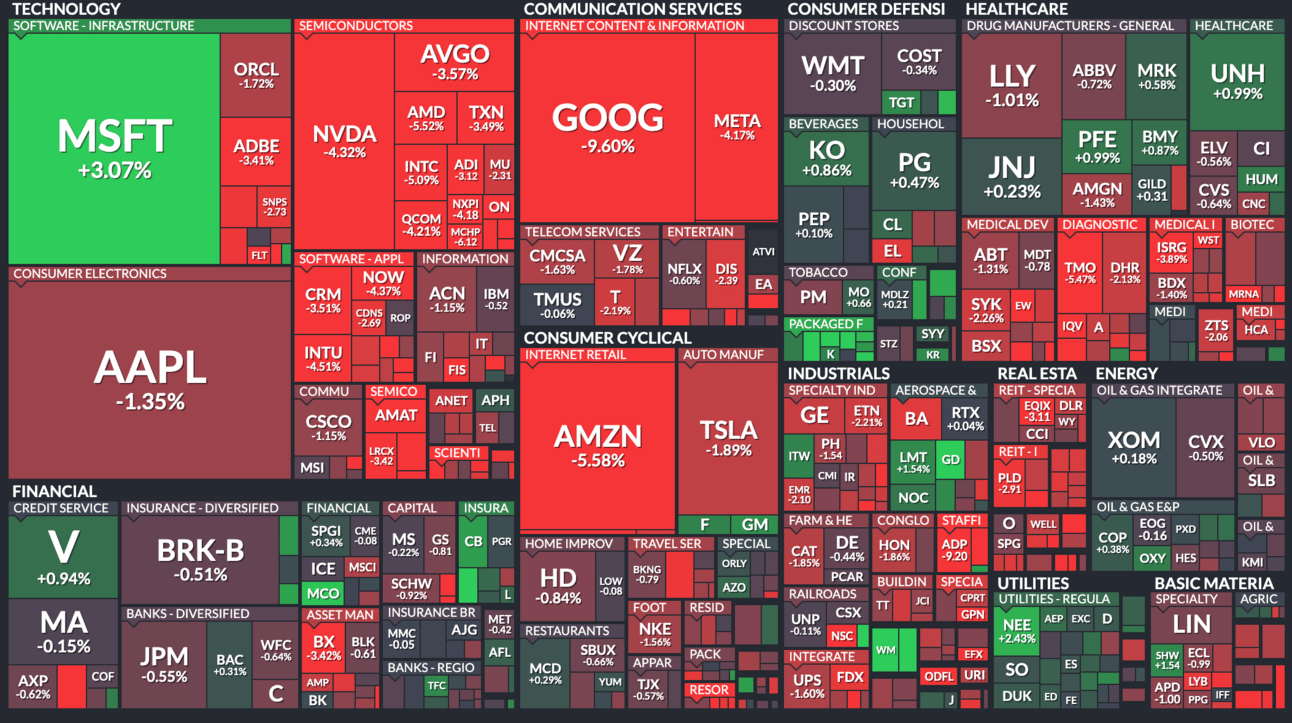

Here’s A Look At The S&P 500 Heat Map:

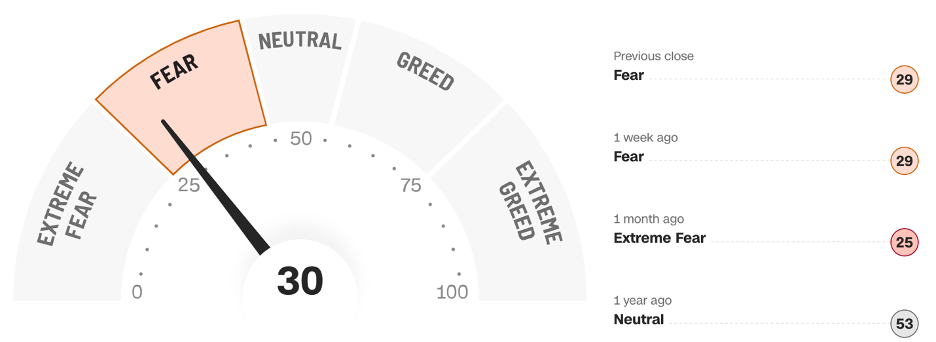

Fear & Greed Index: FEAR

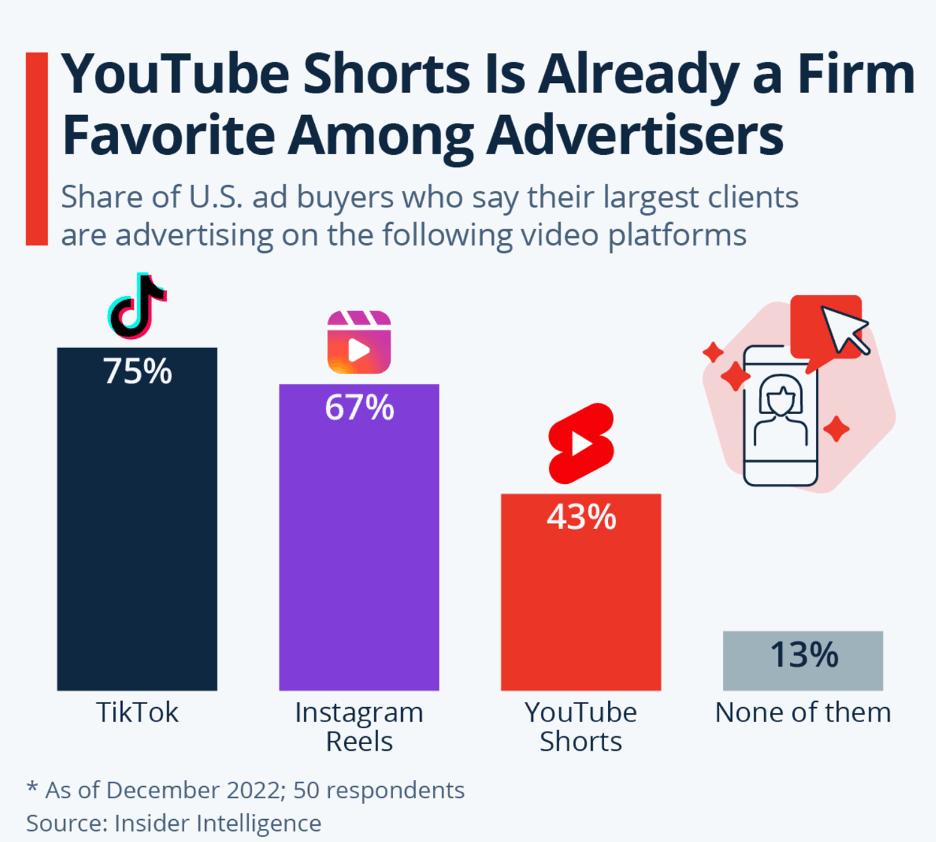

Chart of the Day: YouTube Shorts Gains Popularity with Two Billion Monthly Users

YouTube's short-form video platform, 'Shorts,' has reached over two billion monthly logged-in users, a substantial achievement given its launch in 2020. Advertisers are increasingly interested in this TikTok alternative as video content remains highly popular, presenting significant opportunities for businesses to connect with younger audiences. A December 2022 survey conducted by Insider Intelligence in the United States revealed that TikTok remained the top choice for ad buyers, with 75% of respondents indicating that their largest clients advertise on TikTok. Meta's Instagram Reels also garnered attention, with two-thirds of ad buyers reporting client advertising on it. YouTube Shorts, though newer, is catching up, with nearly half of respondents' clients using it for advertising. Analysts suggest that TikTok may face challenges in maintaining its lead, especially due to ongoing tensions between the U.S. and China concerning ByteDance's divestment of its U.S. TikTok stake.

In Other Interesting News:

Bill Gross Predicts U.S. Recession in Q4: Billionaire investor Bill Gross, formerly PIMCO's chief investment officer, predicted a U.S. recession in the fourth quarter. His forecast is based on challenges faced by regional banks and a surge in auto loan delinquencies, with a record 6.11% of subprime borrowers falling behind on car payments in over 60 days in September. To prepare for this economic downturn, Gross is investing in bonds throughout the Treasury yield curve and adding SOFR futures (Secured Overnight Financing Rate) to his portfolio.

Alphabet Faces Stock Decline Over Google Cloud Unit: Alphabet shares experienced their sharpest drop since the early days of the Covid-19 pandemic, closing down 9.5% at $125.61. This decline was triggered by revenue from Alphabet's Google Cloud unit falling short of analyst estimates. Despite exceeding expectations for both revenue and earnings per share, Alphabet faced a significant setback due to the underperformance of its cloud business. While Alphabet's cloud revenue reached $8.41 billion, it was below Street Account estimates of $8.64 billion.

Meta's Q3 Earnings Boosted by Chinese Advertisers: Meta, despite being banned in China, reported a 23% year-on-year sales increase in its third-quarter earnings. This reflects the company's resilience in the digital ad market compared to smaller competitors such as Snap and X (formerly Twitter). Chinese companies played a substantial role in Meta's strong quarter, using the platform for online commerce and gaming to reach customers in other markets via targeted advertising on platforms like Facebook and Instagram.

IBM Beats Expectations with 8% Growth in Software Sales: IBM exceeded Wall Street estimates in its third-quarter results, with earnings per share of $2.20, adjusted, compared to an expected $2.13. The company's revenue reached $14.75 billion, surpassing the expected $14.73 billion. IBM's overall revenue grew 4.6% year over year in the quarter, or 3.5% at constant currency, with net income of $1.70 billion, compared to a net loss of $3.20 billion in the same period the previous year.

Bill Ackman Earns $200 Million on Treasury Bond Bet: Billionaire hedge fund manager Bill Ackman, known for his focus on stocks, made approximately $200 million from a bet against U.S. 30-year Treasury bonds. Despite primarily focusing on equities in his Pershing Square portfolio, Ackman periodically uses hedges to protect against risks. He previously argued that factors like higher defense spending, energy scarcity, the transition to green energy, and labor's increased bargaining power would keep inflationary pressures high. Ackman's prediction proved correct as he hedged against a rise in 30-year Treasury rates when the yield was around 4.16%, anticipating it could reach 5.5%.

Morgan Stanley Appoints Ted Pick as CEO in 2024: Morgan Stanley announced that Ted Pick will succeed James Gorman as CEO at the beginning of 2024. Pick, a veteran of Morgan Stanley, will also join the bank's board. Gorman will remain as executive chairman for an undisclosed period. This announcement concluded the top succession race on Wall Street, as Gorman had previously announced his intention to step down within a year, with the successor chosen from the bank's main division heads.

Japan Leading Stablecoin Regulation: Japan is at the forefront of stablecoin regulation, having implemented a stablecoin law in June, making it a pioneer in this field. This serves as an example that stablecoin regulation is feasible. In contrast, countries like the United States are still debating this matter without a stablecoin bill becoming law. The European Union is set to implement stablecoin regulations next year, but gray areas remain. Japan's experience highlights the complexity of regulating stablecoins. These cryptocurrencies, designed to maintain value against real-world assets, were effectively banned in Japan until recently. Regulators and businesses now face the challenge of creating a system that is both secure and profitable for stablecoin issuance, with the total stablecoin market cap estimated at over $124 billion.

Disclaimer: This is not financial advice, the newsletter is strictly educational and is not investment advice.